The shifting commercial real estate finance landscape – An opportunity for alt lenders?

Key highlights

Recent regional banking woes echo the savings-and-loan institutions crisis of the 1980’s, characterized by high inflation, rising interest rates, and numerous bank failures

Constrained bank lending activity could open a window for alternative lenders to take market share or for new creative financing mechanisms to arise, as CMBS did in the 1990’s in the wake of the S&L crisis

Lending competition continues to weaken. Commercial mortgage originations and CMBS issuance are at their lowest levels in a decade, with year-over-year declines exceeding 50%

Banks recently accounted for more than 60% of commercial mortgages, and while there is no obvious existential threat to the sector, the CRE debt scene seems primed for a shakeup

A familiar crisis and a new opportunity

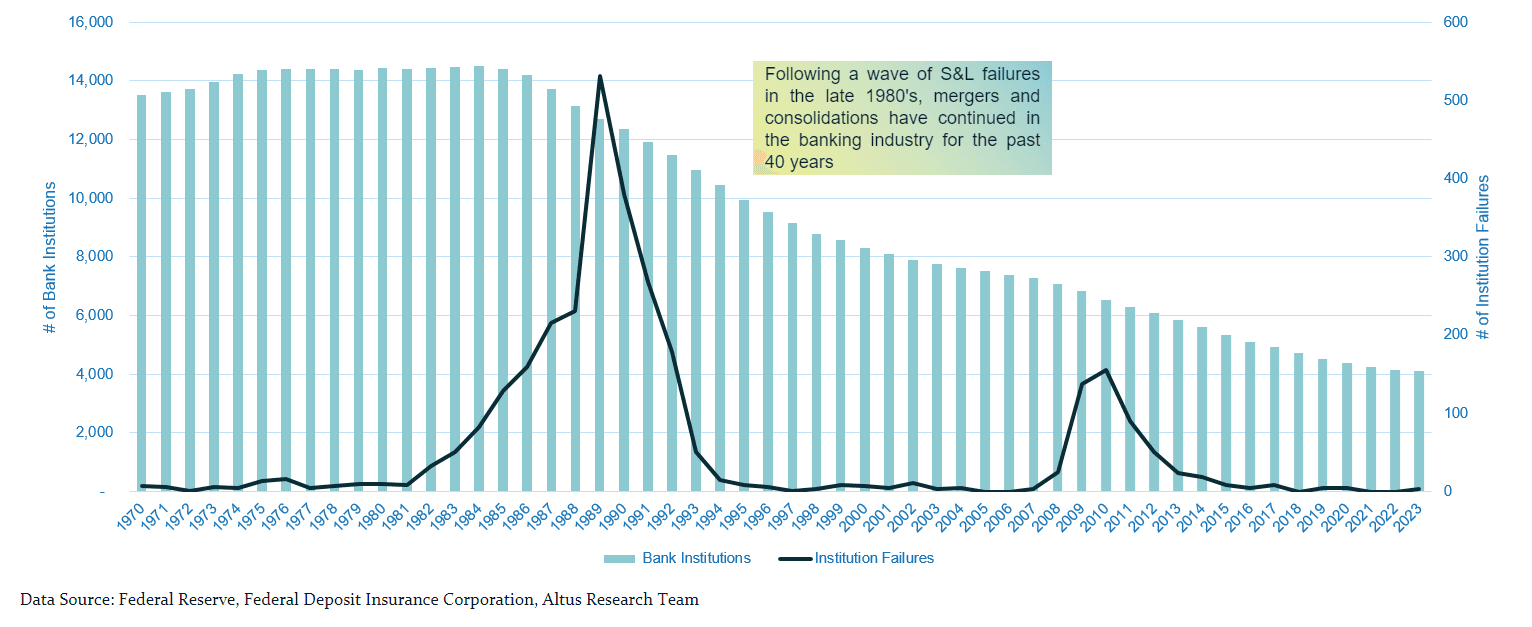

To seasoned commercial real estate professionals, the current environment may seem eerily familiar. Throughout the ‘70s and ‘80s, unchecked inflation prompted the Federal Reserve to hike interest rates, creating major problems for savings-and-loan institutions, “S&Ls” or “thrifts”, then a major lender for real estate, including commercial real estate (CRE). Burdened by thousands of previously originated long-term fixed-rate mortgages and the inability to attract new deposits, losses mounted and insolvencies became inevitable. With that, the savings-and-loan crisis began.

