Key highlights

Concerns related to cost and availability of capital, inflation, and operating expenses remain the top priorities of CRE professionals but are waning as the industry digests the impact of the high-interest rate environment

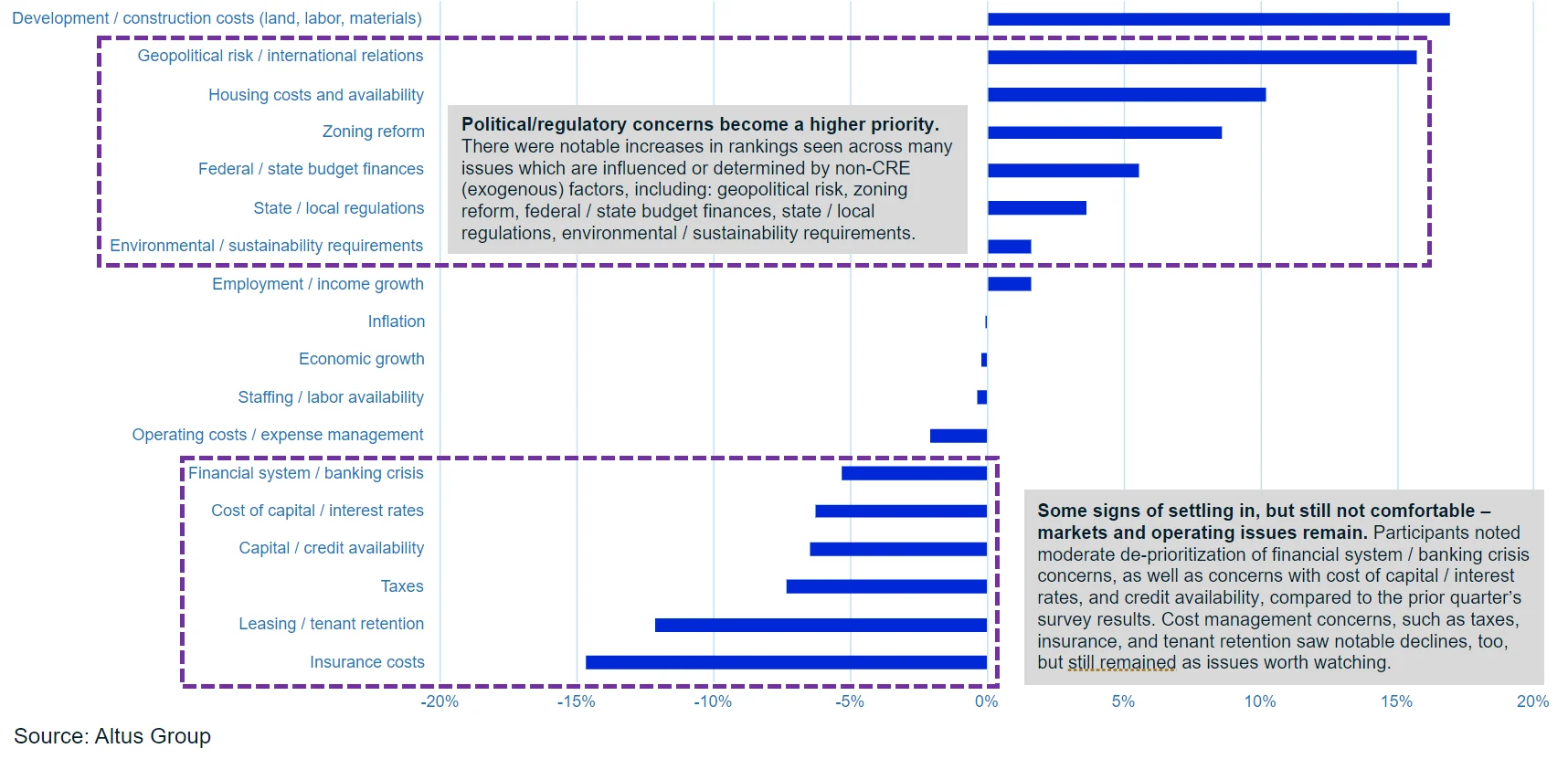

Non-CRE factors such as geopolitical risk, federal & state finances, zoning reform, and state & local regulations saw notable ranking upticks as top concerns over the next 12 months in the Q4 edition of the US CRE Industry Conditions and Sentiments Survey

