In an effort to provide insights into the market sentiment, conditions, metrics, and issues affecting the commercial real estate (CRE) industry, Altus Group recently conducted a survey across the US and Canada. We’re pleased to share that the Q3 2023 US results of our “Commercial Real Estate Industry Conditions & Sentiment Survey” are now available for download and that we plan to release the survey results from Canada in the second week of September.

The survey captured the individual practitioner's perspective, representing various functions and across the capital stack.

The US portion of this survey was conducted between June 28th and July 25th, 2023. There were 176 respondents, representing at least 47 different firms. This survey will be updated quarterly with new perspectives from market participants.

Questions in the survey were optional and explored two main topics: current conditions and future expectations. Percentages used throughout the U.S. survey results are representative of the share of all US responses received for each question, excluding “blank” or “not applicable” responses.

Key questions explored

Current conditions:

What your team's primary focus will be over the next 6 months?

How have your expectations for your portfolio changed compared to 12 months ago?

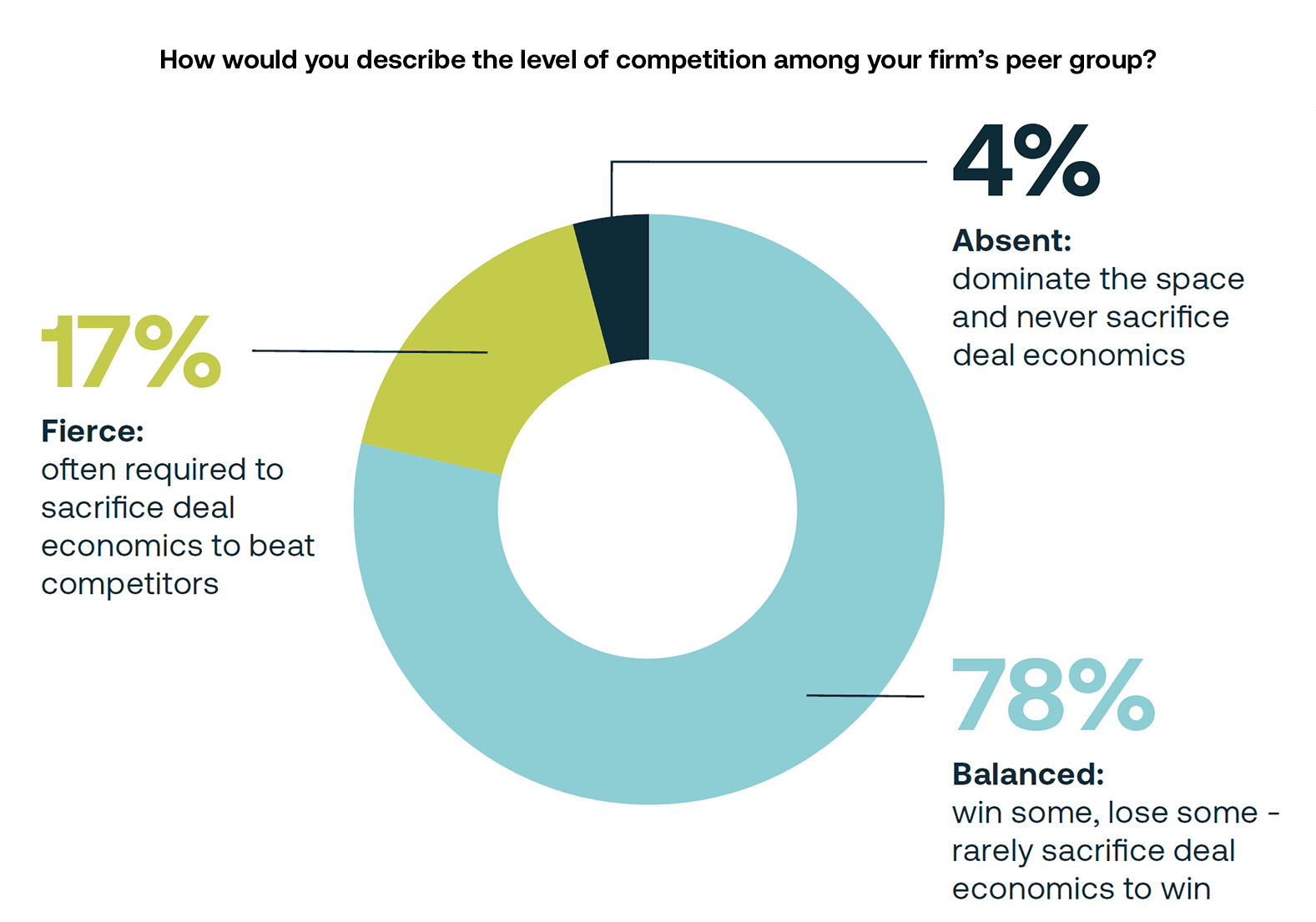

How would you describe the level of competition among your firm's peer group?