Figure 1 - Number of FDIC Insured Bank Institutions

The S&L crisis was characterized by a rising number of failed thrifts and disruption in real estate finance. But out of the crisis, opportunity was born. Non-thrift lenders began to fill in where thrifts once dominated and new sources of capital were found using structured financing vehicles. The resulting widespread standardization of real estate-backed institutional investment products throughout the 1990s effectuated what is now known as the modern Commercial Mortgage-Backed Securities (CMBS) market.

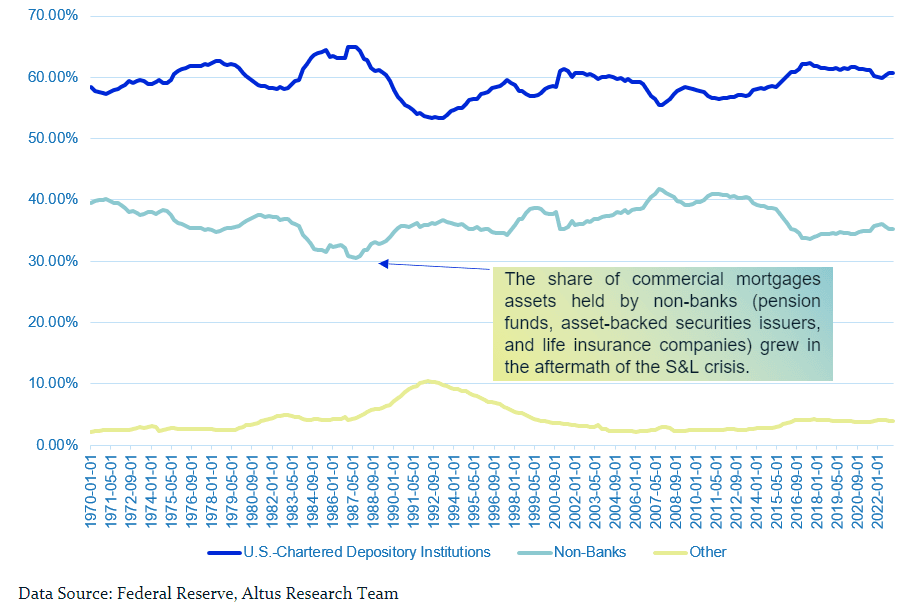

Figure 2 - Percentage of total commercial mortgage assets (banks vs. non-banks)

Fast forward to today, and the recent regional banking crisis (marked by the collapse of Silicon Valley Bank, Signature Bank, and Silvergate Bank in early 2023), triggered a retreat of traditional bank entities from CRE lending. Participants in June 2023’s CREFC conference noted that a market shift similar to that which followed the S&L crisis could be taking place now. As a result, a window has opened for non-bank lenders such as life insurance companies, pension funds, and mortgage Real Estate Investment Trusts (REITs) to enter in the wake of reduced competition.

