ARGUS Intelligence

Manage risk and understand the impact of market changes on your CRE portfolio

Industry-leading commercial real estate asset & portfolio management software

Now available as part of ARGUS Intelligence.

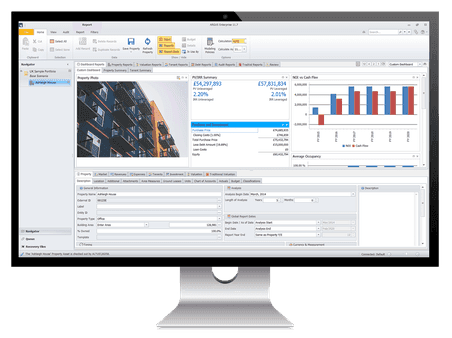

With ARGUS Enterprise you can improve the way you manage and operate your commercial real estate portfolio.

Gain a transparent view into your financial forecast and evaluate the effects of leasing and market changes.

Designed to support:

Asset Management

Get a transparent view of current and future financial outcomes.

ARGUS Enterprise brings together data from different sources and connects multiple workflows to efficiently and accurately give you the intelligence you need to manage asset performance.

Portfolio/Fund Management

Deliver outsized returns for investors.

ARGUS Enterprise delivers an accurate view of your commercial real estate portfolio with the industry’s most advanced scenario and stress testing capabilities to manage risk and capitalize on opportunities.

Acquisition Management

Ensure new properties align to your portfolio strategy.

ARGUS Enterprise cash flow models makes it easy to understand key variables affecting property values to help you identify the right acquisitions and make informed investment decisions.

Key benefits

Created by CRE professionals, for CRE professionals, ARGUS Enterprise supports the management of the following asset classes: office, commercial, industrial and logistics, retail, multi-family/build-to-rent and hotels.

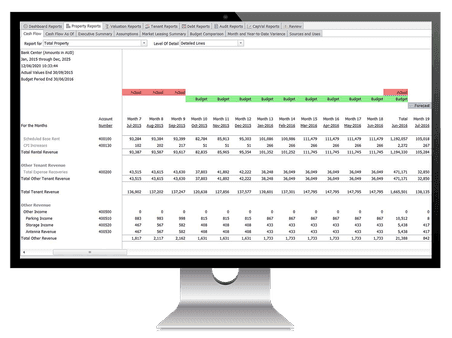

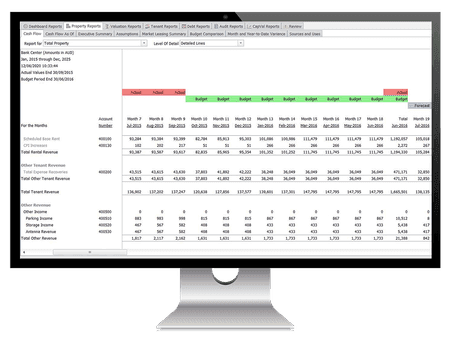

Cash flow modeling, forecasting and valuations

Build detailed cash flow forecasts using current market assumptions. Modify these assumptions quickly and easily for the most accurate view of your property financials and DCF valuations. ARGUS Enterprise provides a clear view of your asset’s future cash flows and value to your portfolio.

Features:

Accurate cash flows with detailed expenses, revenues, and capex modeling

Lease-by-lease cash flows projections with all lease types.

Easily update important assumptions (inflation rates, market rates, future leasing conditions, sale dates, cap rates, and discount rates)

Portfolio analysis and reporting

Transparent portfolio’s performance helps you make informed decisions and exceed investor expectations. ARGUS Enterprise builds on robust cash flow models and provides portfolio views and analysis that enables data-driven decisions helping you to effectively manage your real estate portfolio.

Features:

Customizable dashboard reports to evaluate properties' health and communicate your overall performance

40+ industry-standard asset-level reports

40+ industry-standard portfolio-level reports

Advanced filters and views to “slice and dice” each report

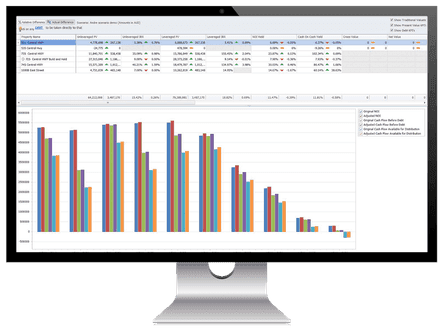

Scenario and sensitivity analysis

Change is a constant factor in real estate. ARGUS Enterprise empowers asset and portfolio managers through volatile, complex and ambiguous market conditions. Run detailed ‘what if’ scenarios on an individual property or an entire portfolio to measure the impact on cash flows and returns.

Features:

Explore best and worst case scenarios to base case analysis.

Compare KPIs for each scenario to manage risks and discover opportunities

Build multi-dimensional matrices based on assumptions set, with over 5 step changes for each variable

See the impact of broader economic changes against the entire portfolios or classes of properties

Asset budgeting and long-term business plans

Building a long-term vision for your portfolio or a short-term budget for each asset. Keep your team aligned and focused while building investor confidence. ARGUS Enterprise expands on a property cash flow model to create detailed budgets or a complete financial outlook of your portfolio.

Features:

Efficient budget workflow with all stakeholders

Compare budgets to prior year to highlight potential risks and opportunities

Supports long-term planning models to assess potential major event such as lease expirations, major capital costs, financing requirement, etc.

Integrates with your property management system for up-to-date budget to actuals performance analysis

7,000+

active ARGUS software clients

30+

years developing CRE software

100+

countries using ARGUS solutions

200+

universities teaching ARGUS

Why ARGUS Enterprise?

ARGUS Enterprise is widely trust on the market. Our high performing calculation engine integrates factual asset data and marries that with more complex market assumptions to produce the long-term forecast that helps you to make better decisions.

Watch a quick product overview to learn how easy it is to collaborate across different property teams when your real estate data is stored in one, centralised solution.

Access insights driven planning

Update budgets based on actuals, test assumptions based on market research and rerun forecasts to analyse impact on KPIs.

Optimize portfolio performance

Identify key variables that affect value and cashflow while comparing scenarios to help you make better informed decisions.

Improve stakeholder reporting

Generate accurate reports for stakeholders with 40+ industry-standard asset-level reports and 40+ industry-standard portfolio-level reports

Request a demo

ARGUS Enterprise empowers commercial real estate investors to invest and operate more confidently and effectively.

About Altus Group

At Altus, our mission is to solve critical asset and fund management challenges for commercial real estate investors, developers, proprietors, lenders and their advisors.

We are uniquely positioned to partner with CRE professionals around the globe by providing them with integrated capabilities across technology, analytics, valuations and cost advisory services. We call this intelligence as a service.