Net present value, more commonly referred to as NPV, is a relatively simple concept that tends to get mucked up when people start digging into the math behind how it works. In this paper, we’ll talk about what NPV is, why it’s important, how to calculate it when analyzing commercial real estate, and how to use NPV to make investment decisions.

The basics of net present value

In order to understand how NPV works mathematically, we need to first understand a concept called the Time Value of Money (TVM). TVM states that the money you have today is worth more than that identical amount of money at some point in the future, due to several reasons.

Inflation could decrease the purchasing power of a dollar. For example, if you have $1.00 today and inflation over a one-year period is 3%, it would take $1.03 at the end of the year to have the same purchasing power that you have today with $1.00. Thus, an investor would prefer to have $1.00 today rather than $1.00 a year from now.

$1.00 today could also be invested to earn a (hopefully) positive rate of return. If an investment earns 5% interest, the investor would have $1.05 at the end of one year rather than $1.00 a year from now.

There are two ways that the TVM can be analyzed. One method is by looking at the future value of $1.00 today invested at a specified interest rate, more commonly known as the “discount rate” in the financial world. The other method is by reversing the calculation and determining how much $1.00 one year from now is worth today at a specified discount rate. In other words, if I want an investment to return $1.00 in the future, how much do I need to invest today in order to achieve that $1.00 return?

The present value method is more applicable to how NPV works, so we’ll only look at that and not go into detail on the future value method in this paper. Below are a few examples of the present value formula to understand how it works so we can then apply it to the NPV formula.

Present value

The table below shows a hypothetical investment that returns $100.00 to an investor at the end of each year. The investor expects a rate of return of 8.0%. That is the discount rate.

In this scenario, the investor wants to know how much the $100.00 received at the end of each year is worth today given that they demand a return of 8.0%. We can see from the table that the investor can invest $92.59 today at an 8.0% return to get back $100.00 a year from now. For a $100.00 return at the end of year 2, the investor can invest $85.73, and so on for the remaining years.

Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

Cash flow | $100.00 | $100.00 | $100.00 | $100.00 | $100.00 |

Present value | $92.59 | $85.73 | $79.38 | $73.50 | $68.06 |

The formula for present value is as follows:

Present value = Cashflow / (1+ Rate of return) * number of periods

Using the first year of the table above, the formula would be: $92.59 = $100 / [(1 + .08)]1

Year 2 would be: $85.73 = $100 / [(1 + .08)]2

The discount rate determines how much the future cash flow is worth today (i.e. the present value). The table below shows the present value of a series of cash flows of $100.00 at the end of each year over a five-year period at various discount rates, ranging from 6.0% to 10.0%.

As the table illustrates, the higher the discount rate the investor expects, the lower the present value of that future cash flow. This is an important relationship to understand when it comes to choosing the discount rate on a specific property.

Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

PV = 6% | $94.34 | $89.00 | $83.96 | $79.21 | $74.73 |

PV = 7% | $93.46 | $87.34 | $81.63 | $76.29 | $71.30 |

PV = 8% | $92.59 | $85.73 | $79.38 | $73.50 | $68.06 |

PV = 9% | $91.74 | $84.17 | $77.22 | $70.84 | $64.99 |

PV = 10% | $90.91 | $82.64 | $75.13 | $68.30 | $62.09 |

The concept of net present value

Now that we’ve covered the TVM, we can dig into how this concept relates to determining the NPV of a property.

When an investor purchases a property they usually have a rate of return that they want to achieve by owning the property. If the estimated return for a property is above the investors’ required rate of return, then the investor should purchase the property.

If the rate of return is below that required by the investor, then the investor should not purchase the property. As mentioned above, this rate of return is often referred to as the “discount rate.”

The NPV of an investment refers to the initial investment an investor makes in a property, minus the sum of all future cash flows discounted at the investors chosen discount rate.

We’ll look at a simple example of this and slowly add components so that all the inputs are clear before we discuss the mathematical formula for NPV (which is really a simple extension of the present value formula we explored earlier).

Extending the present value formula we used earlier, the NPV formula requires that we add together the present value of all the future cash flows expected on the property, as we can see below.

Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Total | |

|---|---|---|---|---|---|---|

Cash flow | $100.00 | $100.00 | $100.00 | $100.00 | $100.00 | $500 |

Present value | $92.59 | $85.73 | $79.38 | $73.50 | $68.06 | $399.27 |

The sum of the present value of each years’ cash flow is $399.27. Thus, if an investor plans to receive a total of $500.00 over the five-year period ($100.00 each year) and expects to earn a return of 8.0%, the investor can invest $399.27 today in that investment.

