Key highlights

Strong economic growth, cooling inflation, and increased expectations for monetary easing by central banks has lifted sentiment across businesses, consumers, and capital markets

Interest rates remain in center focus for 2024, as markets anticipate the Fed to begin cutting, lowering the cost of capital across the economy and risk assets

However, the transmission of these expected rate cuts, from the policy rate to businesses and investments, is highly dependent on the availability of credit and lenders’ willingness to extend credit

Lower capital cost is beneficial to commercial real estate (CRE) markets and valuations, but rising distress levels and recapitalization risk remain in many 2024 CRE outlooks

Sentiment rises on expectation of falling rates

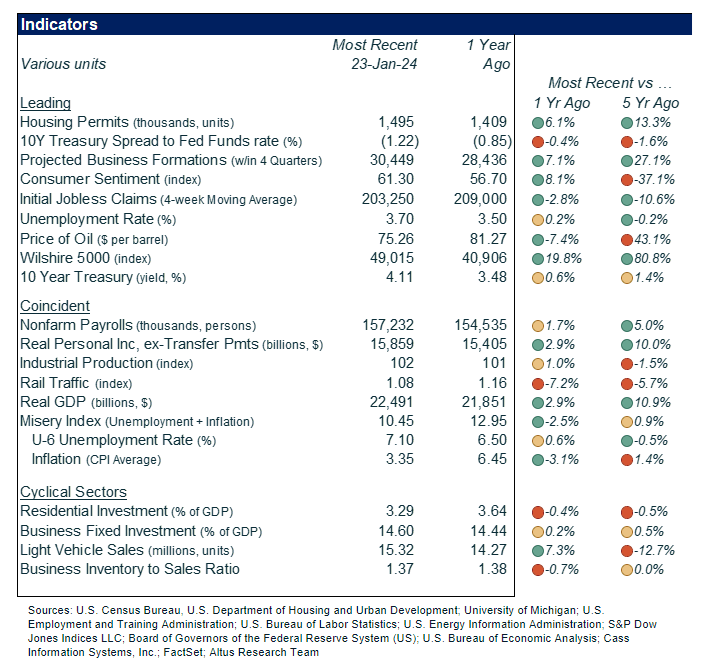

It is hard to dispute the data – the economy is growing at an impressive clip (Q4 2023 GDP was +3.3%), inflation is falling (December Producer Price Index by Commodity was +0.9%, and core Personal Consumption Expenditures was +2.9%), capital markets are thawing (equity markets closed 2023 up +20% while the yield on the 10-year US Treasury security was little changed from where it started the year), sentiment is improving (consumer sentiment was up 21.4% in January 2024), and labor market remains tight (3.7% unemployment). To this effect, the January 2024 edition of the WSJ Economic Survey showed the average probability of a recession in the next 12 months falling to 39% from 63% in October 2022.

While there have been some signs of loosening in the labor market (such as declining openings, hires, and quits), the participation rate and non-farm business productivity continue to establish new highs, and the US labour market remains tight. Low levels of unemployment coupled with positive earnings growth has benefited the US household and consumer. Overall financial health of the consumer and US household remains solid – buoyed by high home prices, positive stock market returns, rising incomes, and low levels of indebtedness – and has contributed to improving consumer sentiment. In turn, the US consumer’s ability and willingness to spend despite the higher rate environment has been the primary contributor to overall broad and strong economic growth. In short, the US economy is in a great position at the start of the year, and an even better position relative to other major economies around the world.

A major contributor to increased optimism is the anticipated shift in the Federal Reserve’s (Fed) monetary policy from interest rate hikes to interest rate cuts through 2024. The Fed has signaled that it expects to cut approximately three times through the year (assuming each cut is 25 bps), while investors are expecting closer to six 25 bps cuts over the next 12 months.

