Key highlights

A lackluster environment for CRE isn't harming banks, but creating added challenges for the CRE sector itself

Banking regulation has been less restrictive for smaller banks, which has led to problems for these institutions as interest rates have climbed from record lows

An increase in unrealized losses and a growing mismatch between fair market and book values, particularly among smaller banks, has led to a much more cautious lending environment

Given that smaller banks tend to hold more real estate debt than larger banks, the pain that smaller banks have faced has been felt most acutely in CRE, where the squeeze on lending is putting downward pressure on CRE valuations

Recent headlines would suggest that commercial real estate is to blame for what ails the banking system – but is this truly justified?

Regional banks' exposure to commercial real estate has been relatively high, including loans made to what is now a sluggish office market. However, it's important to note that this has not been the singular catalyst for stress in the banking system. For commercial real estate, on the other hand, the turbulence in the banking sector is having a direct impact on the landscape, as banks are scaling back new loans made to the sector.

During the 2008-2009 global financial crisis, collapsing residential real estate valuations set off a chain of events that helped precipitate the upheaval in the banking system. That isn't the case this time around.

Instead, the main challenge for the banking industry at present is the widening gap between bank assets and liabilities, driven by the recent increase in interest rates and the inversion of the yield curve.

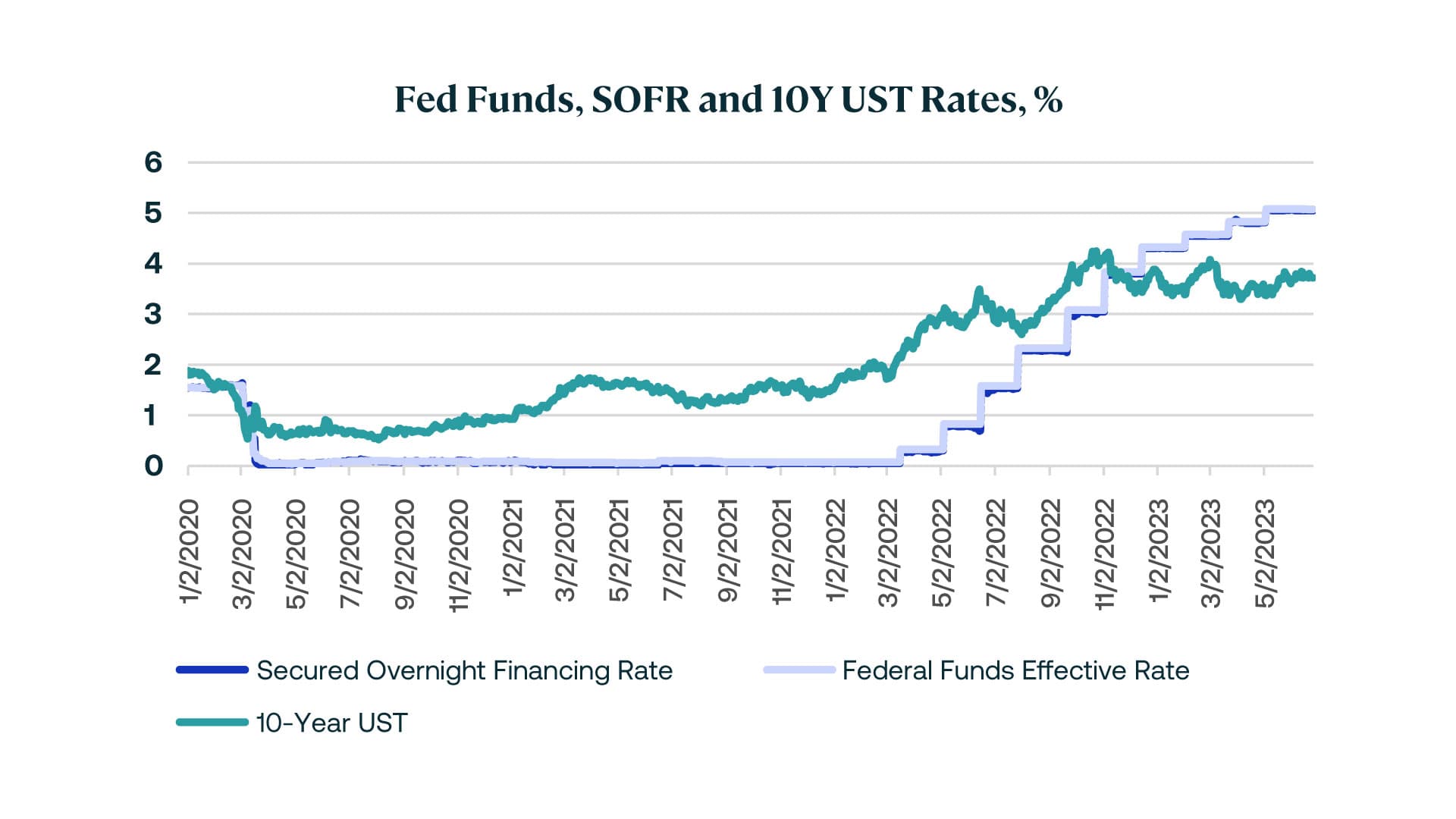

This isn't to say the current level of interest rates reflects new territory; rates have been higher for longer periods in the past. However, what is unprecedented is how fast rates have risen - the central bank's benchmark rate stands at 5.0%-5.25% today from near zero in the spring of 2022.

Although it is possible that rates could remain somewhat stagnant in the near future, the Fed has made it abundantly clear that it will continue to raise rates as long as inflation remains higher than its 2% per year goal. In May, US inflation for the previous 12 months came in at 3.8% according to the Fed's Personal Consumption Expenditure (PCE) deflator, and an even higher 4.6% excluding food and energy.

Moreover, the yield curve remains inverted, which means that yields on the 2-year Treasury are higher than those on the 10-year Treasury — an indicator that has traditionally signaled an emerging recession.

Figure 1 - Fed funds, SOFR and 1-Y UST rates, %

Special pain for regional banks

Banks must assign securities they own to any one of three categories, from an accounting standpoint: trading, available-for-sale or hold-to-maturity. It's important to note that, due to accounting rules, unrealized losses on available-for-sale securities don't impact a bank's net income. With the exception of the largest banks, these losses have no impact on regulatory capital requirements.

