Toronto commercial real estate market update

Q2 2023: GTA market continues to slowdown compared to a year ago, with transaction volume down 27%.

Key highlights

Rising interest rates and continued economic uncertainty contributed to a slowing market during the first half of 2023

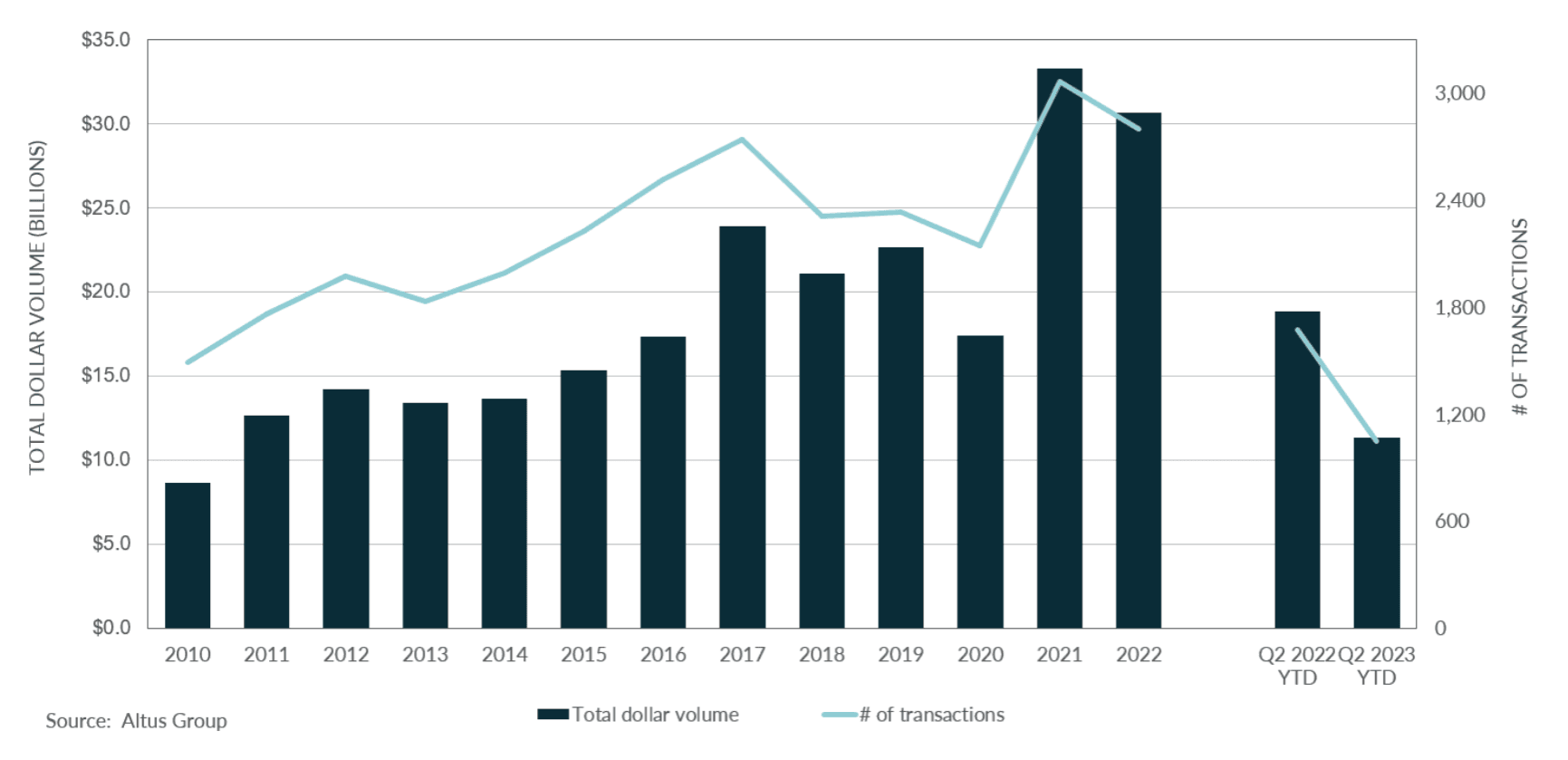

The Greater Toronto Area market experienced a 27% decrease in commercial investment activity, dropping to $6.68 billion in dollar volume in Q2 2023 compared to $9.21 billion in Q2 2022

