Key highlights

Challenges in government approval processes are contributing to a housing crisis that is likely to be a long-term problem that plays out over the next 10 to 15 years

Canada ranks well behind most other Organisation for Economic Co-operation and Development (OECD) countries when it comes to the time needed to obtain necessary construction permits

Construction productivity and quality have decreased; it now takes 25 to 30% longer to build an equivalent project compared to five to six years ago

Long lead times in metros such as Toronto, Markham, and Hamilton could shift development activity to other regions that are more developer-friendly

Excessive taxation on new housing in the form of HST and Development Charges considerably impact the ability to deliver product to the market

Canada’s slowdown in construction activity is masking bigger pain points that pose significant hurdles to future real estate development

Canada, as a whole, is battling incredibly slow government approval processes, a shortage of construction labour, and a higher interest rate environment. Although all developers are impacted, the effects vary depending on the project and region. For some, the biggest impediment is long delays in securing necessary construction permits and government approvals. In other cases, the current economic environment proves to be the bigger issue. Condominium developers, for instance, may have the necessary approvals, but they can’t move forward with construction because pre-sales have disappeared in the wake of higher interest rates.

Developers are tapping the brakes on new construction in the wake of higher interest rates. Nationally, actual 2023 housing starts were down 7% in centres of 10,000 population and over, with 223,513 units recorded, compared to 240,590 in 2022, according to Canada Mortgage and Housing Corporation (CMHC). This decline is primarily explained by a 25% decline in single-detached starts in 2023. Moreover, Altus data indicates that condo sales across Canada are down significantly in each of the major cities when compared to 2022, and low-rise starts are lagging when compared to historical levels. In the short-term, that pullback is alleviating some of the pressures related to the shortage of labour and higher construction costs. The longer-term view is more problematic with significant obstacles ahead in terms of an arduous approval process and declining productivity that will make it more difficult to address the country’s housing crisis.

Approval process slows momentum

Challenges in government approval processes are contributing to a housing crisis that is likely to be a long-term problem that plays out over the next 10 to 15 years. Difficulties in obtaining approvals and permits are especially acute in major metros such as Vancouver and Toronto, with lead times that are often measured in years rather than weeks or months. These prolonged lead times are not only a point of frustration for developers but also pose a significant cost issue. In addition to profitability concerns, long timelines may contribute to a cascade of other problems, including limiting the construction of new housing supply that will drive housing costs sharply higher.