Figure 1 - Macro snapshot – Q4 2023

Interest rate transition and transmission

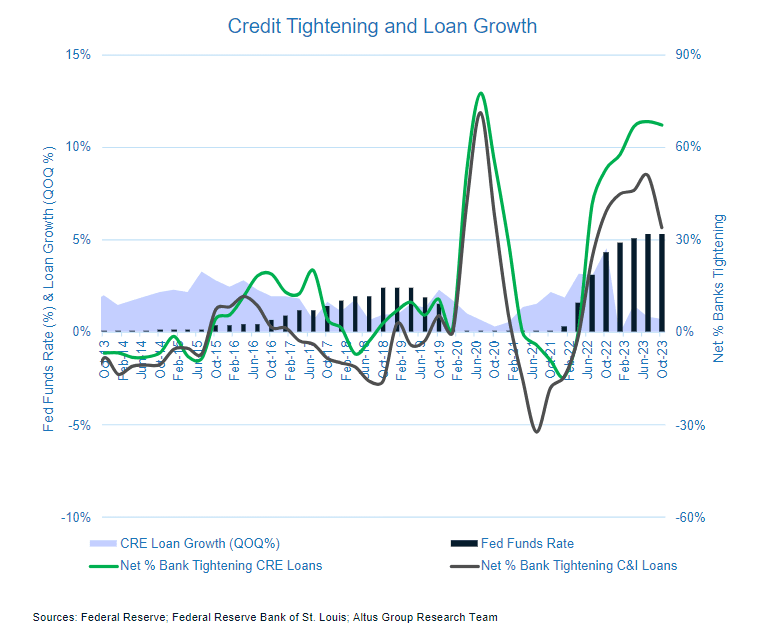

While sentiment heading into 2024 was positive across capital markets (including CRE), given the anticipated rate cuts, the timing, and magnitude of the rate cuts are still uncertain – as a result, the effective transmission of Fed rate cuts to CRE borrowers/owners also remains unclear. And even with renewed optimism across the economy and capital markets, the CRE asset class remains criticized by many investors – many of whom do not believe the asset class has repriced to the higher-cost of capital environment. While shares of publicly traded REITs bounced up on the market’s increased expectations for more rate cuts for 2024, fourth-quarter earnings calls are revealing that many lenders continue to reserve for and write down CRE exposures.

While the level of distress in CRE remains below prior periods of market disruption, the amount of delinquent or troubled CRE credit has been trending up, and many lenders continue to tighten underwriting standards for CRE while showing little appetite for new lending.

Given that debt is frequently used to finance CRE throughout the life of a property, the asset class is somewhat interest rate sensitive. However, while falling interest rates generally drive capital costs down, it only does so to the degree that the lower cost of financing is available. So, the anticipated cut to the Fed Funds Rate is a positive to CRE, but only if that lower capital cost is passed through and made available to the CRE borrowers. If the transmission of falling rates is delayed or complicated by rising levels of distress, then the effective cost of capital for CRE may remain elevated.

Figure 2 - Banks still tightening standards for CRE

What does all of this mean for CRE in 2024?

Short answer: The confluence of macro- and asset-specific forces may drive greater dispersion and require increased selectivity by CRE investors and lenders.

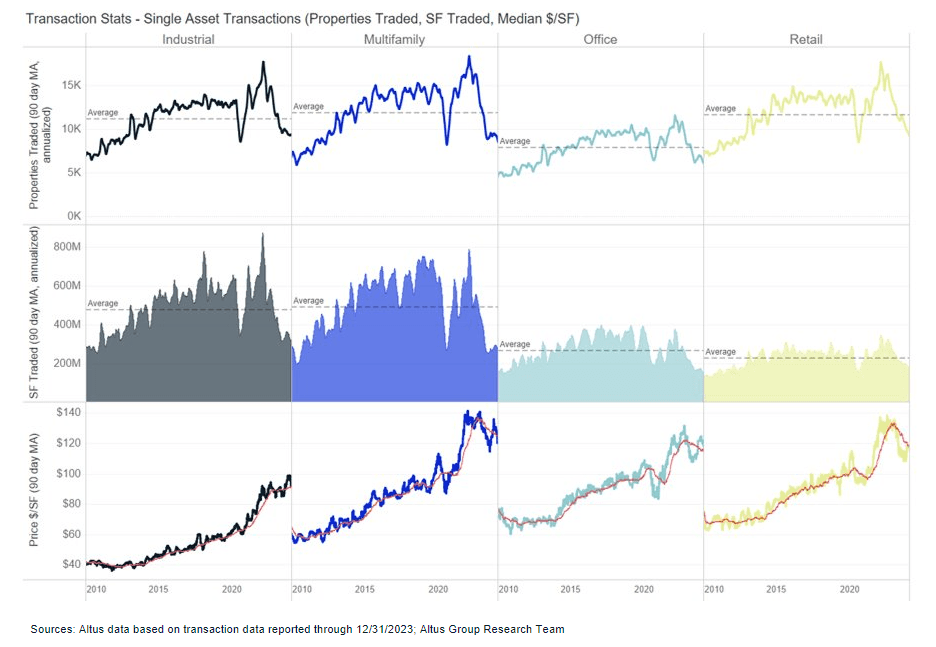

Longer answer: Given that the cost of capital will still be elevated compared to the recent post-pandemic boom years, CRE transaction volumes and valuations are likely not going to reach those peaks, but may be an improvement over the low bar set by 2023. Even just the potential of monetary policy easing will help to restore confidence to would-be potential CRE investors, which may help to encourage more transaction activity. The potential increase in distress and forced sales, due to either asset underperformance or failed recapitalizations, could also contribute to increased market activity and price discovery – putting downward pressure on prices at least in aggregate. Looking at rolling 90-day average transaction data across the US, we have seen signs of CRE private markets finding possible support levels, which could be indicative of the transaction levels finding a bottom after free falling through 2023.