The percentage of respondents indicating “geopolitical risk/international relations” as a top priority increased more than 15 percentage points, possibly due to ongoing conflict in Ukraine and the Middle East alongside elevated levels of distress across the Chinese real estate market

Property-specific and financing-related concerns still dominate CRE stakeholders’ anticipated priorities in the next 12 months, however, exogenous (non-market related) political risks reared their head as part of the outcomes of a recent commercial real estate market analysis utilizing data from Altus Group's Q4 results for the CRE Industry Conditions and Sentiment Survey. Several key recent events have likely contributed to these shifts in the prioritization of political and regulatory issues for the coming year – from domestic politics affecting federal and local finances to increased geopolitical tensions across different regions of the globe.

Measuring the impact of political risk through US Treasury bonds

The yield on US Treasury bonds is often viewed as a barometer for general economic confidence – yields on the bonds generally increase as investors seek higher returns from other investment options and decline as investors buy up the low-risk securities during times of elevated market risk. Yields on US Treasury securities are a vital indicator in financial markets, including the commercial real estate (CRE) sector. Considered "risk-free" investments, their yields provide a crucial benchmark for comparing relative risk and return in CRE.

Robust economic growth throughout 2023 led investors to demand higher yields from treasury bonds, driving them from 4% in early August 2023 to nearly 5% by mid-October, the highest since 2007. And yet, numerous recent attention-grabbing events of concern to the US (such as the ousting of Speaker Kevin McCarthy, Hamas’ attack on Israel, and the signing of stopgap spending measures, to name a few) were associated with notable daily yield declines. The average daily increase in yield from the beginning of Q3 2023 to its peak on October 19 was just 1.1 bps, while the decline on major news days averaged 7.6 bps.

Figure 1 - Yield on the 10-year US Treasury Bond with key international and domestic development dates

Download the US results from the Q4 2023 Commercial Real Estate Industry Conditions and Sentiment Survey.

Charting the effect of politics on the perspectives of the US CRE community

As geopolitical concerns have intensified worldwide, US survey respondents reported a more than 15-point increase in prioritization of international affairs over the next 12 months. The beginning of Q3 marked 18 months since the beginning of the Russia-Ukraine war. Turmoil in China’s real estate sector came to a head around the same time, with developer Evergrande filing for bankruptcy protection and Country Garden Holdings announcing it was on the brink of default. Both announcements affected global markets. These events coupled with increased tensions in the Middle East, particularly the October 7 attack by Hamas on Israel, have heightened concerns about the implications of weakening international relations on economic stability.

Figure 2 - Change in top priorities since Q3 2023Figure 2: Change in top priorities since Q3 2023

Domestically, the US faced its own challenges in Q3, as concerns regarding Federal and State budgets increased five percentage points quarter-over-quarter and regulatory concerns increased by 4 percentage points over the same period. The downgrade of the US credit rating by Fitch, the narrowly averted government shutdown, and political repercussions leading to the ousting of House Speaker Kevin McCarthy all contributed to economic uncertainty. Additionally, the growth of US debt payments and a subsequent downgrade by Moody's further exacerbated these concerns. These developments suggest that budget-related and domestic issues might continue to influence economic perceptions and possibly be reflected in future surveys, such as in Q1 2024.

Looking to 2024

As CRE professionals close out 2023, they carry forward persistent concerns about inflation as well as cost and availability of capital. Yet, the Q4 results of the US CRE Industry Conditions and Sentiments Survey reveal broader geopolitical and regulatory concerns have also been added to that list of worries. Heightened attention to political and regulatory risk underscores the interconnectedness of global events and the CRE sector. With 2024 being a presidential election year in the US, politics both at home in the US and abroad will likely be front and center for most media outlets, and it seems as though they already have the CRE industry’s attention.

Author

Cole Perry

Associate Director of Research, Altus Group

Author

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights