Key highlights

Analysis of the US Census’s 2022 American Community Survey 1-year estimates helps to illustrate the evolving trends in remote work adoption across different US markets and helps to explain the rising uncertainty in demand for office space

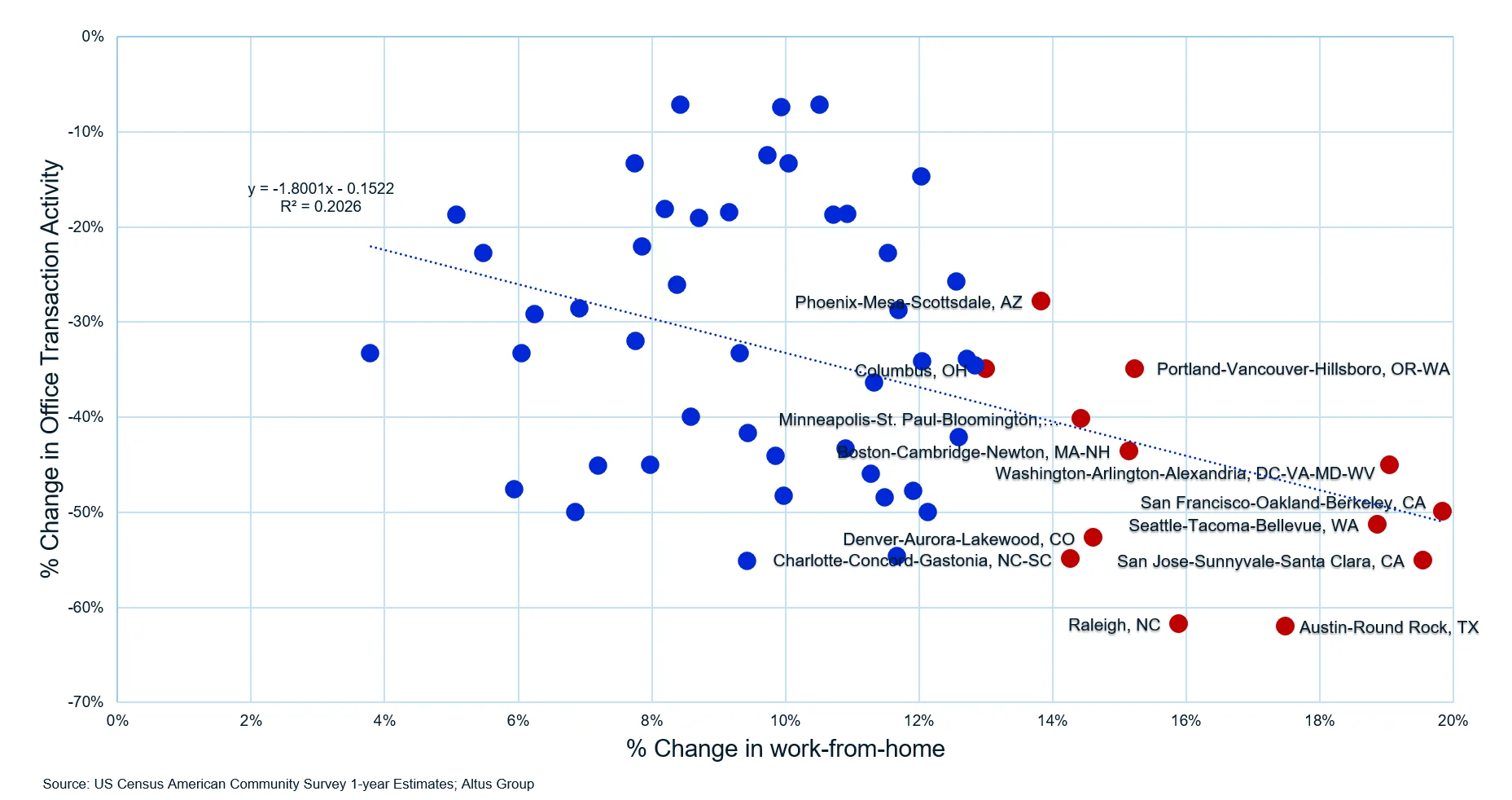

As remote work becomes more popular, office market confidence evidently declines; for every percentage point of increase in fully remote workers between 2019 and 2022, office transactions fell by approximately 1.8%

The forthcoming release of the 2022 ACS 5-year estimates will provide CRE professionals with additional color on remote work trends at a granular level, potentially guiding discussions regarding knock-on effects to other sectors such as multifamily and retail

The current office narrative

The discussion about the future of office is well-covered by the media and industry outlets. The throughlines of these stories have become repetitive and the discussion seemingly stalled on limited new data and analysis. Here’s where the current narrative stands: The shift toward remote work has decreased the demand for office space, challenging the financial position and economics of many office properties, while raising uncertainty around office valuations going forward.

