Ottawa commercial real estate market update – Q2 2023

Q2 2023: Ottawa and Gatineau market slowdown extends into Q2 2023, with transactions down 44%

Key highlights

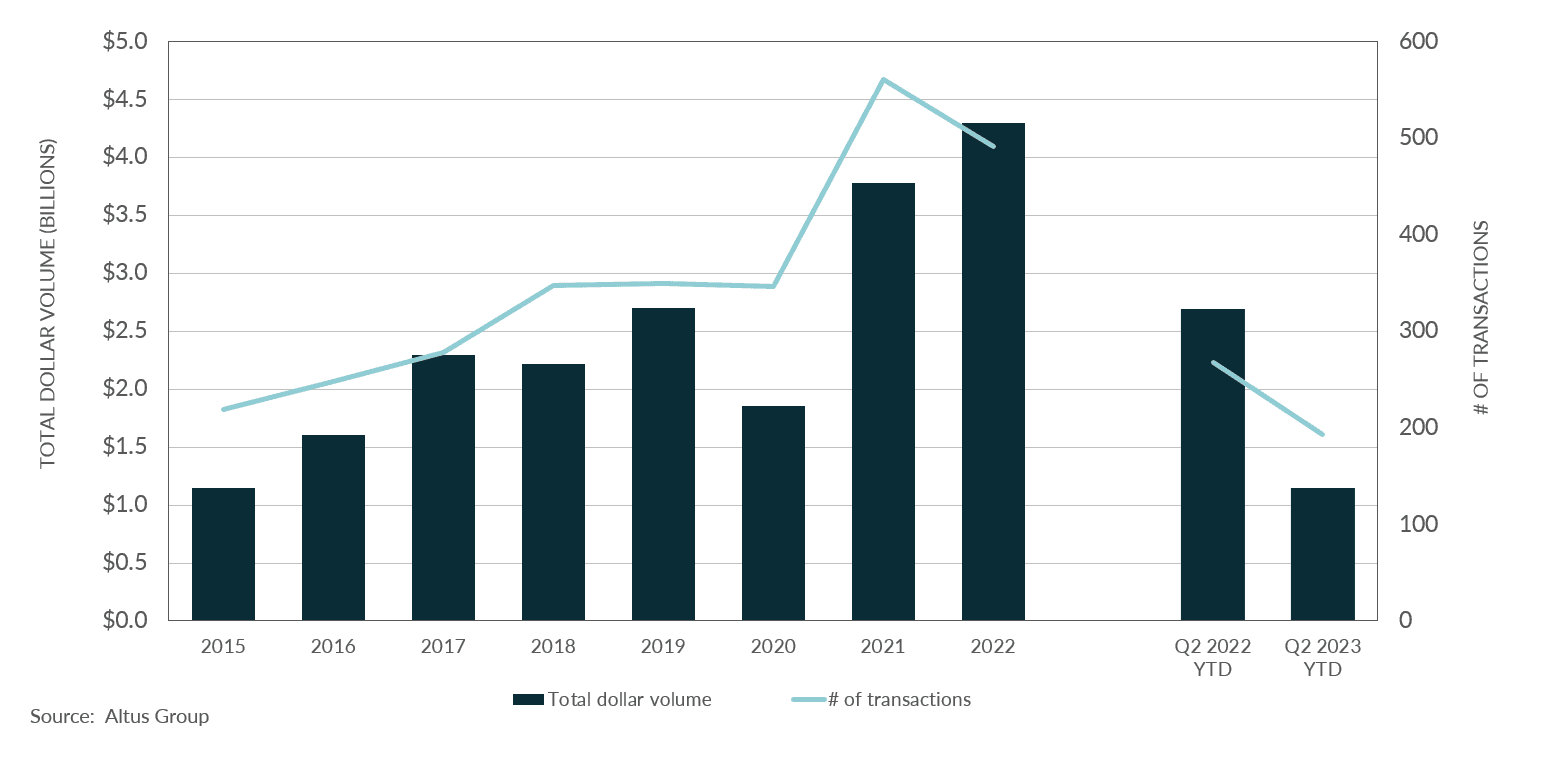

The Ottawa and Gatineau market recorded an investment total of $616 million, representing a 44% decrease year-over-year

Despite market setbacks, Ottawa is the most preferred market for investors across all asset classes, surpassing Toronto in Q2 2023

Office availability rate has climbed to 14.4% from 11.2% in Q2 2022, even with return-to-office mandates for federal public servants

Sublet space availability has continued to rise, with one million square feet in the market

A rapidly growing immigrant population may signal trouble on the horizon, as Canada has not coordinated its current housing policies with its population growth strategy