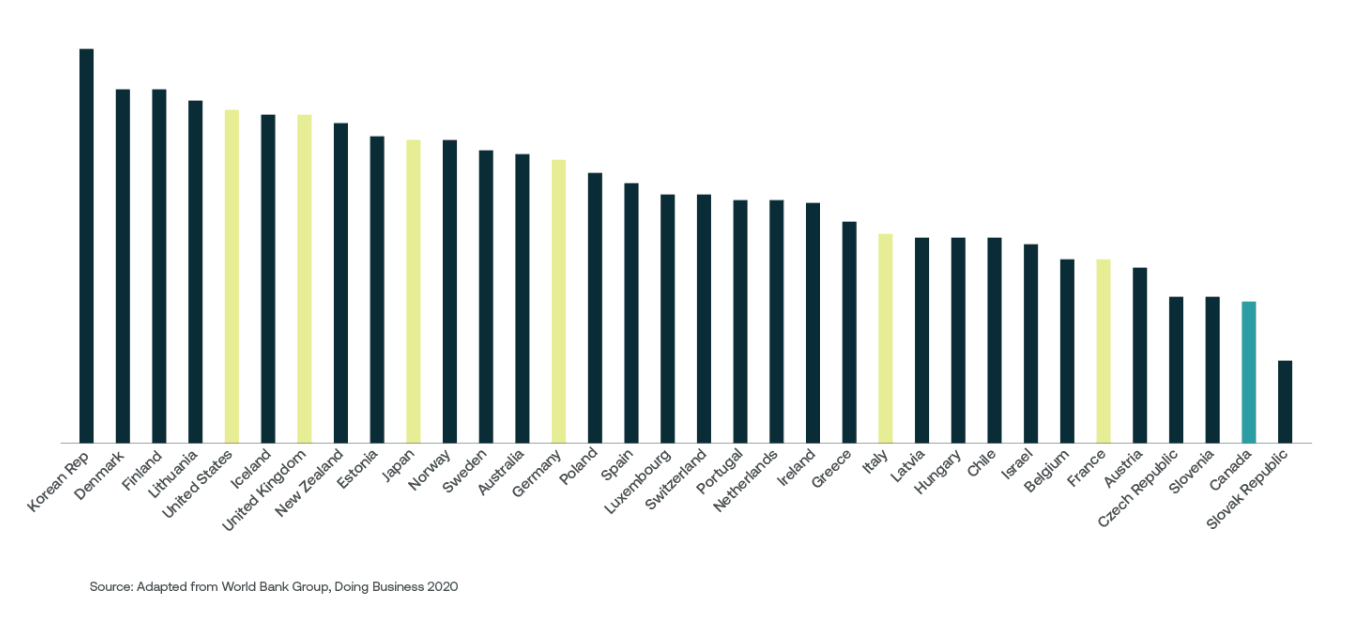

Canada ranks well behind most other OECD countries when it comes to the time needed to obtain necessary construction permits. In fact, out of more than 30 countries, it only scores slightly higher than the Slovak Republic, according to data from the World Bank.

Figure 1 - Time score (low score = bad)

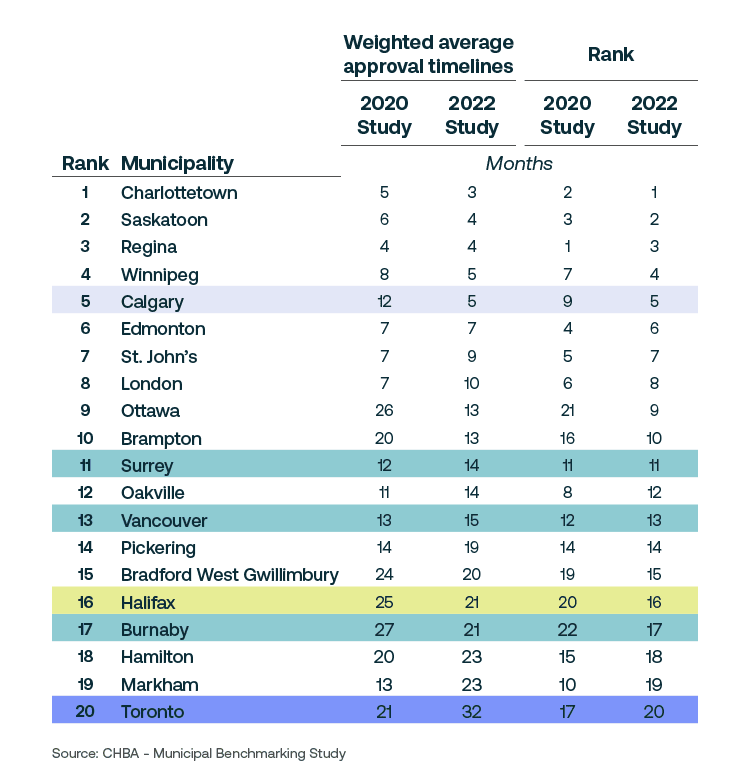

However, timelines vary widely depending on the city. A study conducted by Altus Group on behalf of the Canadian Home Builders Association revealed that the biggest delays occur in Toronto. Shortage of staffing and outdated processes are two of the factors that have contributed to a backlog that has grown from 21 months in 2020 to a weighted average approval time of 32 months in 2022.

Figure 2 - Average approvals are getting worse, and Toronto is terrible

At the other end of the spectrum, Charlottetown, Saskatoon, Regina, Winnipeg, and Calgary all came in with average approval times of less than 6 months. On a positive note, some municipalities are currently working to analyze inefficiencies and work towards improvements. For example, Kitchener recently announced that it has managed to reduce its permitting times by 50 to 60% by addressing some of the pinch points in its approval process.