While the future of the office sector looks challenged on the surface, painting with too broad of a brush is tempting but not appropriate. Not all geographic markets and office properties will be impacted the same. Understanding the market- and property-specific characteristics is ever more important to setting more reasonable expectations for office performance, valuation, and investment returns.

The rapid decline in market confidence of office values, brought about in part by both the rapid rise in the cost of capital and questions surrounding on-going demand for office space, have contributed to a widened bid-ask spread and stalled transaction activity – further reducing market confidence in the sector. If transaction activity can serve as a proxy for market confidence, there is little in the office sector.

Understanding remote work’s direct impact on office is also crucial to understanding broader effects on other sectors. Increased remote work has likely spurred demand for larger multifamily units incorporating home offices. The shift in daytime populations away from Central Business Districts (CBDs) has been a boon for suburban retail near the home and a challenge for retail downtown.

As CRE professionals continue to grapple with the long-term effects and implications of remote work, the recent release of the US Census’s 2022 American Community Survey (ACS) 1-year estimates is invaluable. The survey focuses on US geographies with more than 65,000 in population, covering most US Metropolitan Statistical Areas (MSAs), offering a clearer picture of the evolving trend.

Mapping remote work adoption by MSA

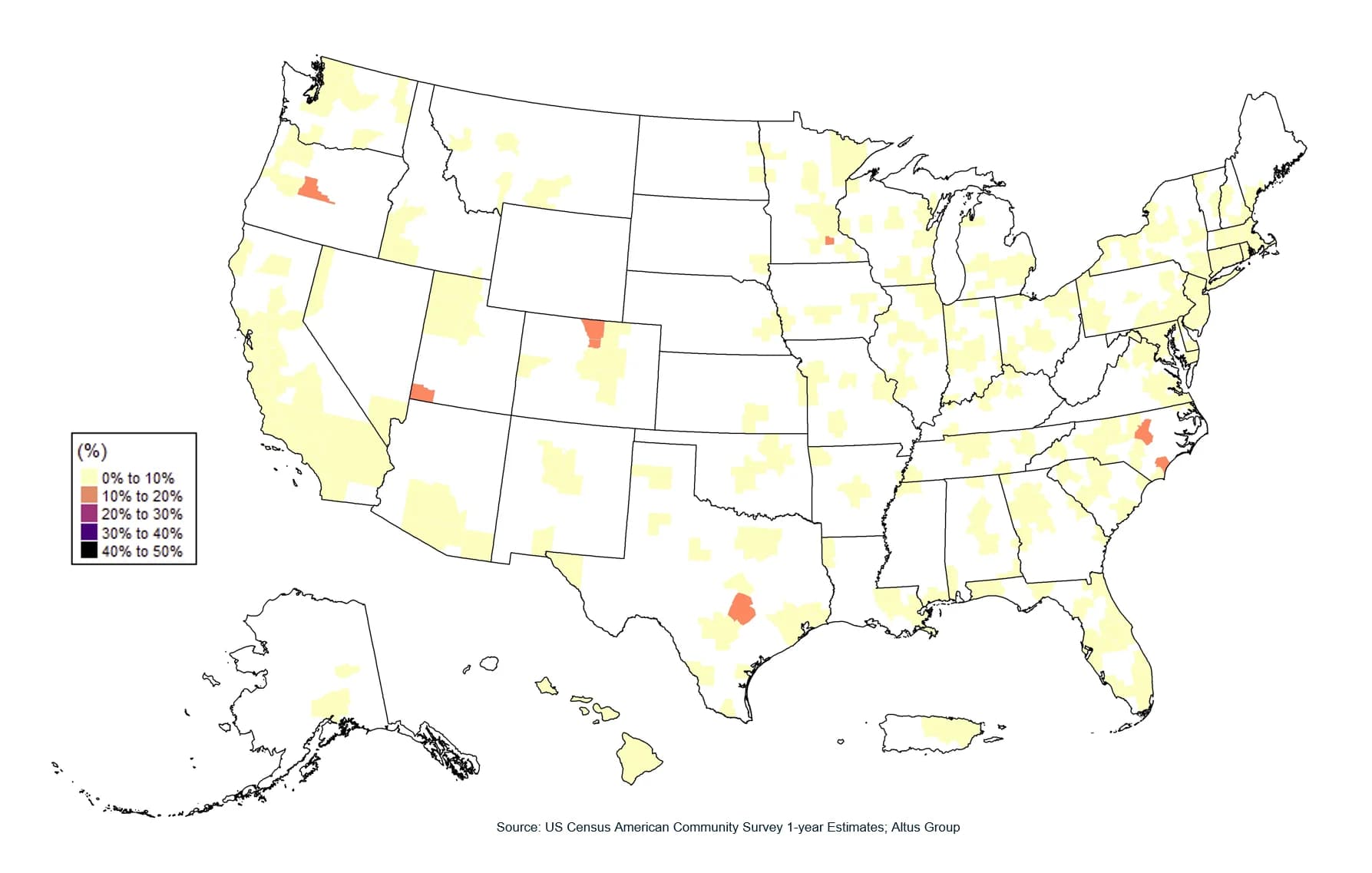

While hardly the norm at the time, the concept of “digital nomadism” preceded the pandemic, reflecting a trend in which technology could enable remote work and promote location-independent lifestyles. In 2019, most MSAs in the United States reported that less than 10% of their workforce were fully remote workers. However, certain regions such as the North Carolina Research Triangle and Austin, TX, were ahead in embracing this lifestyle in large part thanks to their strong tech sectors and vibrant cultural scenes.

In addition to these technology industry hubs, leisure-focused destinations such as Saint George, UT, Boulder, CO, Bend, OR, and Wilmington, NC all exceeded the 10% threshold for populations working remotely. Their reputations for scenic beauty and recreational opportunities attracted those who sought a greater balance between professional responsibilities and personal interests.