The industrial sector reported $56 million in dollar volume, a decrease of 25% year-over-year

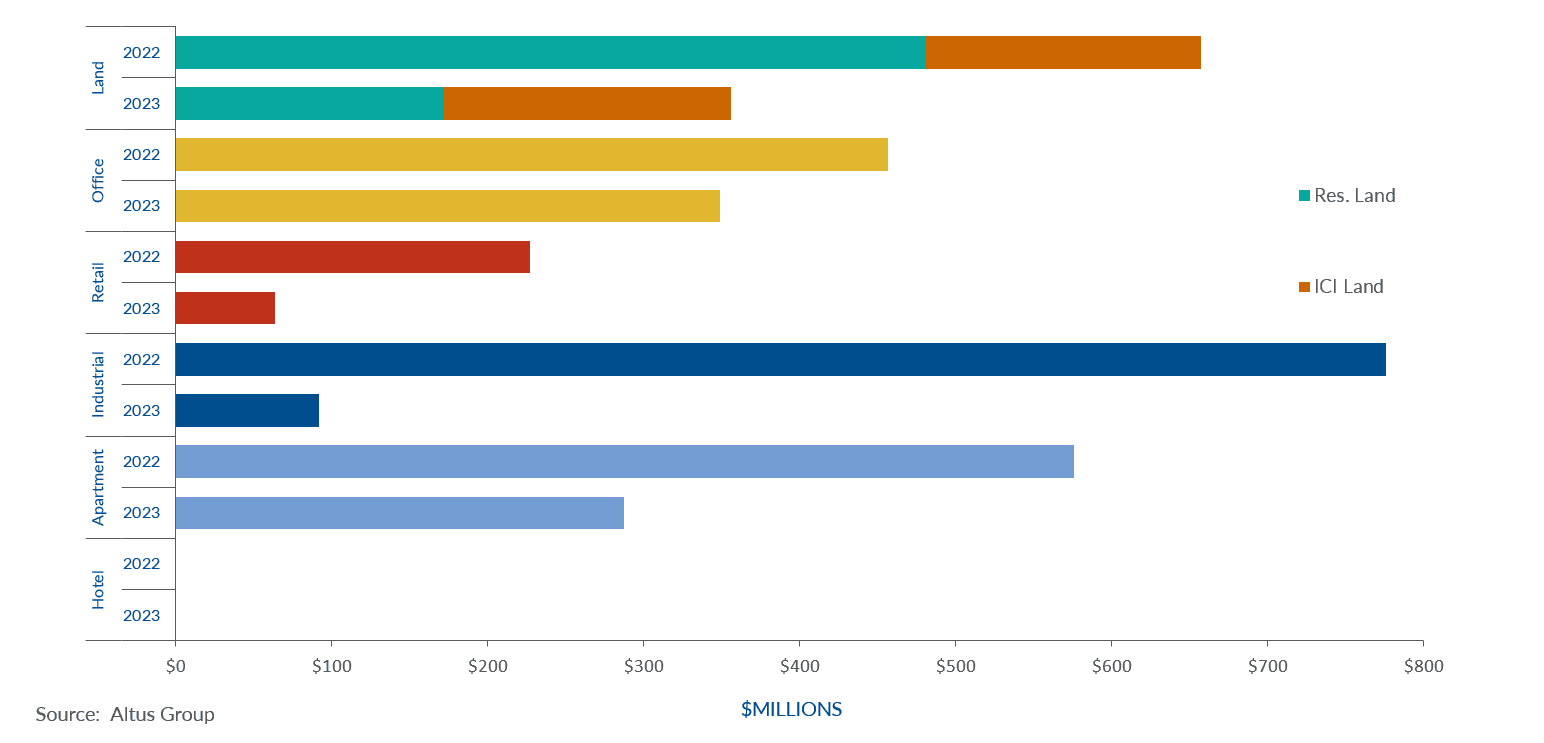

Buyers and sellers continued to navigate through a price discovery phase as aggressive interest rate hikes persisted to rein in inflation. The market recorded an investment total of $616 million, representing a 44% decrease year-over-year. Moreover, the office sector was the only sector to observe growth, mainly due to H&R REIT closing on a $277 million sale of 160 Elgin Street to Groupe Mach. Otherwise, the industrial sector observed minimal decline compared to other sectors as the region remains undersupplied relative to the demand. Despite the setbacks, the Ottawa and Gatineau market supported asset fundamentals. According to Altus Group’s most recent Investment Trends Survey, Ottawa is the most preferred market for investors across all asset classes, surpassing Toronto in Q2 2023.

