Canadian industrial market update - Q1 2023

Q1 2023 – Industrial rental rates continue to rise due to heightened demand and limited supply.

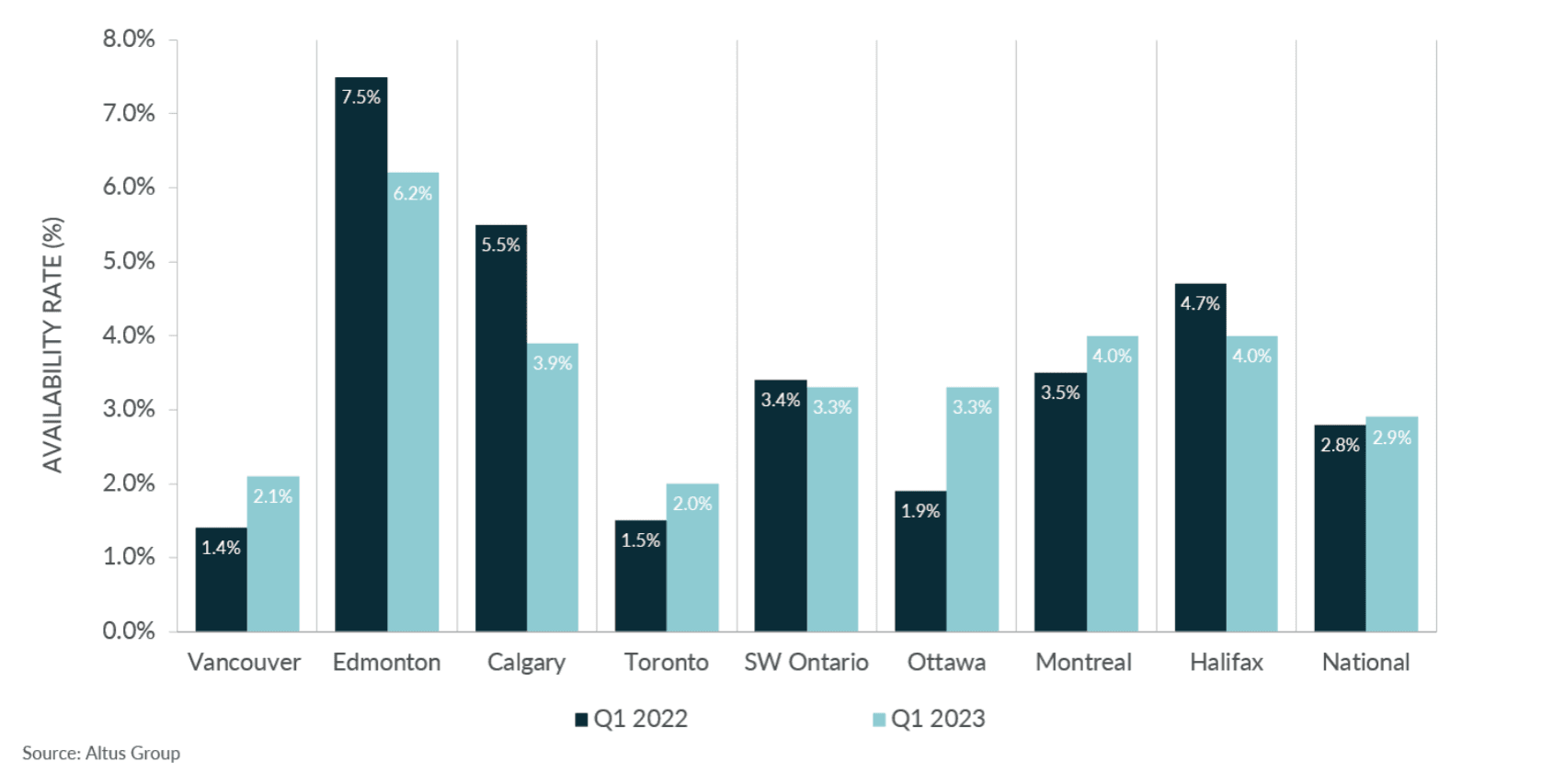

Throughout Q1, the industrial asset class has experienced continued elevated demand with the national availability rate remaining low at below 3%. To this effect, rental rates have climbed between 20%-30% over the last number of years. Demand for last-mile distribution assets has also persisted, especially as warehousing space and strong logistics networks remain, while the shift from just-in-time to just-in-case warehousing has further increased the demand for warehouse space. Even as interest rates climb in lockstep with recession discussion, demand for space remains unaffected. At the same time, new supply continues to be strong, despite high construction costs.