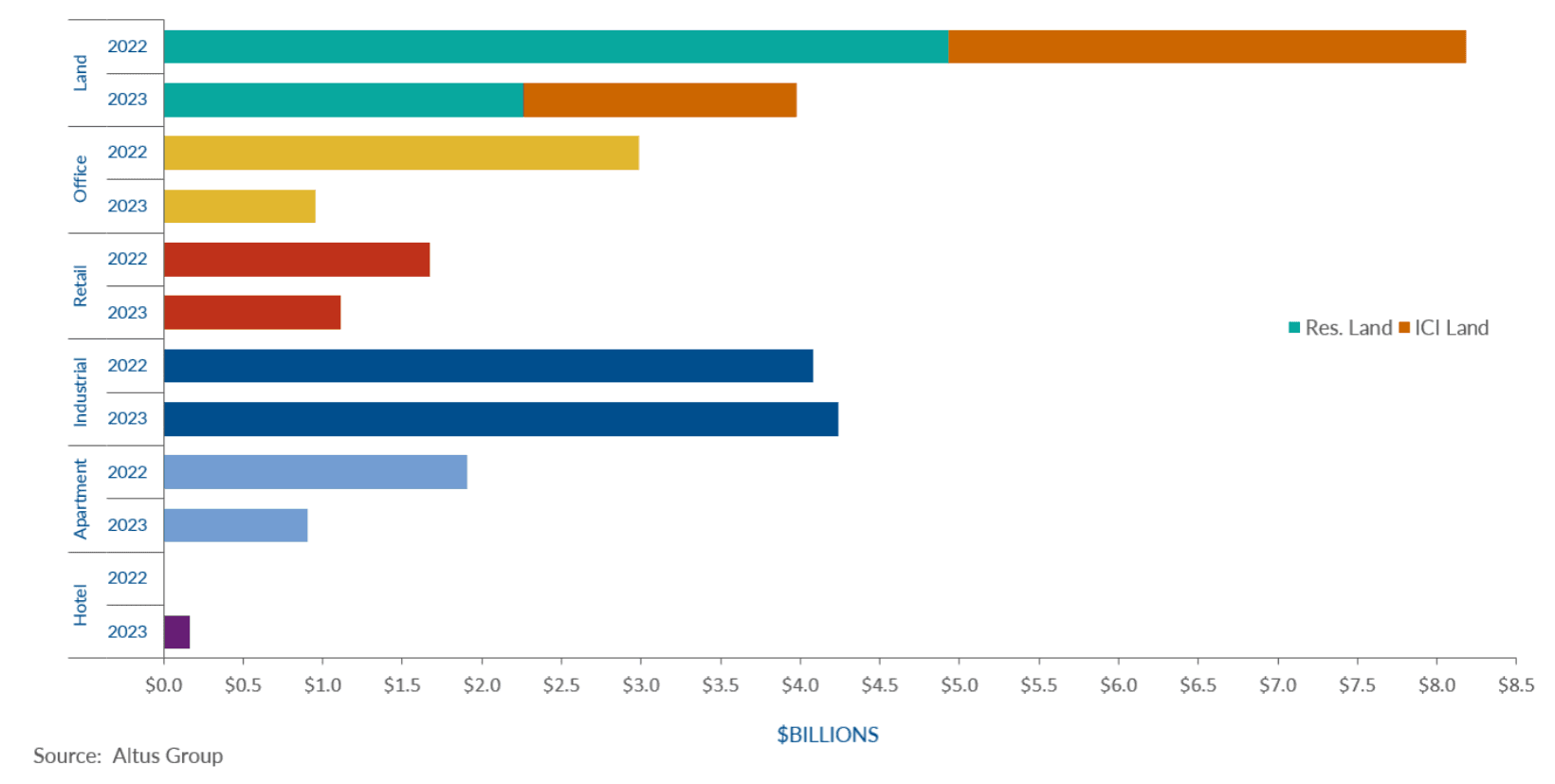

Despite headwinds, the industrial sector continued to experience growth compared to Q2 2022

Residential investment transactions decreased to $563 million in Q2 2023, a 44% drop from Q2 2022

Office investment transactions dropped to $414 million in Q2 2023 from $1.07 billion in Q2 2022

The slowdown in market activity in the first half of 2023 will likely persist for the remainder of 2023 due to continued high-interest rates and a growing bid-ask price gap between sellers and buyers

Rising interest rates and the challenge of securing financing for certain assets have resulted in a slowdown for the first half of 2023. Despite inflation falling within the target range of 2.8% in June, the Bank of Canada has continued its aggressive approach to rein in inflation by increasing interest rates by another 25bps to 5% in July. The Greater Toronto Area market experienced a 27% decrease in commercial investment activity, dropping to $6.68 billion in dollar volume in Q2 2023 compared to $9.21 billion in Q2 2022. Additionally, industrial was the only sector to experience growth compared to Q2 2022. Rising interest rates and construction costs have not deterred investment and new supply as the GTA remains undersupplied relative to the demand.