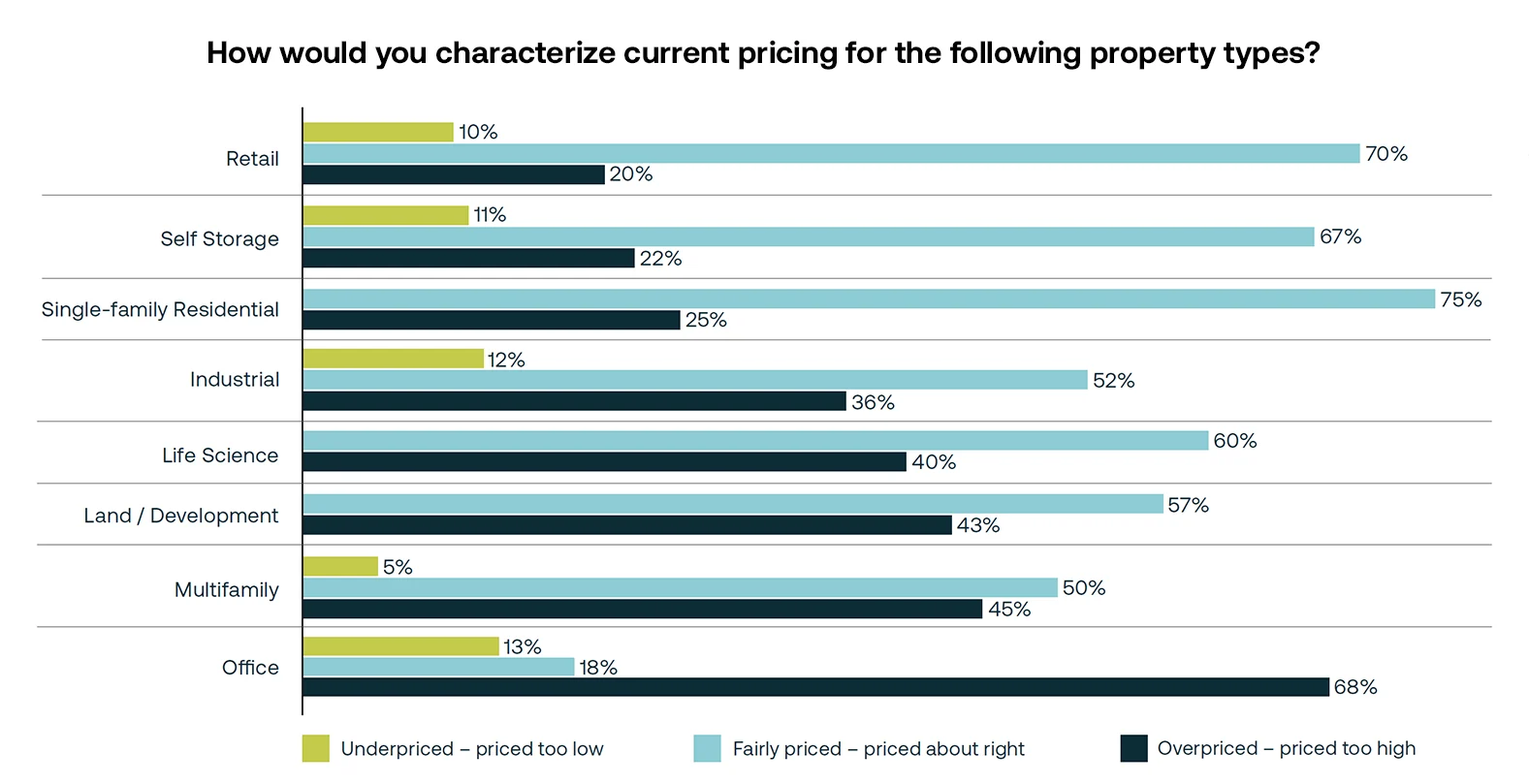

How would you characterize current pricing by property type?

What is your current outlook for the following property types?

Future expectations:

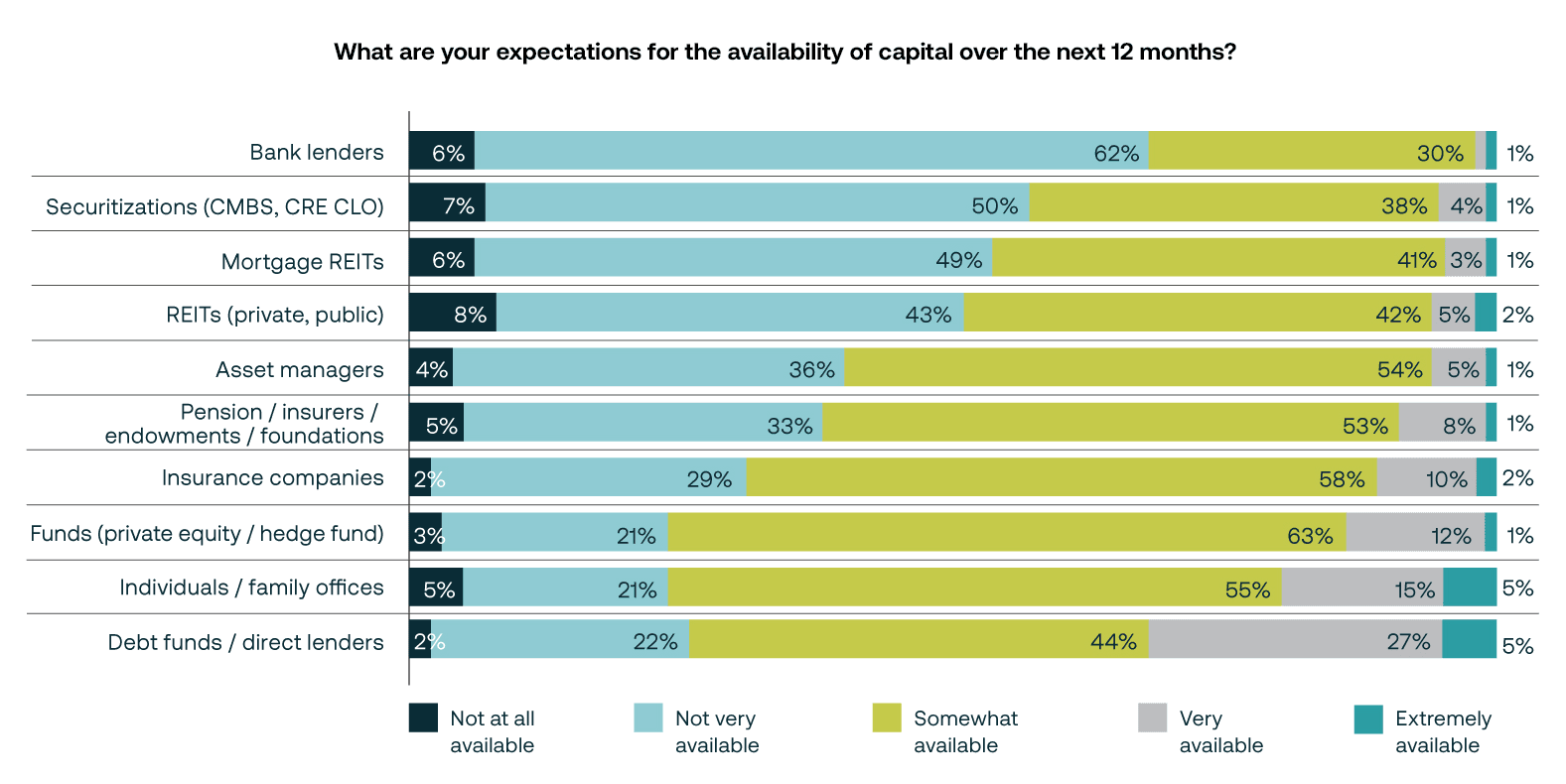

What are your expectations for the availability of capital over the next 12 months?

What best describes your expectations for the operating environment over the next 12 months?

What changes do you anticipate to the following key metrics over the next 12 months? (Both direction and conviction)

Rank which property types you expect to be the best/worst performing in the next 12 months.

Which of the following do you expect will be high-priority issues for you professionally in the next 12 months?

Survey highlights

Gearing up or hunkering down, CRE pros prep for feast-or-famine

While outlooks remain as mixed as the economic data, the industry seems appears to be getting ready for action. Thirty-nine percent of US respondents noted that they are raising or deploying capital, while 13% is derisking their portfolio.

Figure 1 - US results: What do you think your team's primary focus will be over the next 6 months?

Treading carefully: competition in “overpriced” markets

More than one in six US respondents (17%) described the current market competition as “fierce”, while four-fifths (78%) described it as “balanced: win some, lose some”. This suggests that despite the sharp decline in transaction volume seen in 1H 2023, the market remains competitive.

Figure 2 - US survey results: How would you describe the level of competition among your firm's peer group?

By itself, the indication of competition would be positive, however, the survey results also show that at least a third of the US respondents for multiple property types believe that prices are too high: office (68%), multifamily (45%), land/development (43%), life science (40%), and industrial (36%). Taken together, this suggests that many firms may be competing in overpriced markets.

Figure 3 - US results: How would you characterize current pricing for the following property types?

