Australian construction material price outlook - Q3 2023

Altus Group combines our market intelligence with a range of reliable and robust data sources to provide quarterly Australian construction material price indicators for the construction sector. Read the latest update on this article here.

Key highlights

The persistent upward trajectory in material prices came to a halt in Q3 2023, ending 16 straight quarters of cost increases since December 2019

Price hikes were recorded in both bricks and diesel, while prices for structural timber and steel products eased

The Australian dollar’s decline and the “unlucky” thirteenth interest rate increase on 7 November 2023 highlight a challenging financial environment

While the world continues to grapple with geopolitical unrest, most recently in the Middle East, the economic downturn in China has a far greater influence on Australia’s construction industry

Builders and subcontractors continue to avoid residential apartment projects after weighing up the risk/reward equation

Carbon is expected to become a significant additional construction cost as large companies are required to disclose a wider range of emission sources

Over the quarter some items have increased in price, others have been discounted – overall, prices have remained reasonably stable

Altus Group combines our market intelligence with a range of reliable and robust data sources to provide quarterly Australian construction material price indicators for the construction sector.

With localized expertise and global cost management experience, we can help ensure the viability and success of your development and construction projects.

Are construction costs stabilizing?

The persistent upward trajectory in material prices came to a halt in Q3 2023, ending 16 straight quarters of cost increases since December 2019.

Although the overarching trend for the quarter was stability, there were distinct cost fluctuations in specific materials categories. Price hikes were recorded in both bricks and diesel, for instance. In contrast, prices for structural timber and steel products eased. These price fluctuations are the consequence of both domestic and international influences.

Locally, the dip in new housing construction led suppliers to discount preliminary construction materials in a move to stay competitive. A surge in energy prices directly bumped up manufacturing costs, as was particularly evident in brick pricing.

The Australian dollar’s decline and the “unlucky” thirteenth interest rate increase on 7 November 2023 highlight a challenging financial environment. The Reserve Bank of Australia’s (RBA’s) decision to hike its cash rate 25 basis points to 4.35% puts interest rates at a 12-year high. Governor Michelle Bullock said the RBA “will do what is necessary” to pull inflation back to its target rate of 2-3%. While the Consumer Price Index (CPI) fell to 5.4% in September 2023, it is still outside that target, suggesting more pain is yet to come.

Internationally, multiple factors are in play. While the world continues to grapple with geopolitical unrest, most recently in the Middle East, the economic downturn in China has a far greater influence on Australia’s construction industry. In November the RBA warned that a “sharp deterioration” in China's property sector — which is responsible for around 30% of the nation's economic growth – could lead to a global slowdown, weaker commodity prices and lower demand for Chinese imports of Australian goods and services.

Around 70% of Chinese household wealth is tied up in real estate, and the sector’s struggles are a symptom of the country’s overall economic position. As a result, China has rolled out a new batch of stimulus measures to boost the nation's troubled property sector, including lowering minimum deposits to 20% on first homes and from 70% to 30% for purchases of second homes. Country Garden, China's biggest private property developer, is in default and has sold off Australian assets. Embattled Evergrande owes AU$325 billion – more than Russia's entire national debt. The impact of these insolvencies flows through to demand for building materials in China, and consequently to materials in Australia.

While materials prices are easing, margins are still being squeezed and construction companies continue to fall. One of the latest casualties, Sydney-based National Projects & Maintenance (NPM), had developments for some of the country’s biggest property players. NPM chief executive Daniel Afonso has attributed the company’s collapse to the ‘usual suspects’ of “skilled labour shortages, inflationary pressures, interest rate rises and a commercial sector that continues to suffer from flow-on effects of [the] COVID-19 pandemic.”