Figure 1 - Greater Toronto Area: Property Transactions - All Sectors by Year (Q2 2023)

The industrial sector reported $3.39 billion in dollar volume, a 36% increase from Q2 2022. The increasing cost of capital has led investors to turn to assets with minimal risks and stable returns. However, rising interest rates and construction costs have made investors exercise more due diligence as the availability rate increased to 2.3% from 1.3% in Q2 2022. Additionally, industrial rental rates continue to rise based on limited availability. The GTA saw approximately three million square feet of new supply enter the market this quarter, but unlike the previous quarters, a significant portion of it has not been pre-leased. Regardless, investors continued to have a positive outlook for the sector, as the construction of new supply remains strong, with a reported increase to 18.7 million square feet from 17.3 million square feet in Q1 2023.

Residential investment transactions decreased to $563 million in Q2 2023, a 44% drop from Q2 2022. Furthermore, transaction volume started to decline gradually in Q3 2022 due to continued interest rate hikes by the Bank of Canada, the shortage of skilled labour and rising construction costs. However, investors are optimistic as the constrained supply of rental housing and the high cost of housing in the market supports asset fundamentals. According to Altus Group’s most recent Investment Trends Survey, suburban multi-unit residential in the GTA market was the top preferred location and property type combination in Q2 2023.

Office investment transactions dropped to $414 million in Q2 2023 from $1.07 billion in Q2 2022, a 61% decrease as investors turned to other less volatile real estate areas. Furthermore, return-to-office has stalled nationwide, even with a few firms mandating returns. As a result, the national office availability rate continued to climb to 18% as of Q2 2023, with the GTA market at 18.5%, the third highest in the nation after Calgary and Edmonton. Additionally, sublet space represented 24.9% of the total available office space in Q2 2023, a 4% increase from 20.7% in Q2 2022.

Figure 2 - Greater Toronto Area: Property Transactions by Asset Class (YTD Q2 2022 vs YTD Q2 2023)