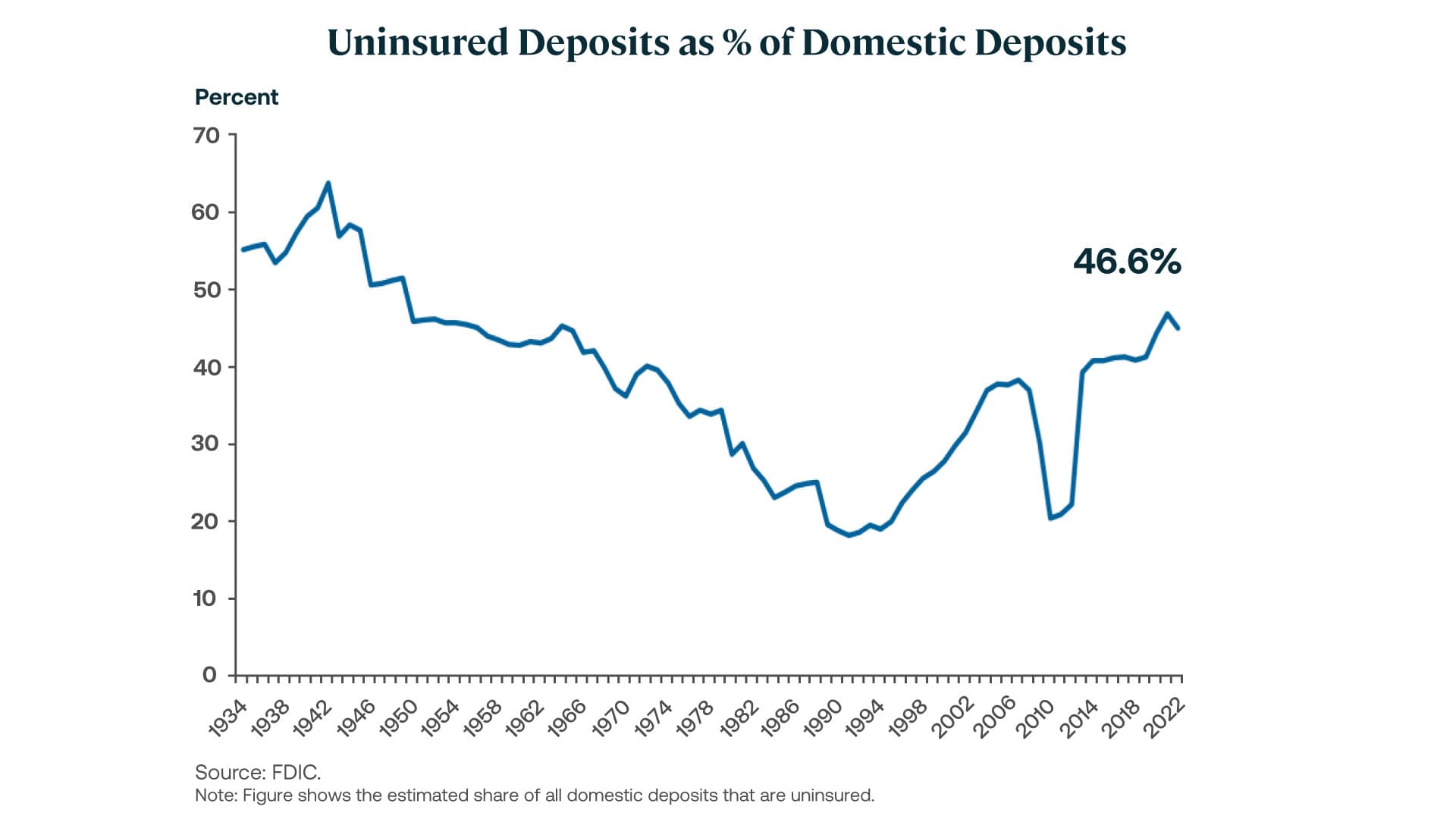

The recent succession of Fed hikes has meant that fixed-rate bonds have lost value as interest rates have risen. Because unrealized losses on smaller banks’ bond holdings in their available-for-sale bucket don’t impact net income and don’t affect regulatory capital requirements, few regional banks took proactive measures to compensate for these declines. However, a bank run can become a self-fulfilling prophecy, particularly if banks are forced to realize losses on their assets. US banks have had a historically high level of uninsured bank deposits in the banking system - standing at 46% of deposits at the end of 2022. While deposits up to $250,000 per customer per bank are insured by the Federal Deposit Insurance Corporation, many people and companies were holding significantly more at individual banks, such as the tech start-ups that banked at Silicon Valley Bank (SVB). When depositors at SVB panicked and regulators put the bank into receivership, the move sparked a wave of pain and uncertainty that rapidly spread to other regional banks, including Signature and First Republic.

Figure 2 - Uninsured deposits as % of domestic deposits

Banks' real estate holdings

In recent years, the largest banks haven't held the most real estate loans. While they may have originated many of them, these loans were securitized into CMBS and, in turn, rapidly moved off their balance sheets.

Smaller banks, on the other hand, have become an increasingly large lender and owner of commercial real estate loans. This trend became particularly pronounced as low interest rates sparked investor and developer demand for real estate deals in lower-priced secondary and tertiary markets, where local and regional banks have had a stronger real estate lending presence.

