CRE This Week: What's impacting the Canadian market

February 25, 2026 - Canada commercial real estate market insights, indicators, and notable transactions

February 25, 2026

Welcome to the latest edition of CRE This Week, curated by Altus Group’s Canada research team.

Our team has handpicked new and noteworthy market indicators, articles, and significant industry transactions that are impacting Canada's commercial real estate sector. We understand that your time is valuable, so we're excited to deliver research that helps you stay informed and saves you some time each Wednesday morning.

FEATURED TrANSACTIONS

Canada property transactions

Greater Toronto Area: Apartment

25 Cosburn Avenue, East York

$40,660,000

$315,915 per unit

Greater Vancouver Area: Industrial

1516-1520 Columbia Street, North Vancouver

$5,484,000

$567 per sq. ft

Broker: Mark Callaghan & Stefan Morissette (Jones Lang LaSalle), Matt Thomas & Matt Upson (Lennard Commercial Realty)

Greater Montreal Area: Office

1130-1140 Sherbrooke Street West, Ville-Marie

$49,000,000

$206 per sq. ft.

Broker: Scott Speirs (CBRE)

Greater Golden Horseshoe: Industrial

10 Washburn Drive, Kitchener

$4,764,500

$224 per sq. ft

Brokers: Darren Shaw, Austin Randall (Lennard Commercial Realty)

Greater Toronto Area

Sector | Municipality | Address | Price | Unit Price | Parameters | Brokers |

|---|---|---|---|---|---|---|

Industrial | Mississauga | 2425 & 2475 Meadowpine Blvd, 2510 & 2520 Royal Windsor Dr | $195,240,000 | $358 | per sq. ft. | Peter D. Senst, Matthew Brown, Kai Tai Li (CBRE) |

Industrial | Scarborough | 1220 Birchmount Road | $8,225,000 | $298 | per sq. ft. | Hanan Goldfarb (Vanguard Northeast Realty) & Dave Stevens (Cushman & Wakefield) |

Industrial | Oakville | 1150 South Service Road West | $7,850,000 | $595 | per sq. ft. |

Greater Vancouver Area

Sector | Municipality | Address | Price | Unit Price | Parameters | Brokers |

|---|---|---|---|---|---|---|

Apartment | Vancouver | 2404-2420 Guelph Street | $4,555,000 | $227,500 | per unit | Dan Chatfield & Trevor Buchan (Colliers) |

Retail | Surrey | 8556 120th Street, #101 | $2,790,000 | $841 | per sq. ft. |

|

Industrial | Abbotsford | 2345 Windsor Street, #4 & #5 | $2,350,000 | $409 | per sq. ft. | Kyle Dodman (NAI Commercial) |

Greater Montreal Area

Sector | Municipality | Address | Price | Unit Price | Parameters |

|---|---|---|---|---|---|

Industrial | Terrebonne | 1085 des Cheminots Street | $33,000,000 | $228 | per sq. ft. |

Retail | Brossard | 8900 Taschereau Boulevard | $11,020,000 | $592 | per sq. ft. |

Industrial | Delson | 121 Industrielle Street & 166-172 Théberge Street | $7,916,530 | $341 | per sq. ft. |

Greater Golden Horseshoe Area

Sector | Municipality | Address | Price | Unit Price | Parameters | Brokers |

|---|---|---|---|---|---|---|

Industrial | Hamilton | 70 Unsworth Drive | $9,470,000 | $273 | per sq. ft. | |

Apartment | Kitchener | 103 Courtland Avenue East | $2,250,000 | $225,000 | per unit | Eric Frey (Coldwell Banker Peter Benninger Realty) |

