It’s very common for developers, contractors and consultants to estimate construction cost escalation, for all asset types and trades, based on a single number or range. This is dangerous and can lead to grossly inaccurate development budgets and forecasts, and more time (and money) spent on contingency plans down the road.

Won’t it all even out over the course of the project?

If the difference was only a few thousand dollars here and there, then you’re right – it would even out over the course of the project. However, the impact to your budget and forecast can be hundreds of thousands of dollars, and sometimes even millions.

When looking at construction cost escalation you need to recognize two things:

1. Each trade cost does not change at the same rate, across the board. For example, we have seen that the cost of formwork can change at a dramatically different pace than the cost of structural steel.

2. Every building/asset type requires a different set of trades and in different proportions. Think about how significant the formwork trade is in high-rise residential buildings, and conversely how insignificant this same trade is in a typical warehouse building.

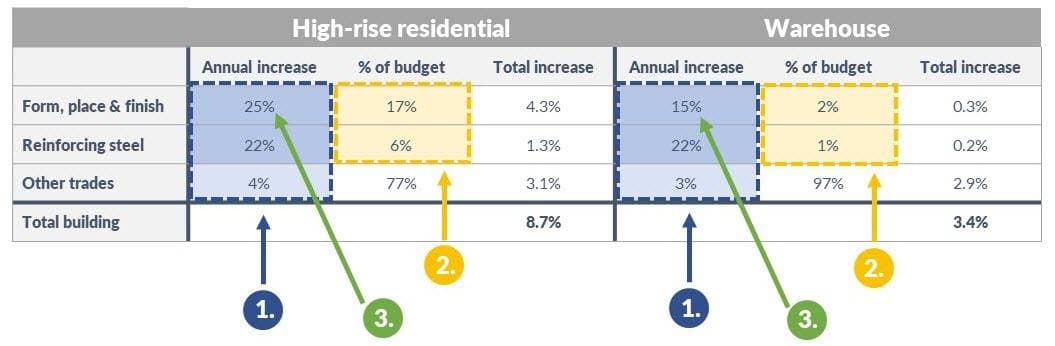

To illustrate this, we used our 2018 construction cost escalation data in a major Canadian city, to compare a high-rise residential building to a warehouse.

Our example above illustrates three important points:

There is a significant difference between the change in cost for formwork and reinforcing steel versus the balance of the trades.

The formwork and reinforcing steel, in the residential building, represent almost a quarter of the building’s cost. In the warehouse, these same two trades are only 3% of the overall building cost.

Even within the same trade, the rate of change in costs can differ by building type. In the residential building, formwork cost increased much more than it did in the warehouse.

Overall, the high-rise residential building experienced construction cost escalation of 8.7%, and the warehouse saw a 3.4% increase. The net result is that the cost increase for the residential building was 2.5 times that of the warehouse.

Why does this matter?

If you’re still asking yourself, why does this matter? Think about a large development project, where even a small percentage change can add up to millions of dollars.

If a high-rise residential project’s total construction cost is $100 million, the formwork trade alone will represent approximately $17 million of the construction costs. That means every 1% change in the cost of formwork equates to $170,000.

Using the example above, if we applied the total building construction cost escalation of 8.7% to formwork it would tell us that we should expect a $1.5 million formwork cost increase, when the reality is that we should be applying a 25% cost escalation rate and expect a $4.25 million cost increase. That’s a $2.75 million mistake, and we would end up having to cut corners or go over budget in the future.

Mitigating project risk by better estimating cost escalation

To close things out, there are myriad ways that the misapplication of construction cost escalation rates can result in financial or reputational damage. Here are some ways you can ensure you are mitigating any cost escalation risk associated with your next development project, right from the start:

Investors, developers and lenders are better able to understand the viability of a project. As was illustrated above, inaccurate construction cost forecasts can result in millions of dollars in variance to budget. The greater the accuracy upfront, the better the feasibility decisions.

Lenders can tailor their loan conditions to better reflect the risks associated with cost escalation. Making conditions more stringent in times of higher cost risk, and more moderate in times of reduced cost risk.

Developers gain the ability to better time their procurement decisions. They can negotiate contracts early for trades that are rapidly increasing, and wait for the completion of construction documents for trades that are expected to remain steady or decrease.

Developers better understand trade by trade cost escalation to confidently approve or reject claims based on the data and avoid protracted legal disputes.

Author

Altus Group

Author

Altus Group

Resources

Latest insights

Mar 27, 2025

2025 Canadian Cost Guide: Costs are stabilizing despite looming threats on the horizon

Jan 22, 2025

Building solutions - The impact of CMHC loans on Canada's rental development efforts

May 16, 2024