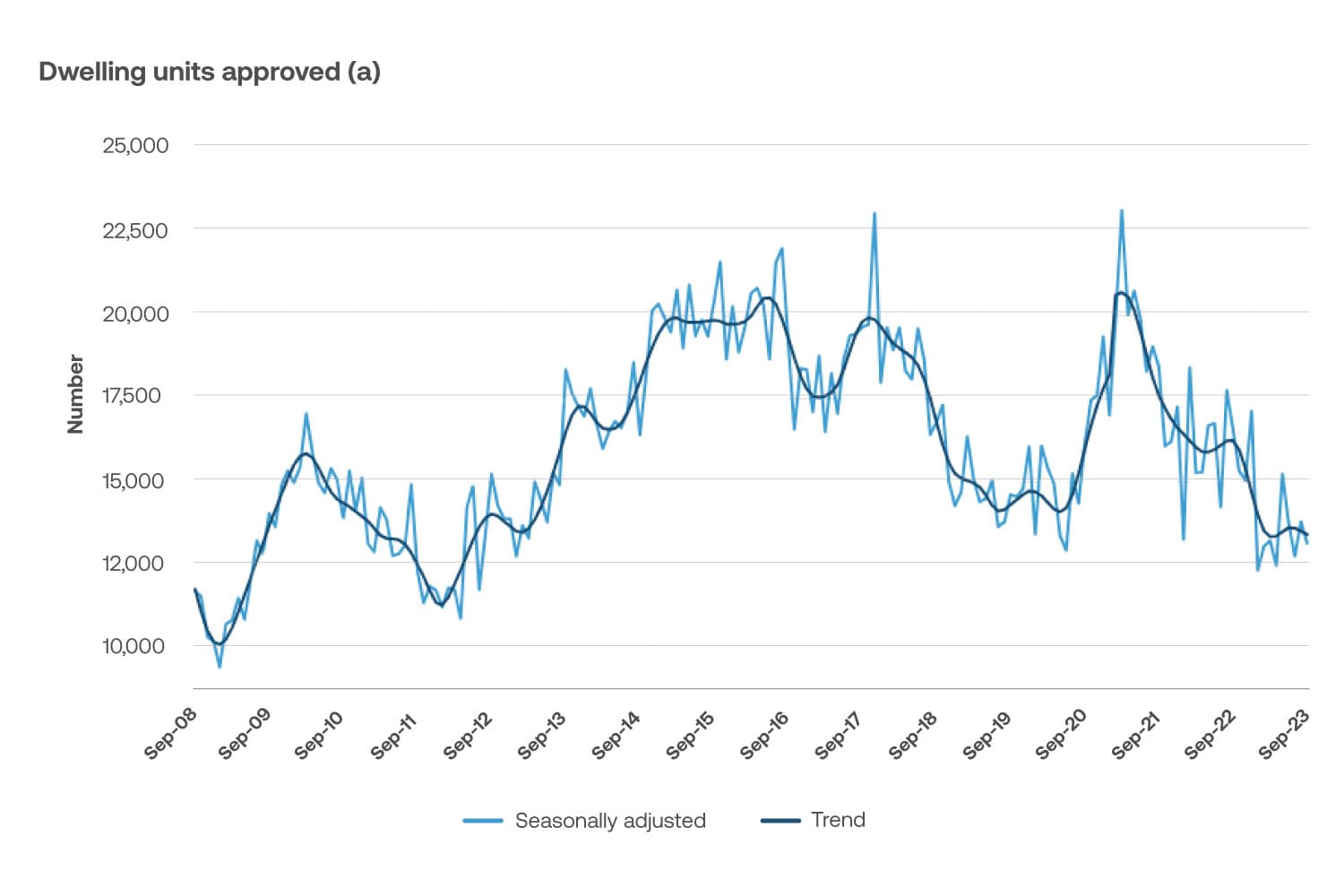

Builders and subcontractors continue to avoid residential apartment projects after weighing up the risk/reward equation. Jamie Crookes, the founder of Richard Crookes Construction told the Australian Financial Review in October that multi-residential development was down to 15% of pipeline, compared with 50% five years ago, because residential projects are “the most difficult” and require “more resourcing.” A poor participation rate among builders has significant implications for federal and state housing targets, especially the Australian Government’s 1.2 million homes over the next five years.