Decline in productivity

Once projects move into the construction phase, they face additional challenges that are stretching project timelines with declines in productivity. To this effect, Altus Group conducted a study from a sampling of projects in cities across Canada that found that it now takes 25 to 30% longer to build an equivalent project as compared to five to six years ago.

Productivity and quality have decreased, while the need for supervision has increased. The main reason behind that decline is the shortage of skilled labour. Many workers simply lack the necessary skills and experience to get these jobs done.

In theory, the current slowdown in construction activity will alleviate some of the near-term strain on construction labour. However, any near-term improvement will be somewhat artificial. The drop in demand will cause people to move to other jobs outside of residential construction, and likely those people won’t come back when demand picks up. Ultimately, that will likely result in a massive shortage of labour that is further compounded by an aging workforce.

According to BuildForce Canada’s latest forecast, 245,100 people are expected to retire from construction jobs over the next 8 years (by 2032) – this represents roughly 20% of Canada’s current construction industry workforce. Although the industry is expected to recruit approximately 237,800 new-entrant workers under the age of 30 during this period to help offset some of the projected losses, even at these heightened levels of recruitment, the industry is likely to be short 61,400 workers by 2032, according to BuildForce. There are efforts underway to address that labour and skills shortage. However, it is years away from delivering the needed results.

Development outlook: Iceberg ahead?

Despite significant hurdles, the outlook for developers across Canada is mixed. The theme for developers in Toronto is to survive until 2025. Toronto is being hit the hardest by the slowdown because of its size in addition to its over-reliance on condominiums. Generally, construction starts will remain subdued until interest rates drop, and condo sales pick up. The slowdown is not as extreme in Montreal (moving towards the level of Toronto rapidly) or Vancouver, while cities such as Calgary and Halifax remain quite busy.

On another positive note, developers have proven that they can successfully navigate the challenging local government systems. However, the long lead times in metros such as Toronto, Markham, Hamilton, and Burnaby could shift development activity to other regions that are more developer-friendly. Ultimately, the scales could tip a bit in terms of where people and employers want to locate. Over the next decade, major secondary cities, such as Surrey, London, Kitchener and Waterloo, are likely to gain more prominence as Canada continues to address its housing crisis and people gravitate to good cities with more affordable housing options.

Kitchener and Waterloo, for example, are likely to benefit from the investment they have made in transit. They built their Light Rail Transit (LRT) first (it also functions as intended) and now they are building housing. This highlights the opportunity that exists for secondary cities to beef up their infrastructure, which in turn will help them attract capital investment, development, and people.

The challenge for developers going forward is that revenues are going to have to keep increasing, which means that rents will need to keep rising to cover the cost impact of slow development approvals, fees, and ongoing labour challenges. Right now, the housing prices (condos especially) are in the doldrums to a degree. While there have been spikes, there are examples of even the rental market moderating In some areas – albeit high. However, given the supply and demand dynamics, the only place costs are going from here on out is up, and hurdles to development will only add to the country’s housing crisis.

As interest rates come down, that approval process will become much more critical as the country moves forward over the next 10 to 15 years. Making matters worse is the fact that thus far, local governments have taken an eclectic approach in efforts to address development hurdles that could help solve the housing crisis. This inconsistency is going to cause major issues across Canada in varying degrees as we look to the future. In some respects, it’s a little like being aboard the Titanic – but we see the iceberg and are steering towards it, instead of changing course to veer away from it.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Marlon Bray

Senior Director, Cost Consulting & Project Management

Author

Marlon Bray

Senior Director, Cost Consulting & Project Management

Resources

Latest insights

Mar 27, 2025

2025 Canadian Cost Guide: Costs are stabilizing despite looming threats on the horizon

Jan 22, 2025

Building solutions - The impact of CMHC loans on Canada's rental development efforts

May 16, 2024

Progressive Design-Build provides notable advantages for today's complex P3 infrastructure projects