Altus Data Studio

Access commercial listings and transactions, new home sales, and multifamily rental data across Canadian markets.

Discover ALTUS DATA STUDIO

Unlock intelligent real estate data across Canada

Quick and actionable insights from a centralized platform

Comprehensive coverage across key markets and sectors

Stay on top of market trends with expert analysis and insights

Discover the comprehensive catalogue of Canadian real estate market data available in Altus Data Studio

Commercial property listings

Explore the latest office and industrial property data including leasing, sales and availability across Canada.

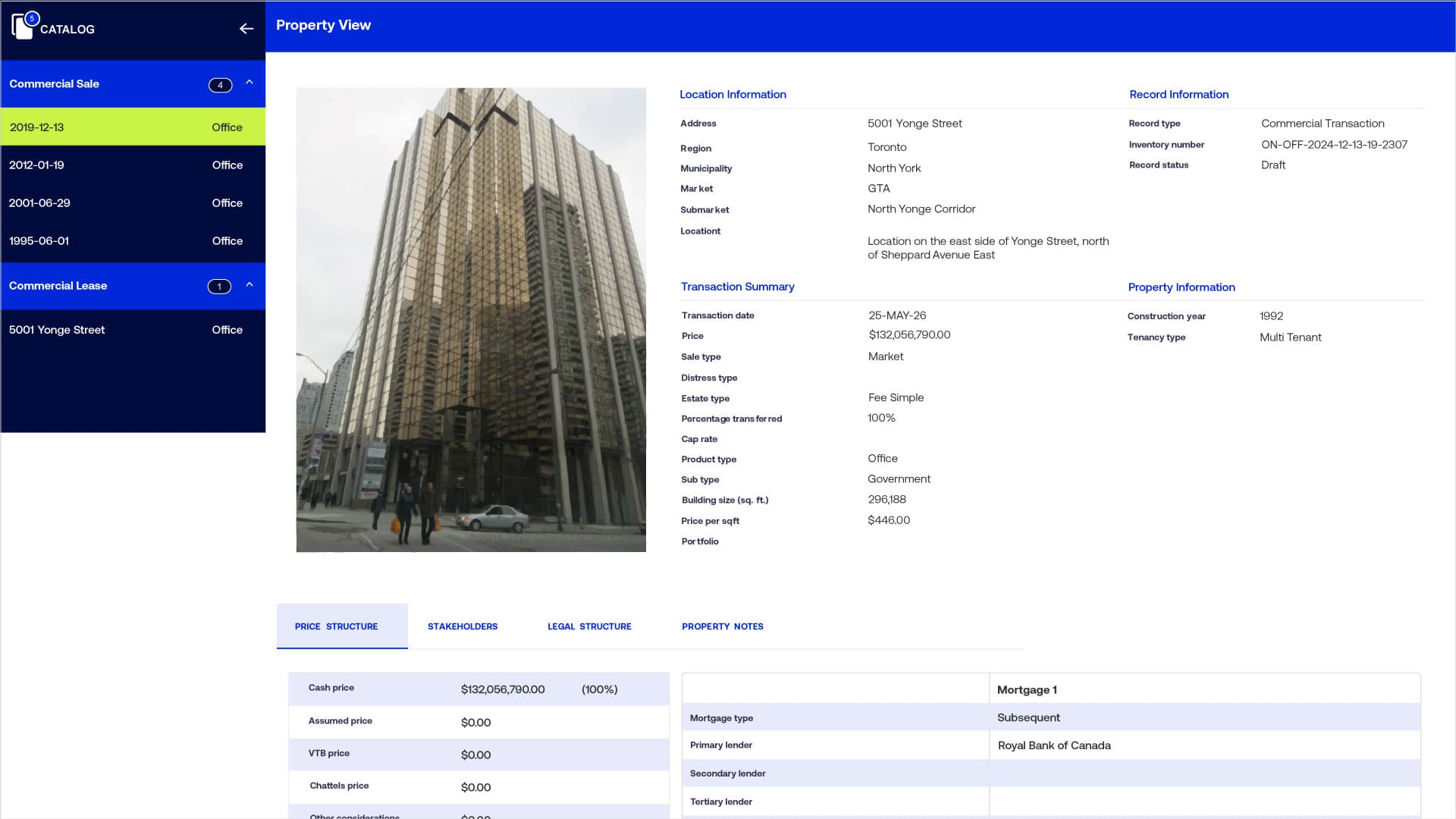

CRE sales comparables

Access detailed sales transaction data for local Canadian markets such as Toronto, Vancouver and Calgary.