The combination of many of these factors may present the opportunity for new investors and lenders to enter the market, but will likely also require increased selectivity on their part to decipher between good and bad exposure. While all CRE is affected by the macro- and market environment, each CRE asset is unique and requires idiosyncratic considerations.

Figure 3 - Is US CRE private market activity finding bottom?

Here are the recent developments that caught my attention over the past weeks:

Economy:

The advance estimate of gross domestic product (GDP) released by the Bureau of Economic Analysis for the fourth quarter of 2023 showed that the US economy grew faster than predicted, +3.3% at an annualized rate and adjusted for inflation. The consensus estimate was for a 2% expansion. Economic activity was driven by strong consumer and government spending amidst cooling inflation.

The US Consumer Price Index (CPI) rose 0.3% in December (month-on-month), faster than expected and faster than November’s 0.1% rate. On an annual basis, CPI rose 3.4%, compared to November’s 3.1% pace. This increase in rate of change was largely driven by high housing and auto insurance costs. While the CPI print was market-negative, the other gauges of inflation (Producer Price Index and Core Personal Consumption Expenditures) helped to allay market fears that inflation will remain above the Fed’s target range.

The latest release of existing home sale data showed that 3.78 million existing homes were transacted in December. The median existing-home price for all housing types in December increased at an annual rate of 4.4% over December 2022 to reach $382,600. Price increases were seen across all four US regions tracked.

The Federal Reserve Bank of Philadelphia released a report on consumer credit and showed that US credit card delinquencies rose 40 bps in the fourth quarter to the highest level in a decade, 3.2%.

The Conference Board released its Leading Economic Index (LEI) report, which provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. In December, the index fell by 10bps to 103.1, this minor decline comes after a 50 bps decline in November. In the most recent release, six out of ten leading indicators were positive, but were more than offset by weak manufacturing conditions, high rates, and still depressed consumer confidence. In the press release, the Conference Board noted that they expect GDP growth to turn negative in Q2 and Q3 of 2024, but begin to recover late in the year.

Capital markets:

Fourth quarter 2023 earnings season is underway. As of January 26, Factset reported that more than 25% of S&P 500 companies had released results, 69% of S&P 500 companies had reported a positive Earnings per share (EPS) surprise, and 68% of S&P 500 companies have reported a positive revenue surprise. However, not all of the top line was able to translate into profits, as the blended year-over-year (YoY) earnings decline for the S&P 500 was -1.4%. If the trend holds true through the remainder of earnings season, this would mark the fourth time in the past five quarters that the index has reported a YoY decline in earnings.

S&P reported that corporate defaults rose 80% in 2023 compared to 2022. Defaults totaled 153 in 2023 compared to 85 in the year prior. The majority of the defaults (63%) were in the US and 42% of the defaults were in consumer-facing sectors.

Market volatility increased over the month, as the VIX (CBOE Volatility Index) ended the month at 13.6. The rolling 60-day correlation between equities and bonds moved rose to 0.48, up from a month prior (0.36). The US Dollar was little changed compared to other major global currencies during the month at approximately 1.6%.

Stocks ended the month little changed, with the US broad market indices ending the month flat at 2.8% on the month. Performance across sectors was mixed, as Communication Services (+9.%) and Information Technology (+6.9%) were leading, while Real Estate (-3.9%) and Utilities (-2.7%) were lagging.

The yield on the 10-year US Treasury security rose 20 bps during the month, settling at 4.08%. The risk-free yield curve remained inverted with the 10-year/3-month US Treasury pair ending the month at -1.34%.

Corporate credit spreads tightened during the month, with spreads to US Treasury securities ending the month AAA (55 bps vs 63 bps a month prior) and BBB (134 bps vs 147 bps a month prior). Effective yield on high-yield corporate debt rose to 7.5%.

Commercial real estate:

Shares of US REITs ended the month of January down (-5.1%), trailing the US broad market indices, which finished the month up 3.4% from one month prior. Price to FFO multiples for REITs overall contracted during the month, ending at 15.1x down from 15.8x. Performance across REIT sectors was mixed, and the gap between top- and bottom-performing sectors spanned 5.9%. The best-performing REIT sector for the month was Regional Malls (-2.3%), and the worst-performing REIT sector for the month was Self-Storage (-8.1%).

Disclaimer: The opinions expressed in this article are solely those of the author and are not endorsed by Altus Group Limited, its affiliates and its related entities (collectively “Altus Group”). This publication has been prepared for general guidance on matters of interest only and does not constitute professional advice or services of Altus Group. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy, completeness or reliability of the information contained in this publication, or the suitability of the information for a particular purpose. To the extent permitted by law, Altus Group does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. The distribution of this publication to you does not create, extend or revive a client relationship between Altus Group and you or any other person or entity. This publication, or any part thereof, may not be reproduced or distributed in any form for any purpose without the express written consent of Altus Group.

Author

Omar Eltorai

Director of Research

Author

Omar Eltorai

Director of Research