Further afield, we expect carbon to become a significant additional construction cost as large companies are required to disclose a wider range of emission sources. From mid-2024, the Australian Securities and Investments Commission will expect the nation’s biggest companies to disclose their Scope 3 emissions – those generated by their supply chain, including during construction. ASIC chairman Joe Longo has said the new disclosure requirements are the “biggest change to corporate reporting in a generation” – and the construction sector is yet to fully grapple with the implications.

Material price snapshot

Altus Group combines our market intelligence with a range of reliable and robust data sources, including those from the Australian Bureau of Statistics and the Australian Institute of Quantity Surveyors, to provide national price indicators. These prices are subject to market movements.

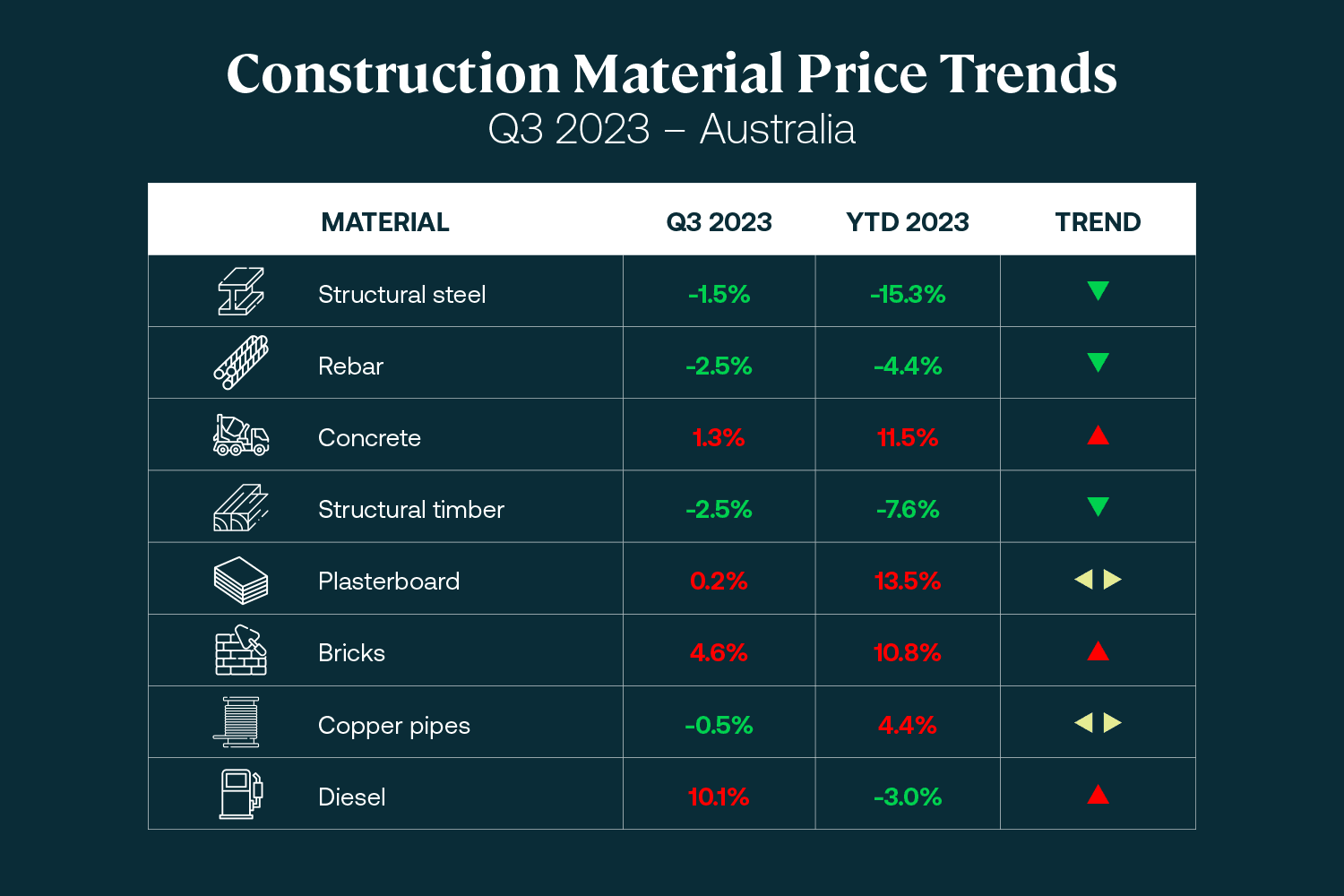

Figure 1 - A snapshot of Australian construction material price trends – Q3 2023

Material price movements

Altus Group provides insight into the materials and commodities that are common across most projects and sectors, and therefore have the greatest influence on costs. These include:

Structural steel and rebar

Steel prices, which soared over the pandemic, are showing signs of stabilisation. The slowdown in China’s building sector has led to an influx of Chinese steel, which is cheaper than local product because it doesn’t require the same rigorous testing and standards as Australian steel. However, analysts suggest the Chinese Government's moves to shore up its ailing property sector could trigger higher demand for steel and tighten the iron ore market.

Concrete

Prices rose marginally during the previous quarter, primarily due to increasing electricity costs. Building products group Boral, for instance, lifted the price of concrete by 12% and cement by 8% in the past year, passing through higher energy and transport costs. We don’t expect significant cost escalation over the next quarter.

Structural timber

Structural timber prices, while elevated when compared to pre-pandemic prices, are trending downwards as supply conditions improve and demand for new home construction falls. Several innovations in Australia’s market could drive the uptake of structural timber, including a world-first use of a robot to install screw fixings and a software program designed to mainstream mass timber. Higher adoption of the Design for Manufacture and Assembly (DFMA) utilises this technology at a greater level.

Plasterboard

The price of plasterboard has held steady this quarter, although still at higher than pre-pandemic levels as energy prices rise. Major manufacturer of plasterboard, James Hardie, attracted investor approval for pushing through a 12% price rise in Australia, despite a slowdown in work. Considering sluggish demand, we do not expect an immediate rise in plasterboard.

Bricks

As one of Australia’s internally sourced materials, bricks have recorded a big price increase this quarter following energy price hikes. Australia's largest producer of bricks, Brickworks, lifted prices by around 11% over the past year, following energy cost increases of up to 28% and labour cost rises of 13%.

Copper

Prices of copper – considered a bellwether for the global economy – have tumbled in recent months, suggesting that soaring borrowing costs and slower spending are beginning to hurt. Looking long-term, the world will need at least twice as much copper as it currently produces to meet renewable energy targets, and this will influence prices. Short-term, we don't anticipate an immediate price hike. However, we anticipate the development of Green Copper for use in the green energy market to create a separate product line that will impact the general copper market when reported as a whole.

Diesel

Diesel remains the primary fuel for construction activities. In the June 2023 quarter, the industry enjoyed a slight reprieve; although the average diesel price rose to $2.06 per litre – a 19-cent increase on the previous quarter. If recent tensions in Gaza draw in other Middle Eastern countries, particularly Iran, fuel prices could skyrocket. The World Bank estimates that oil prices could increase by up to 75%, depending on the level of conflict.

Manufactured stone

In October, Safe Work Australia published a report recommending a ban on the use of all engineered stone, due to the risk of silicosis, and the union movement resolved to support a ban on the product by the middle of 2024, if the government does not take steps to do so. Engineered or composite stone is considerably cheaper than natural alternatives, such as Corian, natural stone products, or marble. The consequence is, therefore, not a material price increase but a specification change which will lead to large cost increases.