Development applications

Search development application monitoring data for local Canadian markets such as Toronto and Vancouver.

Multifamily rental

Discover multifamily rental data including market inventory, rental rates, vacancy, incentives across Canada.

New homes data

Analyze detailed new-home sales and historical data on new housing developments across Canada.

How Altus data studio works

Streamline your research and start searching faster

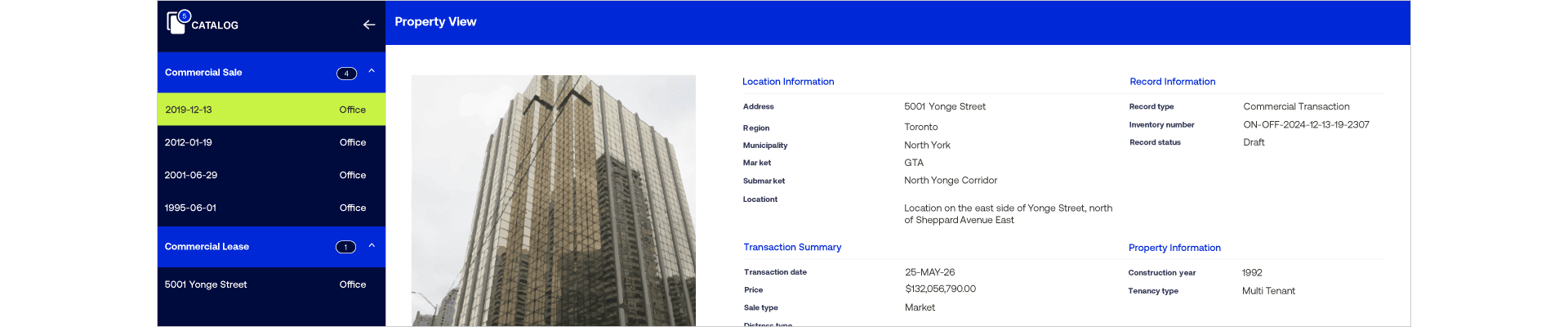

1. Select data catalogue

Start your research process by selecting from one of our five data catalogues.

2. Start searching

Select your market, sector, asset or property and see results based on your unique needs.

3. Apply advanced filters

Use multiple filters to drill down into search results and analyze data more precisely.

4. Analyze results

Instantly generate and customize powerful data visualizations to gain better insights.

5. Export data

Generate a custom built report directly from Data Studio or export to an Excel file for further analysis.

Testimonials

Hear what our customers are saying

FAQ

Get answers to commonly asked questions about Altus Data Studio

Did Altus Data Studio replace RealNet and Altus InSite?

Yes - RealNet and Altus InSite are no longer sold nor currently supported, and have been replaced by Altus Data Studio. In this upgraded experience, our R&D team has worked very hard to bring over all the functionality from our legacy software, combining them all into one complete solution.

How much does Altus Data Studio cost?

We have several subscription plans available to support businesses of all sizes. Discount packages are available for multi-year subscriptions. To find the best package for your business, please contact us.

What's different about the tools in Altus Data Studio?

The tools that were previously available to you in Altus InSite have been improved in Altus Data Studio to increase searching capabilities and allow you to work with the data with greater flexibility. The enhanced features include customizable filters and results grids, saved layouts, analytics tools, data dashboards, and more.

How do I access my market report subscriptions?

After logging in to Altus Data Studio, market reports can be found in the menu bar on the left side under 'Market Reports'. For greater insights, you can also generate your own custom reports by using the data dashboards.

Access to the Investment Trends Survey is unchanged and can be accessed here.

180K+

commercial real estate transactions records

50K+

industrial and office leasing data

11K+

new home development projects

5K+

multi-family rentals across Canada

Options

A powerful data analytics platform that provides you with access to market and transaction data

Solution

Data Studio web app

Ideal for investors, brokers, property developers and researchers looking for market and transaction data across key Canadian markets.

Solution

API & data feed

Power your applications and workflows with immediate access to Altus Data Studio data.