Competition continues to weaken

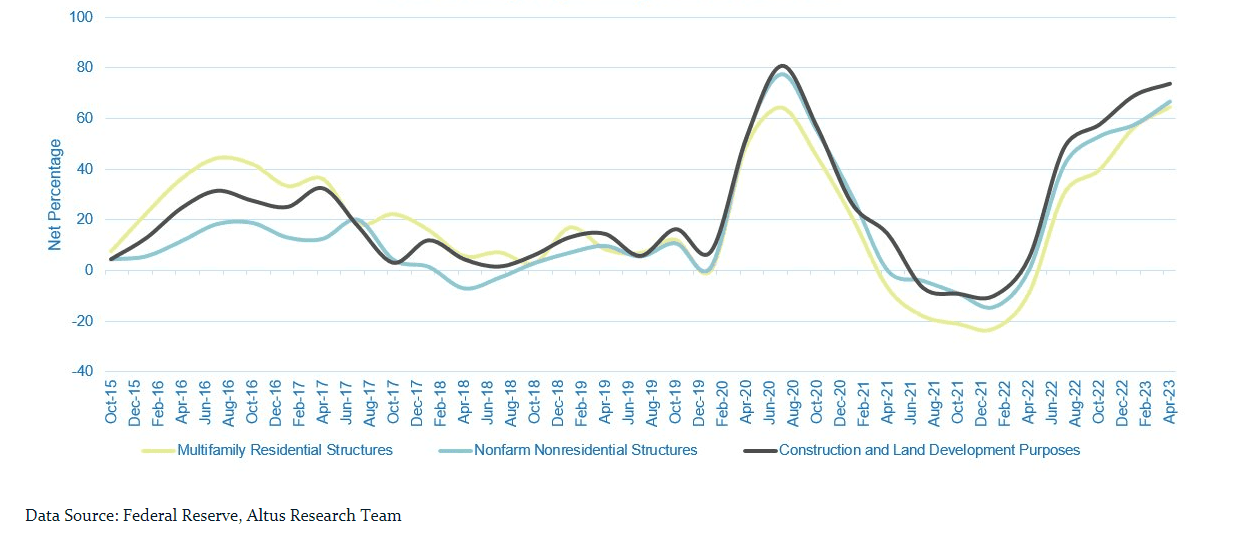

Since the first quarter of 2022, when the Fed began its tightening cycle, bank lenders have been pulling back on CRE lending. While the March 2023 regional bank crisis was not the reason for banks pulling back, it brought added scrutiny from investors and regulators to these institutions and exacerbated the slowdown. According to the Federal Reserve, the net percentage of traditional banks reporting tightened underwriting standards increased every quarter between Q1 2022 and Q2 2023 across all commercial asset types. By Q2 2023, the net percentage of banks reporting tightening standards reached +73.8% for construction and development loans, +64.5% for multifamily loans, and +66.7% for all other CRE loans.

Figure 3 - Net percentage tightening standards for CRE

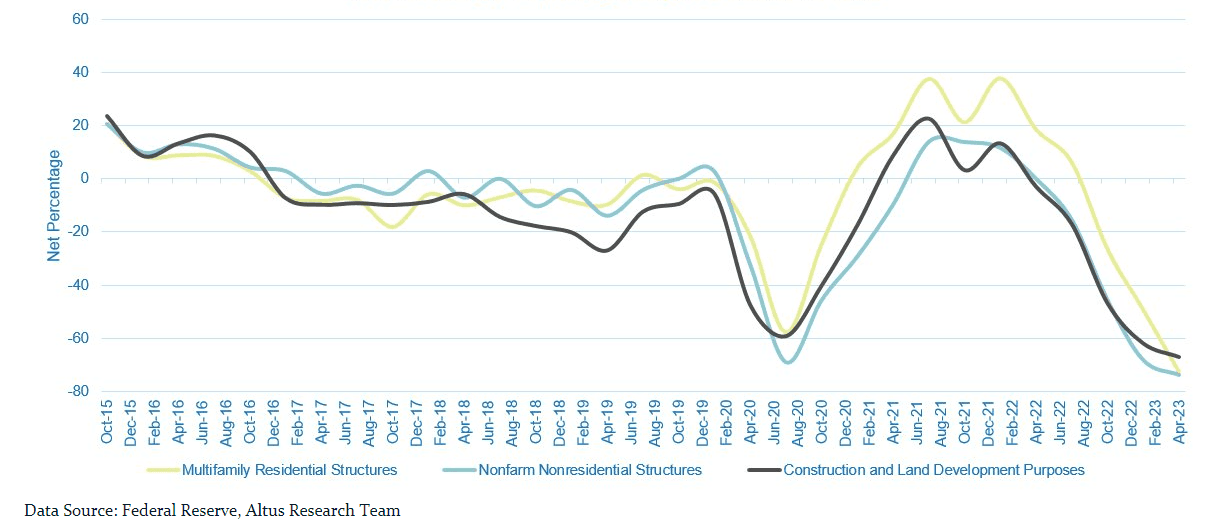

Similarly, the net percentage of these entities reporting strong demand decreased every quarter across the same period for all CRE property types. By Q2 2023, the net percentage was -67.2% for construction and development, -72.6% for multifamily, and -73.8% for all other CRE.