The latest Statistics Canada data indicates that retail sales rose 1.4%, sitting at $66.4 billion as of January 2023. Higher sales were posted by motor vehicle and parts dealers (up by 3%) and beer, wine, and liquor retailers (up by 2.3%). Conversely, e-commerce sales were down by 0.1% in January.

Figure 1 - Industrial Availability (Q1 2022 vs. Q1 2023)

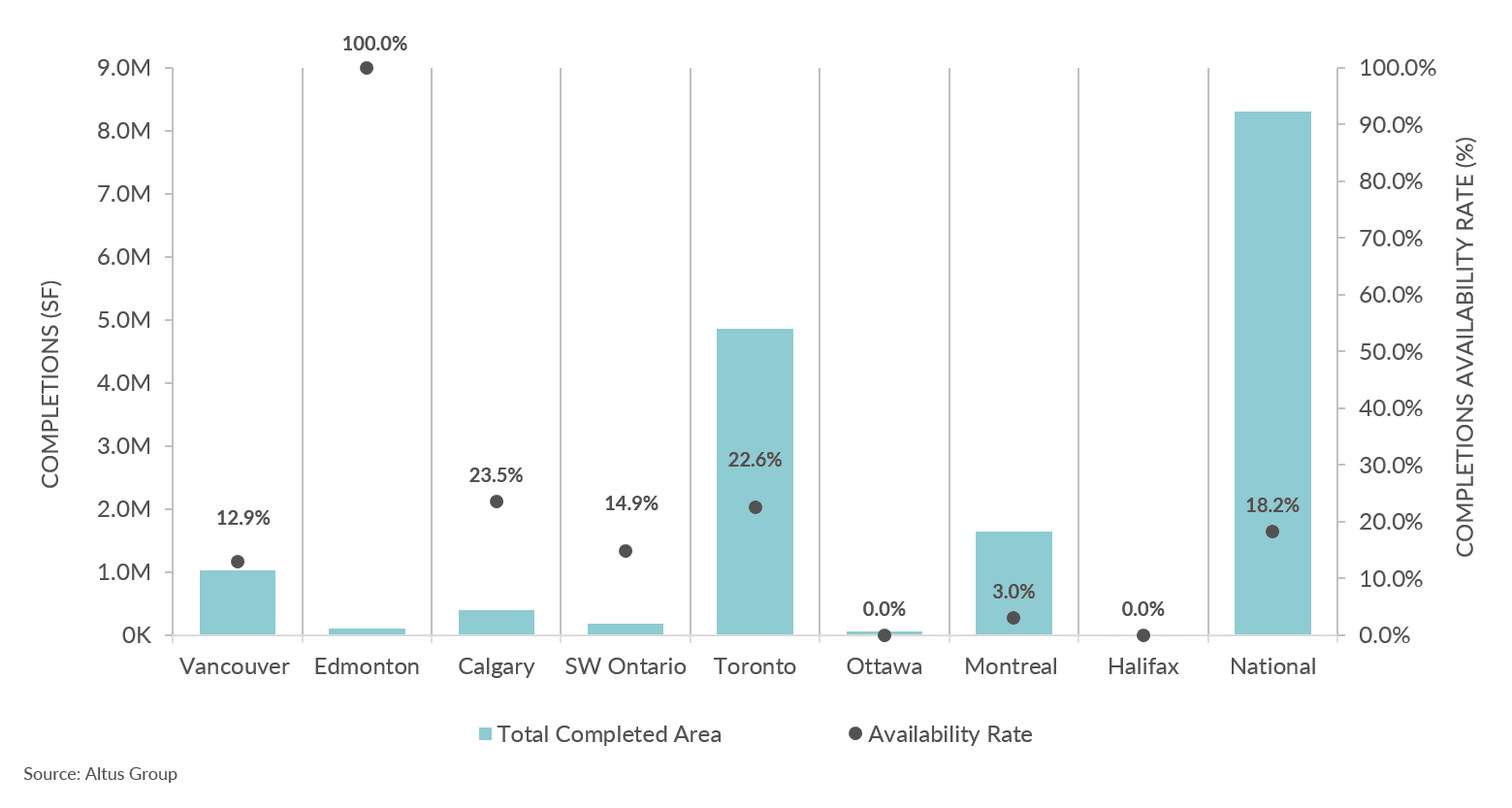

There were 35 building completions in the first quarter of 2023, totaling 8.3 million square feet of space, with an availability rate of 18.2% (Figure 2) and most of the new supply occurring in Vancouver, Toronto, and Montreal. New supply is still not keeping up with demand and industrial availability rates remain low across the country.