Macro-economic review - Q3 September 2023

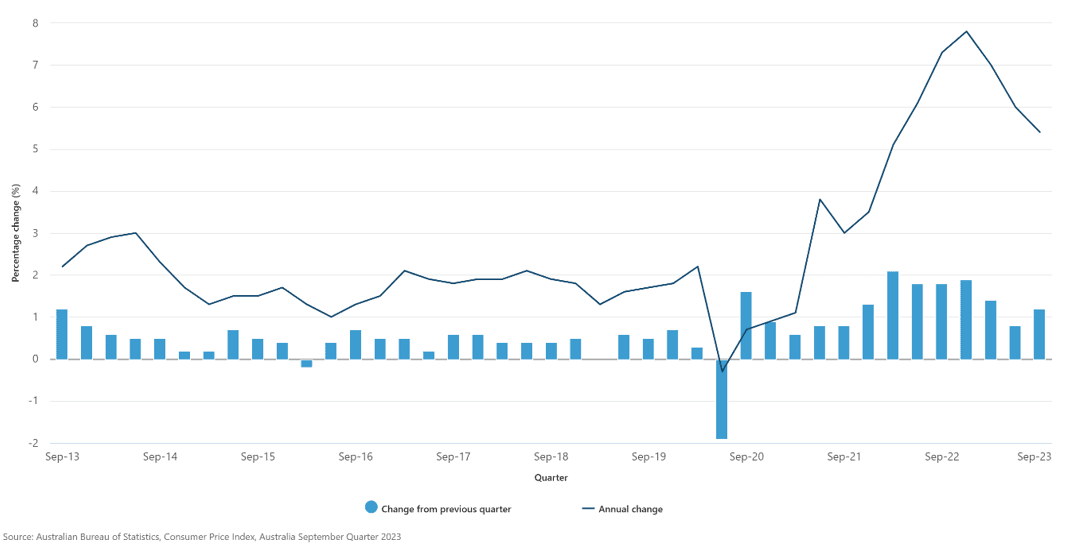

Consumer price index

Figure 2 - All groups CPI, Australia, quarterly and annual movement (%)

The Consumer Price Index (CPI) increased by 1.2% in Q3. Key contributors to this rise included a surge of 7.2% in automotive fuel, a 2.2% uplift in rents, a 1.3% uptick in new dwelling purchases by owner-occupiers, and a 4.2% escalation in electricity prices.

Taking a broader view, the CPI grew by 5.4% over the 12 months to September 2023. Notably, this rate surpasses the RBA’s inflation target of 2-3%. The downturn in the Australian dollar, coupled with the interest rate hike in November 2023, paints a picture of testing financial times ahead.

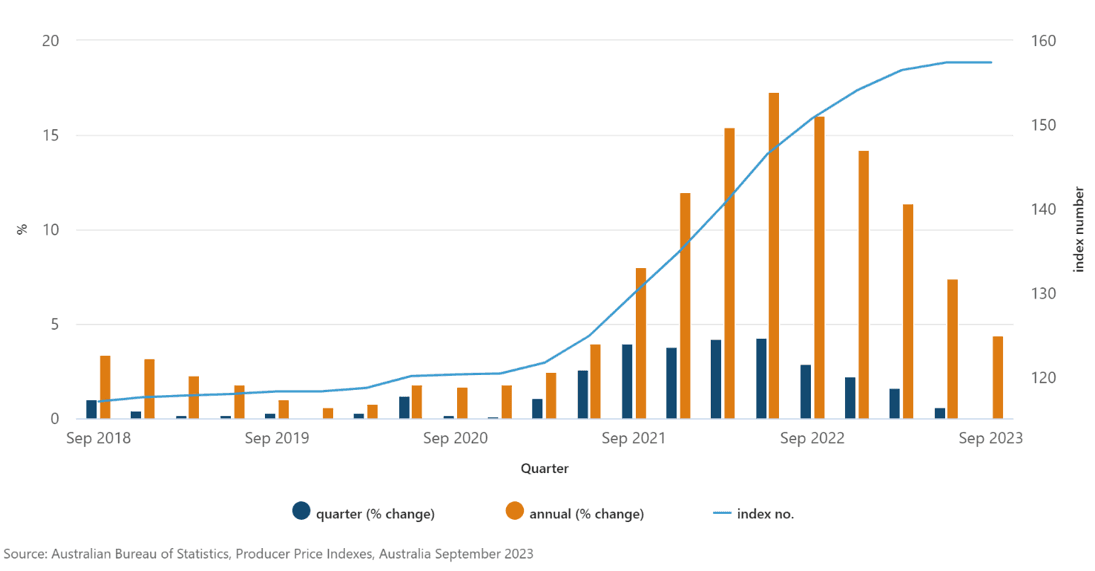

Producer price indices – Input

Figure 3 - Shifting demand contributes to flat input to house construction growth

Input prices for house construction remained steady. The 0.0% quarterly change follows 16 consecutive quarterly price rises since December 2019. Price rises in some materials were offset by falls in early-stage construction materials, such as structural timber and steel products.

