Multifamily sentiment rebounds as the US housing market rebalances

Learn why multifamily investor confidence is rising, rental demand remains strong, and new supply is slowing — signaling renewed momentum for the sector.

Key highlights

Multifamily sentiment has reversed course, reflecting improved fundamentals and growing conviction in the sector’s near-term performance

Elevated mortgage rates and constrained for-sale housing inventory continue to redirect demand toward rentals, reinforcing occupancy and rent stability

With new supply decelerating and rental demand holding firm, the sector is benefiting from a rebalancing in housing dynamics

Just one year ago, sentiment around the US multifamily sector had taken a dramatic turn

Altus Group’s Q1 2024 Industry Conditions and Sentiment Survey captured a sharp downturn in expectations for the multifamily sector. The share of respondents who viewed the sector as a likely top-performing asset class over the following 12 months fell from nearly two-thirds to under half, while those who saw it as a potential worst performer rose to nearly one-third. This nearly 30-point net negative swing marked one of the largest quarterly sentiment shifts in the survey’s history. Our April 2024 outlook cited several key headwinds driving the perception shift: rising operating and insurance costs, mounting distress in the CRE CLO markets, and most prominently, an expected surge of new supply poised to pressure rents.

Fast forward to Q1 2025, and the mood has shifted dramatically. Sentiment has rebounded, with 62% of respondents now identifying multifamily as a potential top performer (up sharply from the 46% figure a year prior) while just 6% now consider it a likely worst performer. This 40-point swing signals a complete reversal in respondent outlook.

Figure 1 - Q1 2024 to Q1 2025 sentiment shift

What changed? The rebound reflects a broader realignment of housing fundamentals, driven by a frozen single-family market, cooling construction pipelines, and steady rental demand. Below, we explore the key forces behind multifamily’s momentum.

The mortgage rate lock-in effect is far from easing

The single-family housing market remains deeply constrained by the mortgage rate "lock-in" effect, a phenomenon significantly amplified by the massive refinancing wave during the pandemic. According to the Federal Reserve Bank of New York, between 2020 and 2021, approximately 14 million homeowners refinanced their mortgages to take advantage of historically low interest rates, with many securing rates below 3%. This surge in refinancing led to a substantial portion of homeowners holding mortgages with rates well below current market levels. As a result, with the average 30-year fixed mortgage rate remaining above 6% since late 2022 according to Freddie Mac, many homeowners have little financial incentive to sell their homes and take on higher-rate mortgages. This dynamic has effectively frozen the existing home market, leading to exceptionally tight inventory. According to the National Association of Realtors, there were just 4.02 million existing home sales in March 2025 on a seasonally adjusted annual basis, fewer than during the depths of the Global Financial Crisis and the lowest in over 30 years.

Figure 2 - Single-family home sales and average mortgage rates

Some of that sidelined demand did shift toward new construction. According to the National Association of Homebuilders, at one point in early 2024 new home sales accounted for over 30% of all home sales, well above historical norms. But with mortgage rates still elevated and construction costs continuing to rise (and the threat of tariffs elevating this concern even more), even that segment is showing signs of leveling off. Builders face mounting challenges in delivering new supply, especially in high-demand markets. As affordability erodes and development slows, housing demand is increasingly being channeled back into the rental market.