Figure 1 - Work-from-home share in 2019

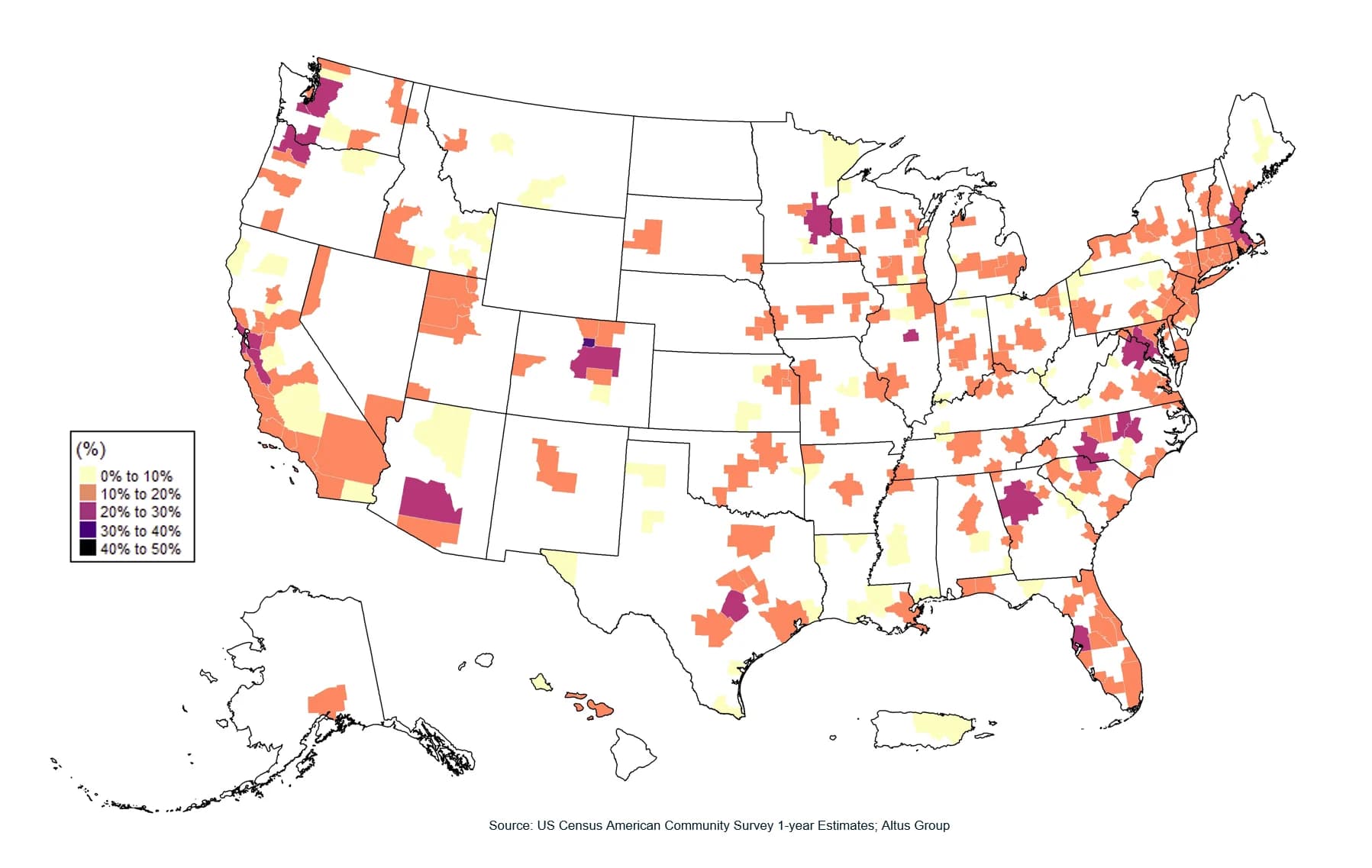

But by 2022, digital nomadism was not limited to the technology sector. Most MSAs had more than 10% fully remote workforces, despite the reopening and push by many employers to get their employees back to the office post-pandemic. Many notable MSAs maintained elevated levels of remote work through 2022, with 18 MSAs showing more than 20% fully remote workforces; these MSAs included:

Boulder, CO - 32.0% | San Jose-Sunnyvale-Santa Clara, CA - 24.4% |

Austin-Round Rock, TX - 28.0% | Denver-Aurora-Lakewood, CO - 23.7% |

San Francisco-Oakland-Berkeley, CA - 27.0% | Portland-Vancouver-Hillsboro, OR-WA - 23.3% |

Raleigh, NC - 26.1% | Charlotte-Concord-Gastonia, NC-SC - 22.3% |

Washington-Arlington-Alexandria, DC-VA-MD-WV - 25.4% | Phoenix-Mesa-Scottsdale, AZ - 21.7% |

Seattle-Tacoma-Bellevue, WA - 25.4% | Durham-Chapel Hill, NC - 21.6% |

Tampa-St. Petersburg-Clearwater, FL - 21.2% | Minneapolis-St. Paul-Bloomington, MN-WI - 20.9% |

Atlanta-Sandy Springs-Roswell, GA - 21.0% | Boston-Cambridge-Newton, MA-NH - 20.8% |