Interestingly, the smallest banks (by assets) hold significantly more in dollar terms, to US CRE loans, than the largest ones., As a percentage of all CRE loans outstanding, the smallest banks hold 43% while for the largest banks, this figure is just 8%.

Figure 3 - High concentration of CRE on regional bank balance sheets

As a result of the stress in the banking sector, smaller banks who were previously active lenders in the CRE space are now reluctant to make additional real estate loans, particularly against a backdrop of lower projections for rent growth and occupancy. Real estate borrowers have other sources of capital than banks, but in many cases, these sources (such as life insurers) have pulled back as well. Simply put, the cost of capital is up, and the willingness to lend to the real estate sector has fallen.

The current climate is squeezing credit availability, which has impeded the ability of buyers to finance their purchases and as a result, is adversely impacting transaction volumes. It is an entirely understandable reaction on the part of both potential sellers (who don't want to realize a loss), and potential buyers (who are waiting for the best deal that they can get).

One indirect result of the current credit squeeze is that real estate values have become harder to calculate, with fewer properties being able to serve as comparable sale benchmarks. Is another shoe going to drop in commercial real estate or is a recovery in site? At least until we have a clear sign that the Fed has reached peak policy rates in the current cycle, we’re unlikely to see funding pressures ease and stability return to the commercial real estate sector.

Author

Heidi Learner

Head of Innovation

Author

Heidi Learner

Head of Innovation