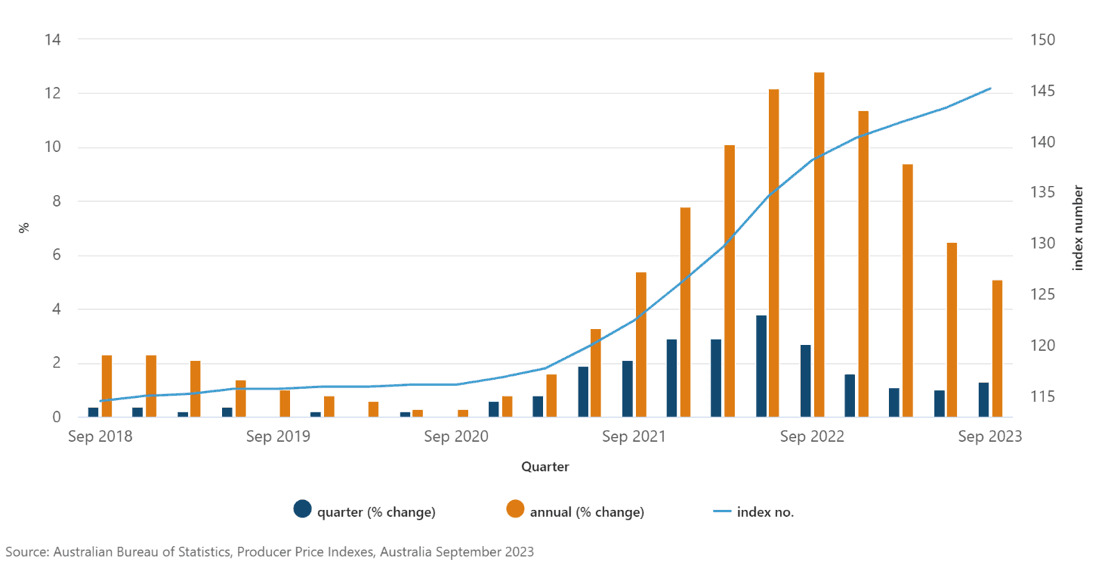

Producer price indices – Output

Figure 4 - Rising output prices of building construction driven by sustained demand for skilled labour

Growth in output prices was driven by demand and labour cost increases, due to ongoing shortages of skilled tradespeople. While material prices have stabilised, prices increased for structural components and internal fixtures due to high demand and manufacturing delays.

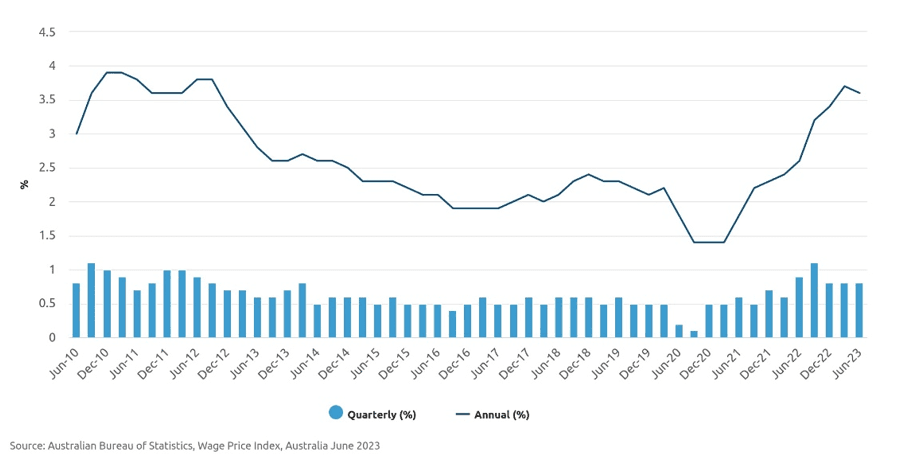

Wage price index

Figure 5 - All sector wage price index, quarterly and annual movement (%), seasonally adjusted (a)