Apartment | Hamilton | 17 Cloverdale Avenue | $1,600,000 | $145,455 | per unit |

ECONOMIC PRINT

Canada commercial real estate market indicators

Analyzing CRE valuation trends across property types

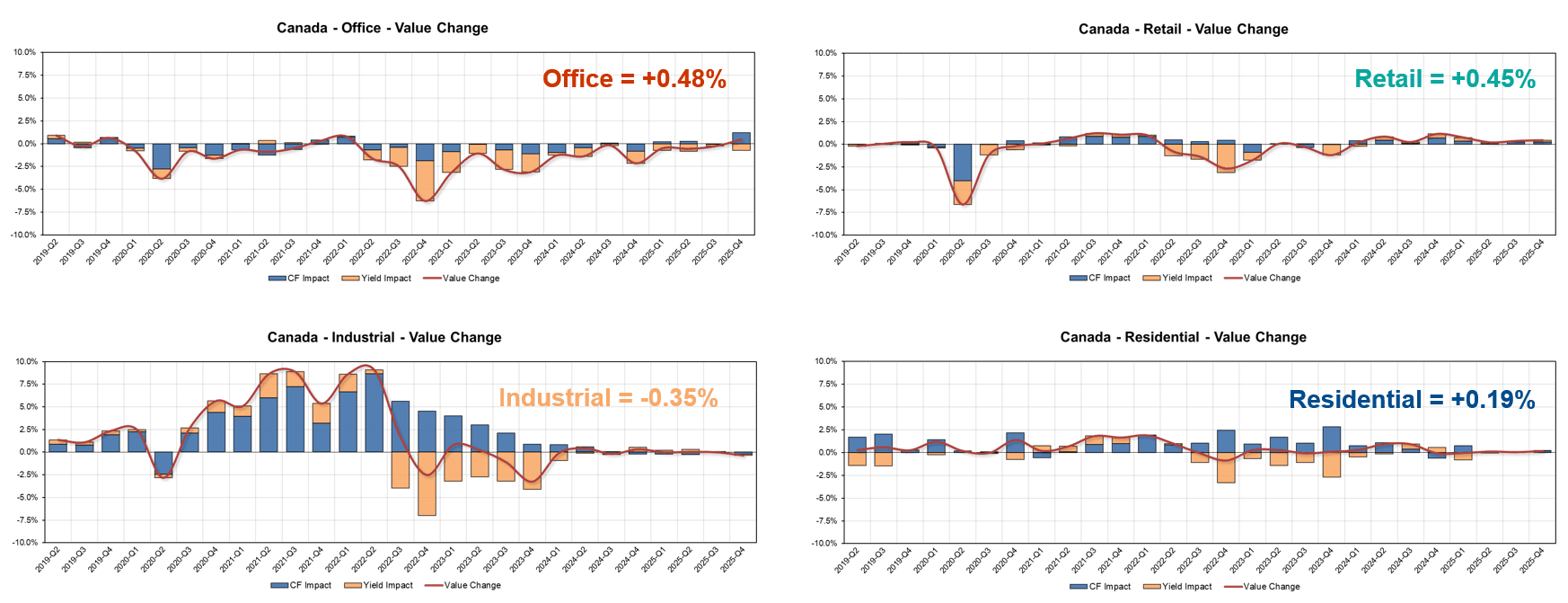

The big story from our Q4 2025 data is that office values are up, which represents the first quarterly increase in four years. Retail also posted value gains, whereas residential was relatively flat. Softening fundamentals in the industrial market resulted in a slight dip in Q4 values.

Figure: Canada sector value change, quarterly

INSIGHTS Spotlight

Catch the latest research and insights from Altus

Canadian CRE valuation analysis – Q4 2025

Stability remained a key theme across Canada’s commercial real estate market in Q4. However, the latest data also reveals some notable shifts in how different property sectors are faring against market forces.

Montreal CRE market update – Q4 2025

Investment volume in Montreal’s CRE market totalled $10.6 billion, a nominal 5% year-over-year increase. The multi-family sector accounted for 49% of total volume, up 31% year-over-year at $5.2 billion.

About our research team

Ray Wong

Vice President, Data Solutions

Altus Group

Ray is the Vice President, Data Solutions, Client Delivery team with the Altus Group and has over 30 years of market research experience. He works closely with both internal and external clients to provide timely information and industry insights about the Canadian market and at a global scale. Ray is regularly asked to speak at various industry events and answer media outlet requests.

Edward Jegg

Research Manager, Data Solutions

Altus Group

Edward Jegg serves as a Research Manager on the Data Solutions team at Altus Group, leveraging over 35 years of extensive experience in the commercial real estate sector to deliver market intelligence to the industry. Jegg plays a key role in creating and disseminating detailed market reports across Canada, providing stakeholders with timely insights for investment decision-making. Jegg is a recognized expert, frequently offering media commentary on real estate trends and recently receiving the prestigious Chair's Award of Merit from BILD for his outstanding contribution to the field.

Jennifer Nhieu

Senior Research Analyst, Data Solutions

Altus Group

Jennifer Nhieu is a Senior Research Analyst, Data Solutions with Altus Group, where she specializes in providing timely, data-driven insights into the Canadian market. Leveraging her background in commercial real estate and geographic information science, Jennifer is a key contributor to Altus Group’s quarterly research insights. She transforms complex data sets into clear, actionable intelligence, helping stakeholders make informed decisions.

About the Data Solutions team

Behind every update in our newsletter is the work of our Data Solutions team, a group dedicated to keeping you informed on commercial real estate activity across Canada. From Vancouver to Toronto (and everywhere in between), they track transactions, visit properties, and add the local context that numbers alone can’t capture. Their work goes beyond deals, by providing insights into new home developments and sales trends, as well as detailed office and industrial inventory data across key markets, from Montreal and Calgary to Winnipeg, Quebec City, and Atlantic Canada.

Disclaimer: The opinions expressed in this newsletter are solely those of the authors and are not endorsed by Altus Group Limited, its affiliates and its related entities (collectively “Altus Group”). This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Resources

Latest insights