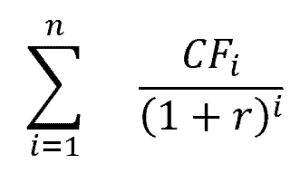

Mathematically, the formula is:

n = total number of periods (in the table above this would be 5)

i = period, where period starts at value 1

CF = CF at end of period

r = rate of return

This formula is much simpler than it seems, so let’s break it down quickly. In layman’s terms, this formula says to get the present value of the expected cash flows from each year in the hold period and then add them all together.

The ”n” refers to the total number of periods in the life of the investment (in this case we’re using 5 years). The “i” refers to the individual year being analyzed. For example, in year 1, the “i” would be “1” and would signify the cash flow (CF) in year 1 along with an exponent of “1” in the denominator of the formula. In year 2, the “i” would represent the CF in year 2 along with an exponent of “2” in the denominator of the formula. As before, the “r” is still the discount rate chosen by the investor.

The next step of the NPV process is to find the difference between the summed present values of cash flow from each year and the initial amount of money invested in the project (note here that the initial investment is usually a negative number indicating money flowing out). The initial amount of money in real estate is typically the equity plus costs the investor places into the property at acquisition.

NPV = – (Initial investment) + (sum of present values of each period)

This is where the importance of NPV comes into play. There are three outcomes that are possible when determining the NPV of a property:

The NPV is exactly zero. This means that the investor can expect to achieve the exact rate of return, or discount rate, that they’ve specified as required for the project.

The NPV is a positive number above zero. This means that the investor can expect to achieve a return above the discount rate they’ve specified as required for the project.

The NPV is a negative number. This means that the investor can expect to achieve a return below the discount rate they’ve specified as required for the project.

Again using the table above that gives us a sum of the present value of all cash flows of $399.27, we’ll look at an example of each of the three outcomes.

Scenario | Initial investment | PV of cash flows | NPV |

|---|---|---|---|

Zero | $399.27 | $399.27 | $0.00 |

Positive | $375.00 | $399.27 | $24.27 |

Negative | $425.00 | $399.27 | -$25.73 |

Decision-making using net present value

It should be pretty clear that investors should invest in properties only if the expected cash flows on the property offer a zero or positive NPV. The higher the NPV, the better for the investor.

Hopefully the process of determining and using NPV as a criteria in the investment decision-making process now makes more sense. However, while the formulas and calculations are relatively straightforward, as with everything in real estate, the efficacy of performing an NPV analysis is highly dependent on the assumptions an analyst makes when constructing the model.

Below we take a brief look at some of the things an analyst needs to be mindful of before fully relying on an NPV model.

Pitfalls of net present value assumptions

There are several inputs to the NPV calculation that are subjective and highly uncertain at the beginning of a hold period of a property. There are numerous inputs that need to be considered to determine the impact of changes in market conditions on the property, but ultimately, the final return an investor achieves could vary substantially from that predicted during the initial analysis.

The first example of these subjective and uncertain inputs is the expected cash flows. It is very difficult, if not impossible, to accurately forecast the exact cash flows that will be received each year over the hold period of the property. While the first year or two might be easier to predict, after that the predictions become more uncertain.

A second issue is determining the discount rate. An investor typically chooses a discount rate that is appropriate for the current economic and real estate market conditions. However, those conditions will most likely change over time for multiple reasons.

For example, if an investor chooses to evaluate the property when interest rates are 4.0% and decides that an acceptable discount rate for the property is 8.0%, the investor will be better off if interest rates subsequently fall to 3.0%, providing an additional spread between the return the investor could achieve in the current market versus the return the investor is currently achieving on the property. Conversely, if interest rates rise to 7.0%, a discount rate of 8.0% on the property is no longer as attractive as it was.

There are numerous inputs that need to be considered to determine the impact of changes in market conditions on the property, but the takeaway should be that the final return an investor achieves could vary substantially from that predicted during the initial analysis.

Conclusion

Other methods, such as the Internal Rate of Return, are useful when the initial investment is known. The NPV, however, is an essential tool for helping investors determine how much to invest in a property when expected cash flows are more readily available.

Analysts should explore the certainty of both the property cash flows and market conditions to reach a higher level of confidence in the accuracy of the NPV analysis, while also indicating any risks to assumptions that could negatively impact the NPV of the property.

Want to be notified of our new and relevant CRE content, articles and events?

Author

Altus Group

Author