Shifts in the lending landscape are expected, indubitably adding to the challenges

More than half of the US respondents expect a meaningful pullback by CRE’s primary sources of debt financing as capital becomes less available at banks (68%), CMBS/CLO (57%), and mREITs(55%). While responses indicated that they expect other lenders (notably funds and individuals / family offices) to be more available, it has yet to be seen if these lending groups will be able to provide sufficient lending capacity to make up for the bigger capital sources pulling back. The uncertainty around financing sources is made even more acute for the unanimous least-loved office sector, which 94% of the respondents list as the expected worst performer over the next 12 months.

Figure 4 - US results: What are your expectations for the availability of capital over the next 12 months?

Quarterly surveys

Altus Group’s CRE Industry Conditions and Sentiment Survey marks the beginning of an ongoing survey program. While our initial Q3 2023 results capture a moment in time, we’re committed to conducting this survey quarterly so we can share how perspectives on the questions covered in this report trend over time.

A request for your participation

Our ability to share valuable market insights depends on the active participation of industry professionals like you. As we gather a diverse range of voices, the richness of the data deepens, allowing us to segment responses and paint a more detailed portrait of the industry’s collective outlook.

Your participation is instrumental in shaping the narrative of the commercial real estate landscape, please support this survey program by sharing your perspective on our next installment of the CRE Industry Conditions and Sentiment survey.

Authors

Omar Eltorai

Director of Research

Authors

Omar Eltorai

Director of Research

Resources

Latest insights

Jun 19, 2025

EP66 - From uncertainty to stability: How CRE is adapting to the latest mix of volatility