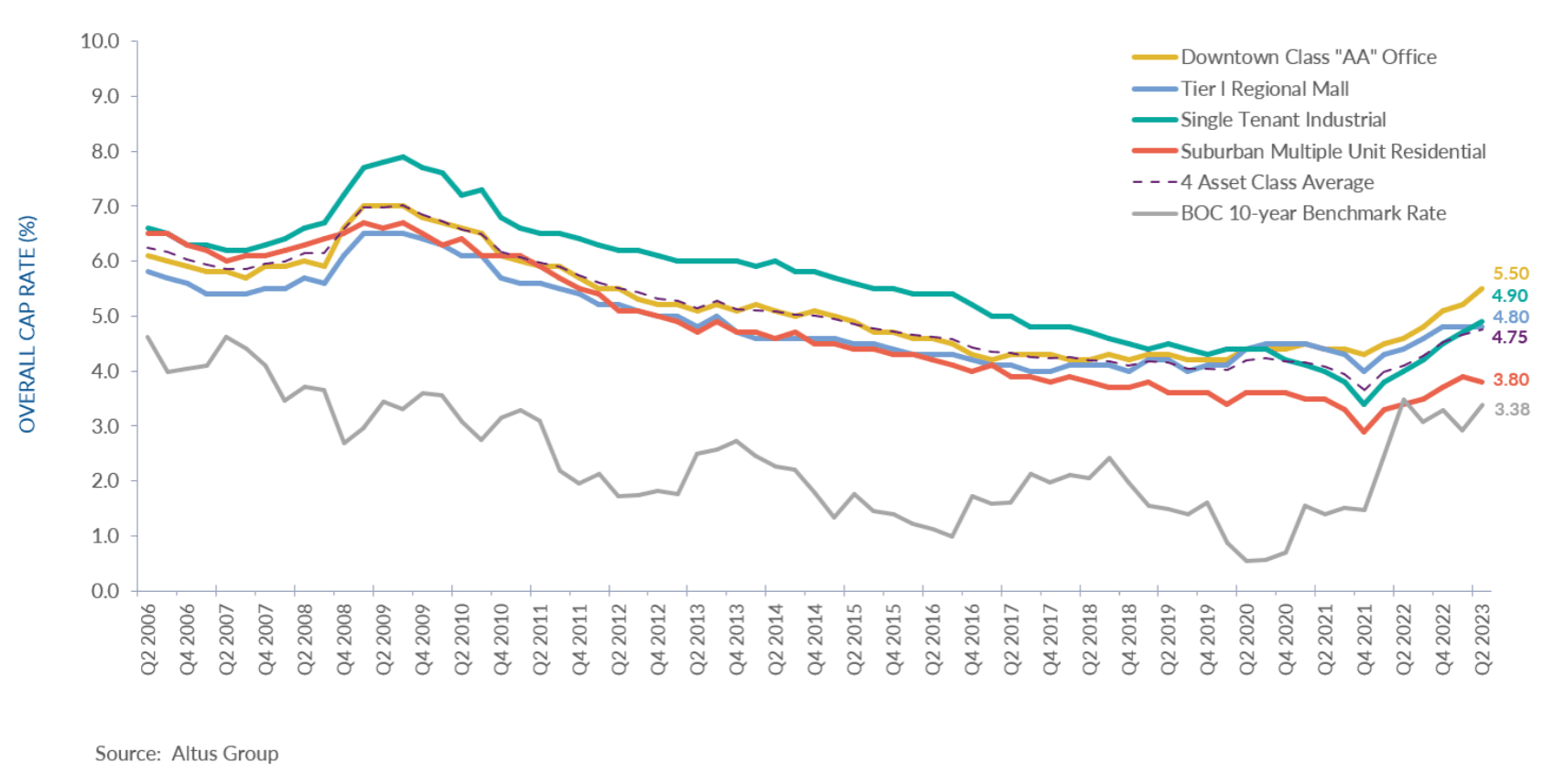

The slowdown in market activity in the first half of 2023 will likely persist for the remainder of 2023 due to continued high-interest rates and a growing bid-ask price gap between sellers and buyers. Investment transaction activity is expected to remain low in the foreseeable future as investors continue to navigate a new high-interest-rate environment. Given the current difficulties in the office and some parts of the retail market, industrial and residential real estate will continue to be favoured asset classes in the GTA market.

Figure 3 - Greater Toronto Area: OCR Trends across 4 benchmark asset classes

Notable transactions for the Q2 2023

W.P. Carey Portfolio, GTA & GGH – Industrial

With nearly 2.3 million square feet of gross leasable area, this 11-property industrial portfolio located in Toronto, Richmond Hill, and Brantford was purchased by W.P. Carey for a total consideration of $638 million. The seller of this portfolio was pharmaceutical giant Apotex, who entered into a sale-leaseback of all the properties for a 20-year term.

45 Di Poce Way, Vaughan – Industrial

Representing the largest industrial transaction of the quarter, the Spain-based Pontegadea Group purchased this industrial building for $198.2 million. Currently operating as a FedEx Ground Distribution Centre, the recently constructed facility spans 422,433 square feet and sits on a 60-acre site. This property is part of a cross-border portfolio that includes seven other properties in the United States. This transaction continues Pontegadea Group’s significant investment in Canadian real estate, having also acquired Royal Bank Plaza for nearly $1.2 billion in early 2022.

The Hazelton Hotel, Old Toronto – Hotel

This five-star 77-room hotel in Toronto's Yorkville neighbourhood was acquired by Hennick & Company from First Capital REIT for $105 million. At $1,363,636 per room, this transaction sets an all-time high for hotel assets in the Greater Toronto Area. This significant valuation reflects the hotel's reputation, luxurious amenities, and Forbes Five Star designation. This sale represents the highlight of First Capital REIT’s ongoing portfolio optimization strategy, which includes selling four properties in Toronto and Montreal through 2023.

141 Roehampton Avenue, Old Toronto – Residential Land

Lifetime Developments acquired this site for $70.1 million, representing the quarter's largest high-density residential land transaction. The existing 36-unit, 10-storey residential condominium building is slated for a wind-up, with a rezoning application submitted proposing the development of a 48-storey residential condominium tower. The development will contain 614 residential units and proposes a gross floor area of 396,639 square feet.

Authors

Jennifer Nhieu

Senior Research Analyst

Wyland Milborne

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Wyland Milborne

Market Analyst

Resources

Latest insights