The construction industry stands out as a primary driver of the wage price index, showcasing a notable 1.3% monthly increase and an annual rise of 3.9%. This surge in labor costs, coupled with escalating prices of construction materials, has led to an overall increase in construction expenses. While there have been some reductions in material costs during this quarter, these have been effectively neutralized by the concurrent rise in labor costs, maintaining the upward pressure on overall construction costs.

Building approvals

Figure 6 - Dwelling units approved (a)

Dwelling approvals are a key indicator for forecasting economic trends, and recent data from the Australian Bureau of Statistics points to a downturn in the housing market activity. In a monthly comparison, total dwelling approvals declined by 4.6% to 13,144. This trend was mirrored in the private sector, with house approvals decreasing by 4.6% to 8,338, while approvals for other private sector dwellings fell by 5.1% to 4,553. Moreover, the value of new residential buildings dropped by 3.6% to $5.83 billion, and non-residential buildings saw a 7.2% decrease to $5.56 billion. This overall contraction in construction activity has made the federal government's ambitious goal of constructing 1.2 million new homes over the next five years increasingly challenging to achieve.

Summary

Much like a basket of groceries, a building is a composite of many materials and products. Over the quarter some items have increased in price, while others have been discounted. Overall, prices have remained reasonably stable.

A far bigger cost factor is labour, which can account for as much as 60% of a project’s budget. Rising labour costs do not correspond with increases in productivity, and this underscores the important role that governments play in adjusting migration settings.

With interest rates now at a 12-year high, attention will shift to wage price index figures due for release in mid-November. A sharp uptick in wages could deliver back-to-back rate rises.

Looking ahead to 2024, general market uncertainty around inflation, interest rates, and insolvencies, together with an unpredictable geopolitical environment, suggests another challenging year for Australia’s construction industry.

Methodology

Market research into the supply cost of core materials is conducted on a quarterly basis with manufacturers and suppliers. Our market assessment also involves a thorough analysis of secondary sources of market data on materials and labour prices.

These sources include the Australian Bureau of Statistics (ABS), the Australian Institute of Quantity Surveyors (AIQS), Catloge.com.au, Metal and Raw Material Price, and proprietary cost data from Altus Group.

Disclaimer

This article is being provided for informational purposes only. No information included in this article constitutes, nor can it be relied upon as, legal, tax, investment, or other advice. Recipients should consult their independent advisors. The views and opinions expressed in this article are those of the authors themselves and do not necessarily reflect the views or positions of Altus Group Limited or its subsidiaries or affiliates (collectively, “Altus Group”). The article, the information contained therein, and any links to other sites are provided “as is” without any representations, warranties, or conditions of any kind, express or implied, including, without limitation, implied warranties, or conditions of fitness for a particular purpose or use, non-infringement or that any information is accurate, current, or complete. Altus Group has not independently verified any third-party information and makes no representation as to the accuracy or completeness of any such information. Altus Group and its advisors, directors, officers, and employees (collectively, its “Representatives”) are not liable or responsible to any person for any injury, loss, or damage of any nature whatsoever arising from or incurred by the use of, reliance on or interpretation of the information contained in the article or sites that are linked in the article. The foregoing limitation shall apply even if Altus Group or its Representatives have been advised or should have known of the possibility of such injury, loss, or damage. Any unauthorized use of the information is strictly prohibited. A user is not authorized to copy, circulate, disclose, disseminate, or distribute the information, either whole, or in part, to any third party unless first explicitly agreed by Altus Group.

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Alvin Yap Abidin

Quantity Surveyor

Authors

Niall McSweeney

Head of Development Advisory, Asia-Pacific

Cody Bui

Quantity Surveyor

Alvin Yap Abidin

Quantity Surveyor

Resources

Latest insights

Jan 9, 2025

Building the future - Key trends shaping Australia’s construction industry in 2025