Figure 1 - Ottawa and Gatineau Market Area – Property transactions – All sectors by year

Office investment transactions increased to $326 million in Q2 2023, an 121% increase due to, as aforementioned, H&R REIT closing on a $277 million sale of 160 Elgin Street, formerly known as Place Bell, to Groupe Mach. Otherwise, the office availability rate has climbed to 14.4% from 11.2% in Q2 2022, even with return-to-office mandates for federal public servants. Additionally, sublet space availability has continued to rise, with one million square feet in the market (indicative of an 80% increase), as tenants sought to maximize their rental space.

The investment volume is down in the apartment sector at $52 million, representing an 87% decrease due to increased interest rates and construction costs. On the other hand, the construction of new supply remains steady due to high demand and limited supply. According to the latest Investment Trends Survey, suburban multi-unit residential in Ottawa placed fourth in investors' preferred product and market combinations in Q2 2023. However, a rapidly growing immigrant population may signal trouble on the horizon, as Canada has not coordinated its current housing policies with its population growth strategy. While an influx in the immigrant population helps to address Canada’s labour shortage, it simultaneously fuels the demand for housing and affordable housing, and the country may ultimately be unprepared to welcome these immigrants.

The industrial sector reported $56 million in dollar volume, a decrease of 25% year-over-year. Moreover, the availability rate jumped to 3.4% from 2.4% amidst the high-interest rate environment. Additionally, the market experienced a negative net absorption of 60,000 square feet this quarter, mainly due to new supply entering the market. Industrial assets continued to be in demand as Ottawa’s limited and aging inventory encouraged higher rental rates and the construction of new supply despite rising interest rates. In the second quarter of 2023, five projects are reported to be under construction, representing 287,332 square feet coming to the market, with 43.1% pre-leased.