A perfect storm drove single-family home prices to record highs

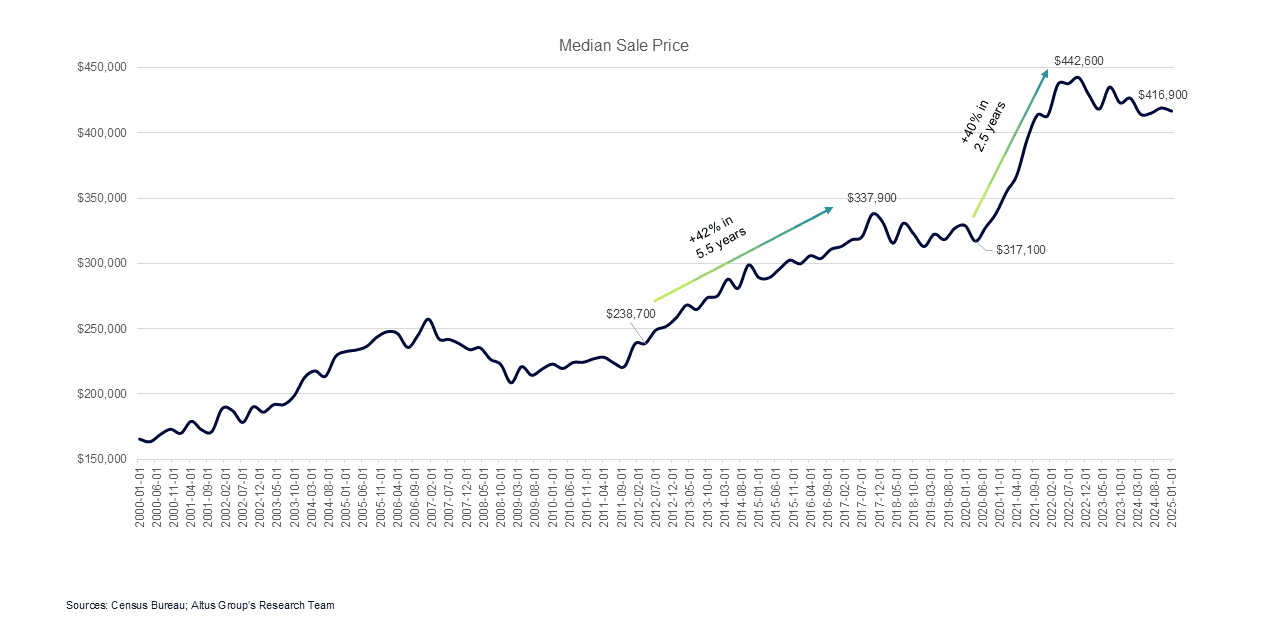

According to US Census data, median home prices rose nearly 40% between April 2020 and October 2022 – a span of just 2.5 years. By comparison, it took 5.5 years, from April 2012 to October 2017, for prices to increase a similar 42% in the post-GFC, pre-pandemic period.

Figure 3 - Median home sale price (2000 – 2025)

This unprecedented appreciation was driven by a perfect storm of factors: surging demand for space during the pandemic, a wave of millennials entering their homebuying years, and chronic undersupply in key markets, many of which had seen little construction activity since the Global Financial Crisis or faced structural constraints on new development. The result was a dramatic run-up in prices that has left affordability stretched and prospective buyers increasingly priced out.

Fundamentals tip back toward back favoring multifamily owners + operators

As turnover in the existing home market remains limited and new single-family development becomes more difficult to deliver, fundamentals continue to favor multifamily. Despite economic uncertainty, overall housing demand remains strong, supported by a stable labor market and resilient consumer spending. However, affordability and access to financing continue to be major headwinds for would-be homebuyers.

The souring sentiment toward multifamily captured in early 2024 survey results coincided with expectations for peak new supply. But the wave of deliveries appears to have peaked in July 2024. Now, the worst fears of oversupply are beginning to recede. Supply growth is slowing, demand is stable, and multifamily owners and operators may now find themselves in a more favorable position than just one year ago as the housing market rebalances.

Figure 4 - Units completed in multifamily structure (2000 – 2025)

The road ahead

According to Altus Group data, multifamily rent growth moderated significantly from its 2022 highs, approaching 0% annually in 2024 for some subsectors. But by Q1 2025, high-rise and mid-rise apartment segments were once again seeing accelerating growth. Despite pockets of localized declines, particularly in overbuilt Sun Belt metros, the broader multifamily market is on firmer footing. A stalled single-family housing market, resilient rental demand, and a marked slowdown in new deliveries are reinforcing the sector’s fundamentals and reviving investor interest.

Figure 5 - Multifamily rent growth (2019 – 2025)

This sharp reversal in sentiment is rooted in a classic supply-demand rebalancing, intensified by structural shifts across the housing market. With fewer new units expected and demand remaining elevated, multifamily is still perceived to be a leading asset class. Supporting this renewed optimism, multifamily was one of only two sectors to record year-over-year growth in transaction volume, according to Altus Group’s forthcoming Q1 2025 Investment and Transactions Quarterly. Signs suggest the sector is potentially poised for a strong performance in the year ahead.

Figure 6 - Year-over-year change in dollars invested (2014 – 2025)

Want to be notified of our new and relevant CRE content, articles and events?

Author

Cole Perry

Associate Director of Research, Altus Group

Author

Cole Perry

Associate Director of Research, Altus Group

Resources

Latest insights