Figure 2 - Industrial Completions and Availability Q1 2023

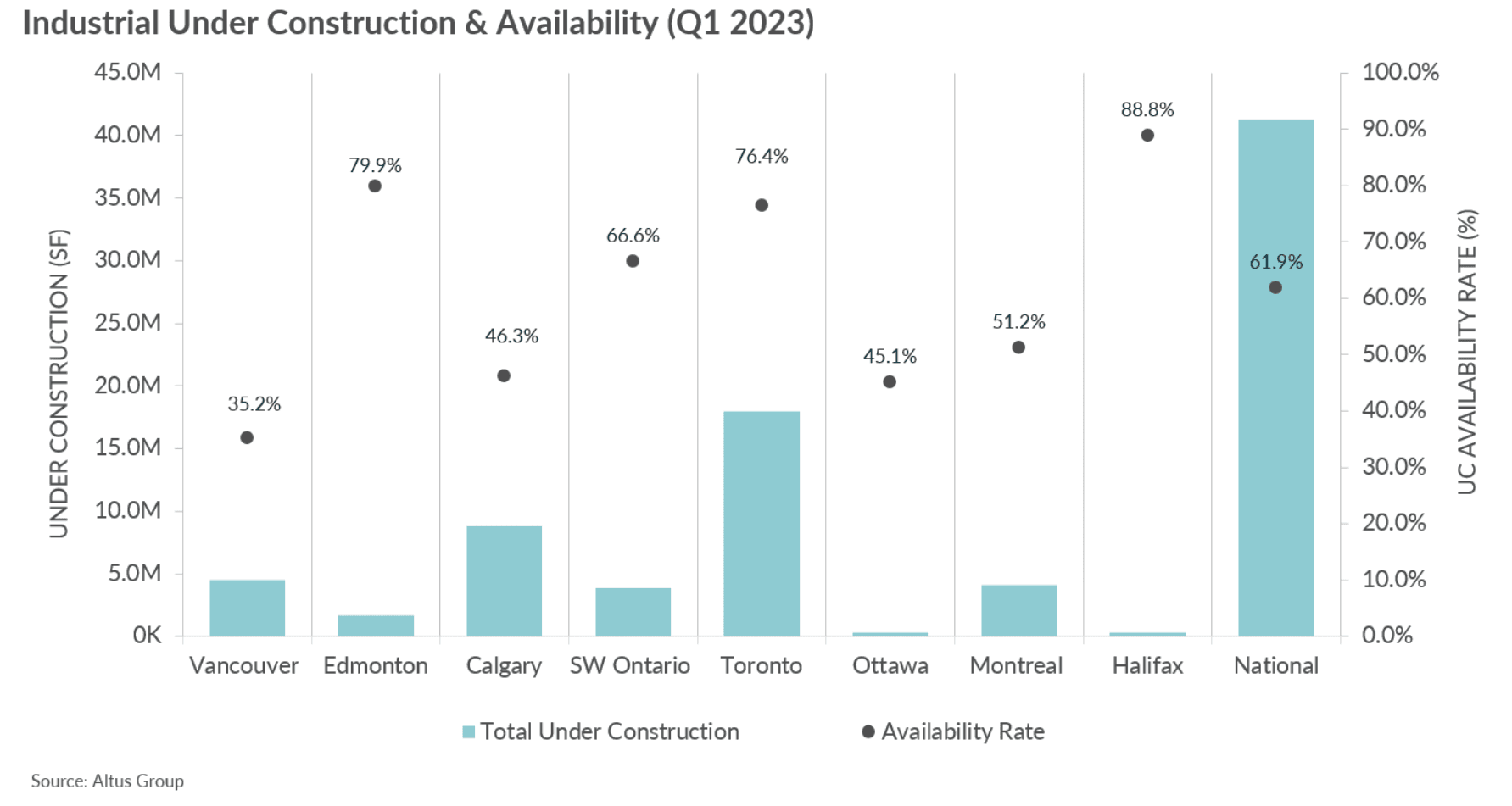

In the third quarter of 2023, there were 191 projects under construction comprised of 41.3 million square feet with about 40% of the space already pre-leased.

Figure 3 - Industrial Under Construction and Availability Q4 2023

As rents continue to rise and availability rates continue to tighten, despite the low availability rate, industrial cap rates are slowly inching up based on restricted and higher interest rates. Rental rates are expected to continue on an upward trajectory, though perhaps not at the same pace we have seen over the past few years.

View the Canadian industrial market update - Q4 2022

Author

Ray Wong

Vice President, Data Solutions

Author

Ray Wong

Vice President, Data Solutions

Resources

Latest insights