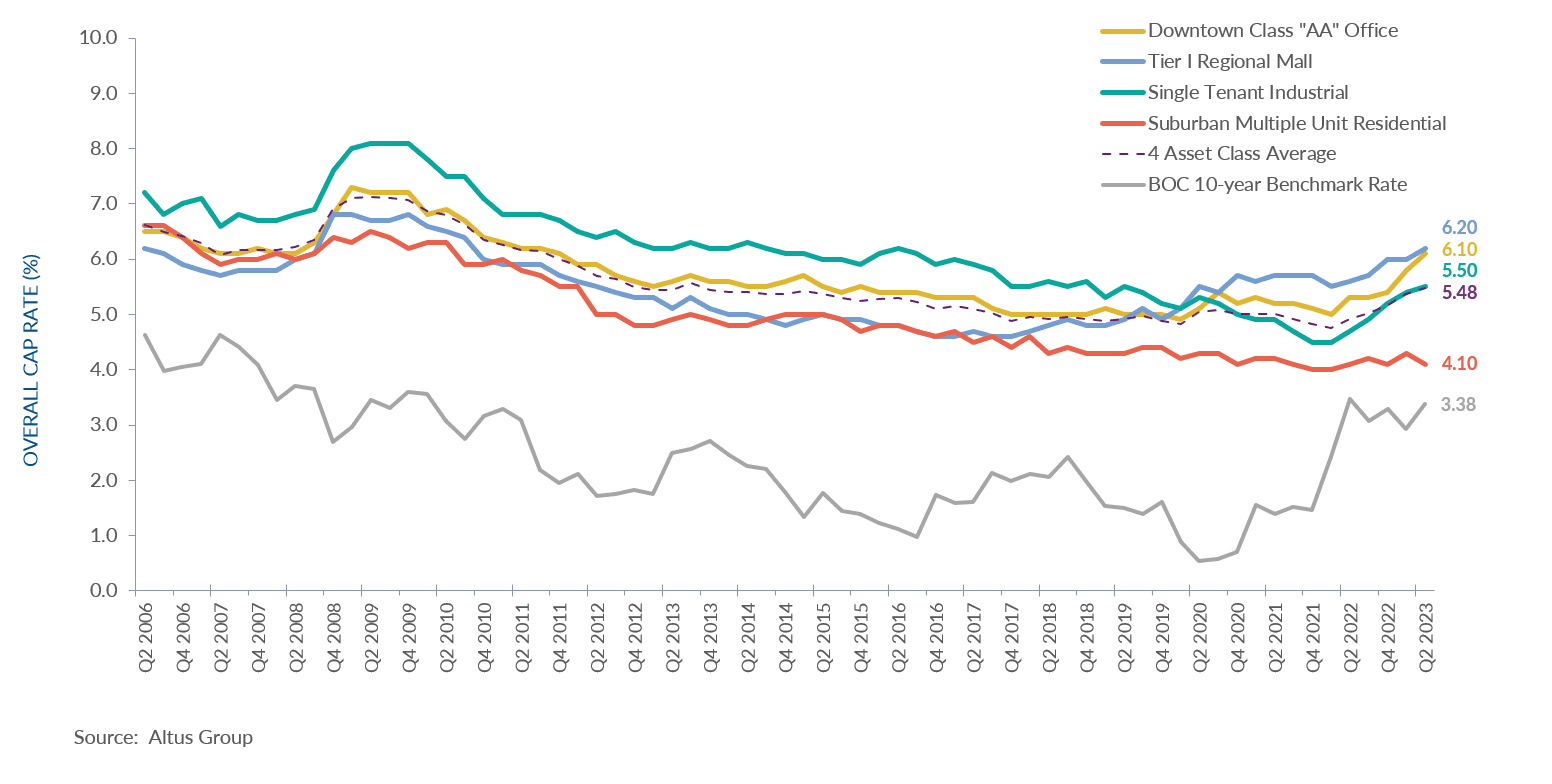

Figure 2 - Ottawa and Gatineau Market Area – OCR trends across 4 benchmark asset classes – Q2 2023

Notable Q2 2023 transactions

The following are notable transactions for the Q2 2023 Ottawa and Gatineau market area commercial real estate market update.

Crown Realty – First Bay Flex Office Portfolio – Office

This $14,250,000 flex office portfolio transaction consists of nine single-storey office buildings located in Nepean’s Camelot Business Centre. At the time of sale, the buildings were fully occupied by national and local businesses. Constructed in 1985, the buildings contain a total net rentable area of 71,601 square feet. Ottawa-based First Bay Properties Inc. adds this property to its growing office, retail, and industrial portfolio, spanning Eastern Ontario and Atlantic Canada.

2151 Thurston Drive – Office

Located on a 2.11-acre parcel within the Ottawa Business Park, this two-storey, single-tenant flex office property features 34,331 square feet of office and warehouse space. Purchased by Ottawa-based Merkburn Holdings for a consideration of $5,600,000, the recently vacated property was listed for lease with immediate occupancy at an asking rate of $15 per square foot net. Before the date of sale, the building had been home to CAA’s North and East Ontario offices.

3105 Hawthorne Road – Industrial

Constructed in 2016, this 29,925-square-foot cold storage industrial warehouse building was acquired by Hydro Ottawa for $11,300,000. The building is serviced by ten truck-level doors and one drive-in door. After the sale date, the vendor entered into a sale lease-back agreement for a portion of the property on a one-year term. This unique warehouse facility features 28-foot clear heights and approximately 12,000 square feet of office space on two floors.

1090 Kristin Way – Apartment

The highest value improved property transaction in Ottawa for Q2, this eight-storey, 102-unit residential apartment building sold for $17,850,000, representing a price per unit of $175,000. Located just north of Montreal Road, between St Laurent Boulevard and the Aviation Parkway, the building is located near the many shops and restaurants of the busy Montreal Road Corridor. The building was constructed in 1960 and features a mix of bachelor, one and two-bedroom units. This apartment transaction is Killam Apartment REIT’s second divestment in the Ottawa market this year, having sold an eight-storey, 43-unit apartment building located at 266 Bronson Avenue for $9,800,000 in March.

2-6 Lattion Road – Residential Land

Located at the western end of des Allumettières Boulevard in Aylmer, this 1.520-acre property was acquired for a total consideration of $2,950,000, representing a price per acre of $1,940,789. The property is adjacent to the new Parc-o-bus des Allumettières transit station and will eventually be the western terminus of the Gatineau LRT system. Purchaser J.B. Construction has already received planning approval from the Ville de Gatineau for their proposed Belvédère Lattion development of three three-storey residential apartment buildings containing 45 units.

Figure 3 - Ottawa and Gatineau Market Area – Property transactions by asset class (YTD Q2 2022 vs YTD Q2 2023)

The Ottawa and Gatineau market was the most preferred market by investors for all asset classes this quarter. However, investment transaction activity is expected to remain low as investors continue through a price discovery phase in a new high-interest-rate environment. Additionally, given the volatility in the office and some parts of the retail market, industrial and residential real estate will continue to be favoured asset classes in the GOA market like with other Canadian markets.

Authors

Jennifer Nhieu

Senior Research Analyst

Stephen Robinson

Market Analyst

Authors

Jennifer Nhieu

Senior Research Analyst

Stephen Robinson

Market Analyst

Resources

Latest insights