Figure 4 - Net percentage reporting stronger demand for CRE

This trend is confirmed in commercial mortgage origination volumes – the sector has seen the largest year-over-year declines in a decade. According to S&P Global, after reaching a Q4 2021 peak of $505 billion, commercial mortgage origination decline accelerated in successive quarters. Q2 2023 originations totaled $176 billion, representing a year-over-year decline of 55.2%.

Figure 5 - Commercial mortgage originations by traditional banks

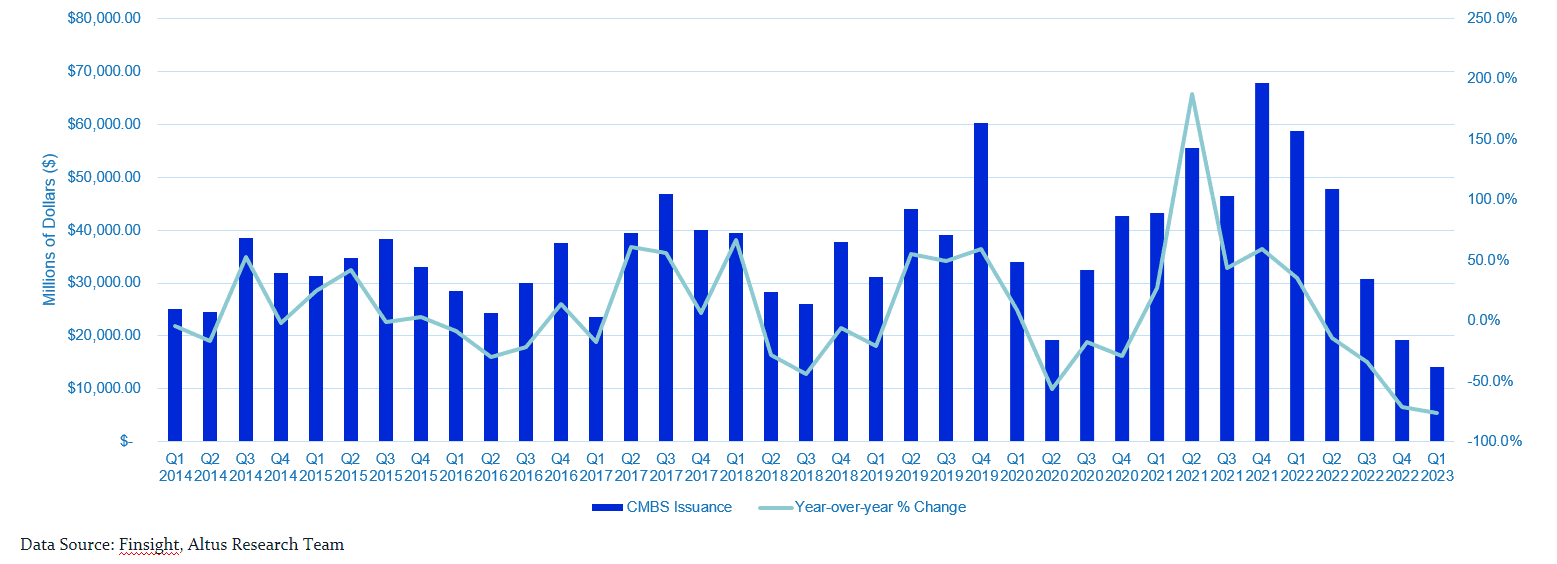

But others are still feeling the squeeze from rising interest rates. According to Finsight, CMBS issuance has been similarly troubled, having declined from $67.8 billion to $14.1 billion, a startling 76.0% year-on-year decline in Q1 2023. However, the CMBS market may well be poised to weather the current storm better than traditional bank entities. Year-over-year declines in CMBS issuance are high but decelerating, with quarter-over-quarter issuance increasing in Q2 2023.

Figure 6 - Total CMBS issuance

What’s to come?

Despite the absence of any obvious imminent threats to the banking system, current market, credit, and regulatory conditions will likely constrain bank lending activity in the near term. This will affect many industries that rely on bank capital for financing, including CRE, where banks have accounted for more than 60% of CRE mortgages in recent years. Whether there is a shift in market share from bank to non-bank lenders, or the introduction of a new innovative source of capital similar to CMBS market launching in the wake of S&L crisis, the CRE debt financing space appears set for a shakeup.

Author

Cole Perry

Associate Director of Research

Author

Cole Perry

Associate Director of Research