Olympia-Tumwater, WA - 20.2% | Bloomington, IL - 20.6% |

Figure 2 - Work-from-home share in 2022

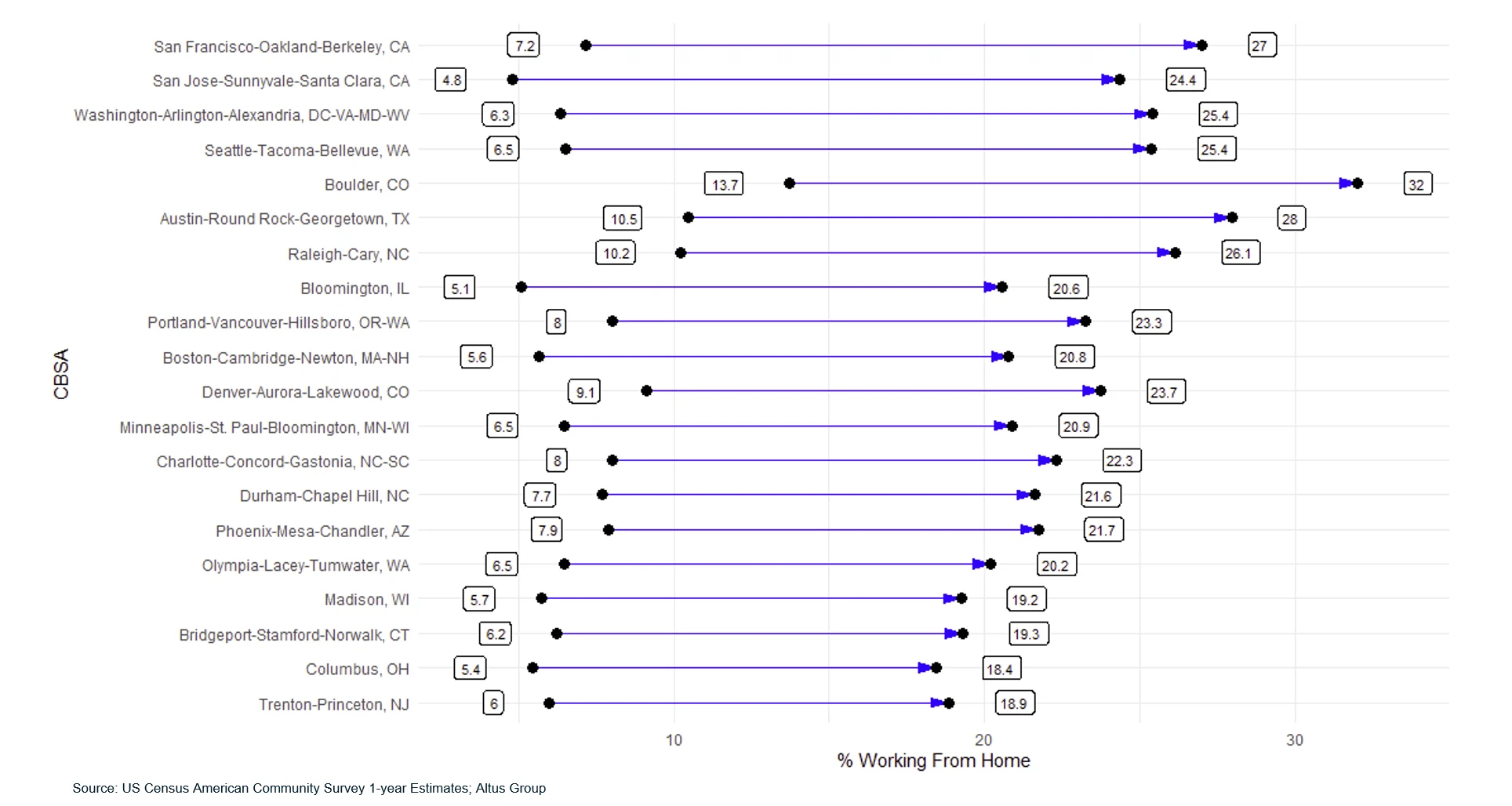

Silicon Valley (San Francisco and San Jose MSAs) saw the largest net change in the remote workforce between 2019 and 2022 at 20 percentage points. Washington, DC and Seattle, WA closely followed with a 19-percentage point shift. Boulder, Austin, and Raleigh, while starting from elevated (>10%) pre-pandemic levels, still saw between 16- and 18-point shifts toward remote work.

Figure 3 - Change in work-from-home share (2019-2022)

Increased remote work, decreased market activity

In markets where there has been greater adoption of remote work, office transaction activity saw larger declines – reflecting the increased uncertainty for office properties in those markets. Various elements, such as financing options and market or asset-specific characteristics, might influence transaction decisions. Yet the higher the level of fully remote workforces appears to correspond with lower transaction activity across markets. For every percentage point of increase in fully remote workers between 2019 and 2022, office transactions fell by approximately 1.8%.

Figure 4 - Change in work-from-home share vs. change in office transaction activity

Looking forward

These findings from the 2022 ACS 1-year estimates mark the start of more in-depth analysis. The forthcoming release of the 5-year estimates will provide a more comprehensive view of demographic trends, including remote work, across smaller geographic scales down to individual census tracts. This analysis is not solely a retroactive exercise but may represent the foundation of a risk model for future exogenous shocks to trends in working habits. These disruptions may not arise from a future pandemic but instead from other looming risk factors such as environmental or geopolitical changes. The evolving nature of American remote work offers insights into wider implications for all CRE sectors.

Authors

Cole Perry

Associate Director of Research

Authors

Cole Perry

Associate Director of Research

Resources

Latest insights